“Davidson” submits:

From this report: “Total nonfarm payroll employment increased by 263,000 in November, and the unemployment rate was unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, health care, and government. Employment declined in retail trade and in transportation and warehousing.”

The media/analyst interpretation is mixed leaning towards pessimism that job gains lead to higher inflation. I view this as incorrect.

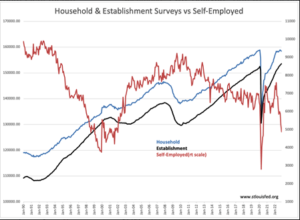

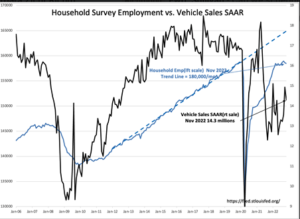

The Household reports shows a decline vs Establishment a gain indicating fewer self-employed as individuals return to Establishment reporting companies. The US continues to report a high level of Job Openings indicating demand for labor by Establishment reporting companies. Industrial Production indicator posted a historical high which reflects re-shoring of manufacturing in my opinion. Real Personal Income posted higher than expected. Interpreting this mix includes the layoffs at COVID-favored companies which means employment gains are occurring in basic manufacturing industries which are skills based and higher wage jobs.

A point key to understanding inflation is that it is not a supply/demand issue as discussed endlessly that requires the Fed to raise rates to levels that destroy economic production and employment. Understanding the relationship between money creation and consumer vs government spending is more complex. The discussion can be separated into two opposing themes:

- Companies raises debt(expand currency) = produce products efficiently for a profit = consumers decide which products to buy = process is deflationary

- Government raises debt(expands currency) = proposes politically directed goals = spends without efficiency or profit = process is inflationary

Companies which successfully supply products are profitable and convert debt to equity (currency backed by economic value creation) and in the process lower the cost of living to consumers i.e. deflationary. Companies which fail to produce goods that advance consumer standards of living fail and debt (currency) is written down to zero. Net/net, no inflation impact.

Government spending is mostly inflationary. Some projects such as bridges and roads do add to society’s productivity as do some level of social services which remove burdens from productive activity but the record of government is one of waste and most spending directed to keep the current politicians in office. Government cannot write off debt which leads to prior mistakes in spending being compounded by continued misspending. There is never accounting for the value added/not added to society as required in the corporate world.

The point to underscore is that employment gains due to corporations hiring to produce goods which result in society operating more efficiently with regards to resources is always deflationary. The calls for the Fed to raise rates to quash inflation misses the fundamental fact that inflation comes from government spending that adds little value and raising rates punishes that part of the economy best suited to counter inflation.

No one listened to Milton Friedman when he stated “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” Milton Friedman, 1963. In this quote, retrieved from an Internet search, the bold portion is what is quoted with the rest ignored even by the most astute. Today’s employment discussion continues to miss the basics that more employees engaged in profit driven enterprise is deflationary and we should not cheer for layoffs to counter inflation.