The fundamentals are piss-poor is you think prices should fall based on supply-demand.

The risk is for a shock higher

“Davidson” submits:

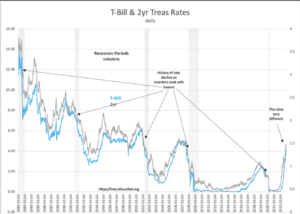

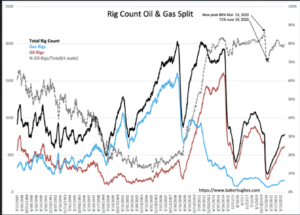

Rig implementation which stalled in recent months shows a small rise in oil rigs. $WTI declined below $80/BBL today. Considering consensus views of pending economic correction and the unusual rise in T-Bill and 2yr Treas rates coupled with hedging investment portfolio downside risk by selling and shorting $WTI, the conclusion one arrives at is a speculative trade has been placed for substantial decline in all markets, equities to commodities. It continues to be my best interpretation that one-sided speculation for economic decline will prove incorrect as US industrials continue their reporting well above expectations with strong backlogs for at least next 12mos.

I should note that my opinion is almost alone in the current environment. The current level of oil exploration has been weak since 2015 with the lack of capital also extending to production facilities. This leaves the consensus with both unrecognized economic expansion and shorting oil to hedge portfolios while energy production is insufficient. The politically motivated release of SPR has only further tightened the supply/demand for crude.

At some point, economic expansion and inadequate energy supply is going to clash with pall of pessimism and downside market bets. It should not surprise anyone that there could be an explosive reversal in market sentiment.