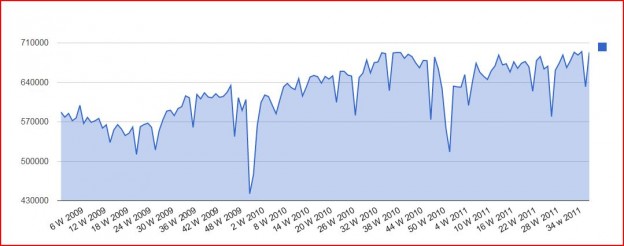

Rail traffic rebounded from the Labor Day dip to the second highest level since 2008 coming in at 693k cars. These numbers are in no way recessionary and point to continued expansion. In 2008 as we slid into recession these numbers were falling off a cliff. All segments saw increases with auto posting a 25% increase over the Labor Day week and a 10% increase over week prior to Labor Day.

I thought the economy ground to a halt in August? Um, turns out it didn’t?

Released: Thursday, September 22, 2011

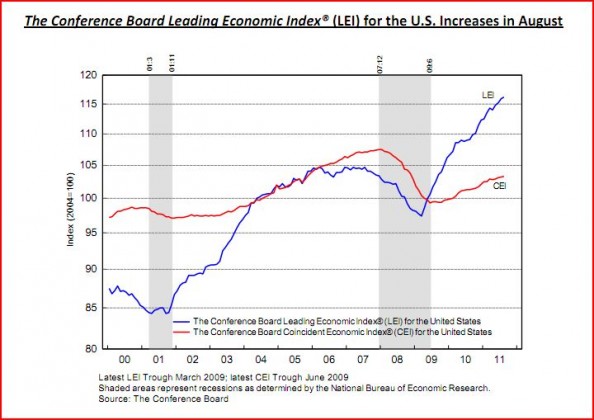

The Conference Board Leading Economic Index® (LEI) for the U.S. increased 0.3 percent in August to 116.2 (2004 = 100), following a 0.6 percent increase in July and a 0.3 percent increase in June.

Says Ataman Ozyildirim, economist at The Conference Board: “The August increase in the U.S. LEI was driven by components measuring financial and monetary conditions which offset substantially weaker components measuring expectations. The growth trend in the LEI has moderated and positive and negative contributors to the index have been roughly balanced. The leading indicators point to rising risks and volatility, and increasing concerns about the health of the expansion.”

Says Ken Goldstein, economist at The Conference Board: “There is growing risk that sustained weak confidence could put downward pressure on demand and business activity, causing the economy to potentially dip into recession. While the chance of that happening remains below 50-50, the odds have certainly increased in recent months.”

The Conference Board Coincident Economic Index® (CEI) for the U.S. increased 0.1 percent in August to 103.3 (2004 = 100), following a 0.1 percent increase in July, and a 0.2 percent increase in June.

The Conference Board Lagging Economic Index® (LAG) increased 0.3 percent in August to 110.3 (2004 = 100), following a 0.3 percent increase in July, and a 0.3 percent increase in June.

Hey, Todd, that is all great but the market is tanking. I know, trust me I know. But, everything we track, items that have historically said recession or not, now say not.

What we have here is 2008 redux in people ‘s minds. Everyone fears banking collapses worldwide and a replay of 2008-09. The difference between now and then was that while banks were in trouble then with paper thin margins of error, businesses were also slowing at a rapid clip. We do not have that scenario now. No matter what anyone wants to say, every economic indicator continues to point to growth (unimpressive, but growth nonetheless). Banks also have materially stronger balance sheets (despite the boogeyman scenarios you can find out there) and far lower risk profiles.

Even housing, everyone favorite whipping boy is showing signs of life in many regions whereas in 2007-09 it was in a free fall nationally.

So, what to do? I am not selling anything because this market is moving with no rhyme or reason. It could just as easily be up 1000 points next week on “not so bad news” as it could be down for the same reason. I am not in a position where I will be a forced seller so any “losses” we are looking at are paper swings (and wild ones at that). We do not own anything in danger of going out of business so market conditions won’t effect us that way. In short, we just ride this out. Eventually reason prevails and the market re-adjusts.