“Davidson” submits:

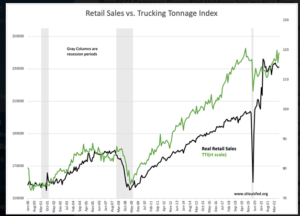

A number of advisors have reported higher than normal inventories as an additional sign of pending recession. The data does not support this perception. Business Inventory/Sales… and Retail Sales vs Trucking… reveal a considerable deficit exists in business Inventories historically with Total, Retail and Manufacturing data shown. Manufacturing appears high relative to the rising trend from 2006, but reshoring has been a theme since prior to 2006 and higher inventories than past levels simply occurs if there is more manufacturing capacity domestically than in prior years. The Trucking Tonnage Index remaining in an uptrend indicates that most businesses are still building levels of operating inventories. Businesses require certain levels of inventories balanced to the characteristics of each industry to maintain capital efficiencies and profitability.

Despite many ascribing inflation to consumer demand and the need for higher interest rates, the inventory/sales ratio indicates continued economic catch-up post COVID continues to be required. In my opinion, economic demand is deflationary not inflationary as demand comes from individuals and businesses seeking to operate more efficiently. Individual and business spending are never inflationary. What is nearly always inflationary is government spending and importantly government policy. Government rarely creates lasting economic value. Unfortunately, rather than recognize government inefficiencies, the consensus calls for stifling demand by raising rates. Demand may slow but history requires rates above the Natural Rate i.e., Long term Real Private GDP rate (~3) and the inflation rate (~8%) or ~11%.

The consensus is for recession with significant capital dedicated to hedging. The traditional signals prior to past recessions are not present. Investors should continue to focus on discounted equites involved in core economic growth and avoid fixed income in my judgement.