Tilson is someone whose opinions are worth listening to. He speaks to the Citigroup’s (C) Chairman’s “tarnished” reputation.

Month: November 2007

Sears Holdings Brand and Land Values

Analyst Seth Sigman of Credit Suisse calculated for the first time values on Sears Holdings’ (SHLD) property and brands.

In a report issued Tuesday he estimated values as follows: real estate, $9.5 billion to $11.5 billion; leased stores, $1 billion to $2 billion; distribution centers, $700 million to $1.1 billion; Hoffman Estates headquarters, $200 million to $400 million; private brands, such as Craftsman, Kenmore and DieHard, $3 billion to $5 billion; Lands’ End, $2.2 billion to $2.8 billion; and home services business, $2.8 billion to $3.5 billion. Total? $19.4 billion to $26.3 billion.

That is just the value of the land and the brand’s, it does not include the results of the retail operations which contributed $2.5 billion last year. Sears current valuation on the market? $18 billion, 7% below even the lowest estimate of just it’s real estate & brand value and 46% below the highest.

Currently shares trade at $127 and there are less than 140 million of them outstanding (we will know exactly how many Lampert has repurchased soon but he may have bought 10.4 million back). If we were to value Sears just on the brands and not on it’s operations, we get a share price of $137 to $185. We also have to value the operations and that gives us an additional $9.47 a share for the past 12 months giving us a price range of $145 to $194.

The important point is that this valuation include NO premium for either the brands, property or earnings. It is a flat valuation of the parts and a years earnings. What type of valuation do we give the capacity of Lampert to monetize the brands or the property?

Sears is trading at 13 times its current earnings, at the lower end of the retail spectrum. Consider Wal-Mart (WMT) trades at 15 times, Target (TGT) 17 and Macy’s (M) 18 times. If we add the value of the property and brands we can effectively double its current share price. The issue for the market currently is that the value of those items will not filter into the stock price until Lampert unlocks that value. If Lampert decide to sell or lease the land he owns, the value of that then filters into the stock price. If he licenses the Craftsman or DieHard brands, that value then filters into the price. Without anyone knowing what his plans are, investors are hesitant to make a leap of faith and assume he may take a certain course.

Thus the “hidden value” in Sears shares… Lampert is smart and will not sit tight forever. My guess is he is buying as much stock as he can at these prices while he can before he moves….

It’s alright, I got time…

There was an interesting disclosure in Archer Daniels Midland’s (ADM) conference call. CEO Patricia Woertz addressed two important issues.

Ann Gurkin – Davenport

“Just wanted to spend a little time on getting an update on your work and, besides ethanol, other renewable fuels, switch grass. Maybe are you closer to doing anything in sugar in South America, Can we just get an update there?”

Pat Woertz

“Sure. We’ve talked about diversifying our feedstocks, which would include more palm, sugar, potential biomass to be run not only for first but sort of second-generation biofuels. Mike Pacheco, who is our new Chief Technology Officer, spent a little bit of time in about five slides or so, which you might want to look up on our website, but talked a little bit about.

So to speak, first of all our advantage in the dry mill ethanol world, which, of course, we’re completing two plants adjacent to our wet mills facility. But then kind of spent time on the nearer term focus on commercializing technology, again in a wide range; food, feed, industrial bioproducts and then biofuels.

And when it comes to the biofuels piece, we kind of walked through the spectrum of not only technology conversion, but also feedstocks and also end products, and are attempting at this point.

And I would say by February of next year, we will have a very limited list, or a very highly focus list, I should say, of the kind of opportunities for both conversion feedstock and end products.

A good example is our ConocoPhillips project that we announced, which is looking at biomass to biocrude, so this would be a type of crude oil that could be run in the traditional refineries yet made from biomass at very cost effective prices.

So that’s an example something where we actually have that one up and running. There’s a couple of other collaborative researches we’ve announced, one with the Colorado Consortium, one with Purdue University, et cetera.

So a lot going on but more clarification and I would say fine-tuning of that by early next year.”

Ken Zaslow – BMO Capital Markets

“Would you think about buying ethanol assets rather than building and at what price? And how do you think about it, just because it seems like a lot of these capacity buildups are slowing down a little bit and it seems like there may be opportunity to come in and buy some assets a little bit cheaper than maybe build it?”

Pat Woertz

“Yes, I’ll take that one, Ken. We’re actively engaged in this market all the time, and we know where every plant location is. We kind of have a sense of what locations might be interesting to us. But it would have to be a real value and scale and fit with our network, but it’s not to say we aren’t looking and aware.”

ADM is clearly on the hunt both for acquisition and JV’s to expand its businesses in biofuels. The beginning of next year will be very exciting as Woertz plans to make additional announcements. the best part is they are doing it in a very disciplined manner and not running around buying everything in sight. This is good because ethanol assets will be on the market and a disciplined buyer will be able to take great advantage of the situation.

Aside from that investors ought to mark their calenders for February, something is coming…

Thursday’s Upgrades and Downgrades

UPGRADES

Sierra Wireless SWIR Avondale Partners Mkt Perform » Mkt Outperform

Novatel Wireless NVTL Avondale Partners Mkt Perform » Mkt Outperform

AbitibiBowater ABH DA Davidson Underperform » Neutral

Optimal Group OPMR B. Riley & Co Neutral » Buy

Corn Products CPO BB&T Capital Mkts Hold » Buy

NFJ Dividend, Interest and Premium Strategy Fund NFJ Stifel Nicolaus Hold » Buy

Nuveen Equity Premium Opportunity Fund JSN Stifel Nicolaus Hold » Buy

Eaton Vance Enhanced Equity Fund II EOS Stifel Nicolaus Hold » Buy

eSpeed ESPD Sandler O’Neill Hold » Buy

United Dominion UDR Keefe Bruyette Mkt Perform » Outperform

Rochester Medical ROCM Northland Securities Market Perform » Outperform

China Finance Online JRJC Brean Murray Hold » Buy

Workstream WSTM Roth Capital Hold » Buy

Hutchinson HTCH Caris & Company Below Average » Average

Quintana Maritime QMAR Oppenheimer Sell » Neutral

Trico Marine Services TRMA Jefferies & Co Hold » Buy

Siliconware Precision SPIL HSBC Securities Neutral » Overweight

Allstate ALL Citigroup Hold » Buy

Horace Mann HMN Banc of America Sec Neutral » Buy

Career Education CECO BMO Capital Markets Market Perform » Outperform

Hercules HPC Bear Stearns Peer Perform » Outperform

Christopher & Banks CBK Sun Trust Rbsn Humphrey Neutral » Buy

Danaher DHR Bear Stearns Peer Perform » Outperform

Martha Stewart MSO Morgan Joseph Hold » Buy

Delek US Holdings DK HSBC Securities Underweight » Neutral

Audiocodes AUDC Susquehanna Financial Neutral » Positive

Archer-Daniels ADM Credit Suisse Underperform » Neutral

Camden Property CPT Credit Suisse Neutral » Outperform

Assured Guaranty AGO JP Morgan Underweight » Neutral

Northrop Grumman NOC UBS Neutral » Buy

UBS AG UBS JP Morgan Neutral » Overweight

Sun Microsystems JAVA Bernstein Underperform » Mkt Perform

Mediacom Comm MCCC Citigroup Hold » Buy

Lululemon Athletica LULU UBS Sell » Neutral

UnitedHealth UNH UBS Neutral » Buy

Marshall & Ilsley MI JP Morgan Underweight » Neutral

Sysco SYY JP Morgan Neutral » Overweight

Performance Food PFGC Wachovia Mkt Perform » Outperform

DOWNGRADES

IndyMac Banc IMB RBC Capital Mkts Outperform » Sector Perform

Cognizant Tech CTSH RBC Capital Mkts Outperform » Sector Perform

Res-Care RSCR First Analysis Sec Overweight » Equal-Weight

Kinross Gold KGC UBS Buy » Neutral

Mueller Water B MWA.B Brean Murray Buy » Hold

Capital One COF Keefe Bruyette Outperform » Mkt Perform

Post Properties PPS Keefe Bruyette Mkt Perform » Underperform

AvalonBay AVB Keefe Bruyette Outperform » Mkt Perform

Quicksilver Resrcs KWK BMO Capital Markets Outperform » Market Perform

Veraz Networks VRAZ Jefferies & Co Buy » Hold

Immunicon IMMC Caris & Company Above Average » Average

Forest Oil FST Jefferies & Co Buy » Hold

iBasis IBAS Jefferies & Co Buy » Hold

Momenta Pharma MNTA Deutsche Securities Buy » Hold

Campbell Soup CPB Banc of America Sec Buy » Neutral

Wachovia WB Sandler O’Neill Buy » Hold

Magna MGA RBC Capital Mkts Outperform » Sector Perform

CollaGenex Pharm CGPI Jefferies & Co Buy » Hold

Expeditors Intl EXPD Robert W. Baird Outperform » Neutral

SiRF Technology SIRF RBC Capital Mkts Outperform » Sector Perform

Innovative Solutions ISSC Boenning & Scattergood Market Outperform » Market Perform

Tongjitang Chinese Medic TCM CIBC Wrld Mkts Sector Outperform » Sector Perform

Telesp Part Adr TSP JP Morgan Neutral » Underweight

Performance Food PFGC JP Morgan Overweight » Underweight

PetroChina PTR Credit Suisse Neutral » Underperform

Omnicom OMC Banc of America Sec Buy » Sell

Interpublic IPG Banc of America Sec Buy » Neutral

Credence CMOS Citigroup Hold » Sell

CBL & Assoc CBL JP Morgan Overweight » Neutral

Jamba JMBA Rochdale Securities Buy » Hold

Delia*s DLIA Rochdale Securities Buy » Hold

Momenta Pharma MNTA Rodman & Renshaw Mkt Outperform » Mkt Perform

Cytogen CYTO Rodman & Renshaw Mkt Outperform » Mkt Perform

IndyMac Banc IMB Friedman Billings Mkt Perform » Underperform

Charlotte Russe CHIC Friedman Billings Outperform » Mkt Perform

PeopleSupport PSPT Friedman Billings Outperform » Mkt Perform

"Fast Money" for Thursday

Thursday’s Picks

Tim Seymour liked Gold Fields (GFI). Open $18.10

Guy Adami recommended shorting the Dow with Short Dow30 ProShares (DOG). Open $59.46

Karen Finerman liked her financials trade; long Goldman (GS) Open $214.18 and short Lehman (LEH). Open $55.96

Pete Najarian liked Evergreen Solar (ESLR). Open $13.65

Wednesday’s Results

Jeff Macke is a buyer of Intel (INTC). Open $27.49 Close $26.90 LOSS

Guy Adami recommended Ford (F).Open $8.63 Close $8.24 LOSS

Karen Finerman would short Lehman Brothers (LEH).Open $59.37 Close $55.96 GAIN

Pete Najarian would short MBIA (MBI). Open $35.65 Close $33.57 GAIN

Since my tracking began on 6/21 (1-1 means one up pick and one down pick and no results from my vacation weeks). The percentage is the percentage of successful picks

Guy Adami= 42-25 = 63%

John Najarian= 13-4 = 76%

Jeff Macke= 47-33 = 58%

Pete Najarian= 30-30 = 50%

Tim Seymore= 4-3 = 57%

Karen Finerman= 26-14 = 63%

Stacey Briere-Gilbert= 3-0 = 100

Ned Riley= 1-0 = 100%

Carter Worth= 0-1 = 0%

Wednesday’s 52 Week Low’s

WM Washington Mutual Inc 20.48

WLK Westlake Chem Corp 21.04

WLDN Willdan Group Inc 7.57

WL Wilmington Trust Corp … 33.73

WIRE Encore Wire Corp 19.64

WFC Wells Fargo & Company 31.45

SURG Synergetics Usa Inc 3.25

SUAI Specialty Underwriter … 6.56

STU The Student Loan Corp … 151.93

STRZ Star Buffet Inc 6.50

SSD Simpson Manufacturing Co 27.52

SOV Sovereign Bancorp Inc 11.95

SCHS School Specialty Inc 32.04

SBUX Starbucks Corp 24.44

SBKC Security Bank Corp 9.10

SAIA Saia Inc 12.49

SAF SAFECO Corporation 54.19

RVI Retail Ventures Inc 7.45

RT Ruby Tuesday, Inc. (G … 14.09

Q Qwest Communications … 6.66

PZN Pzena Investment Mgmt Inc 16.29

PVH Phillips-Van Heusen C … 42.93

PULB Pulaski Finl Corp 11.50

PTV Pactiv Corp 25.44

PBI Pitney Bowes Inc 37.52

PBH Prestige Brands Hldgs Inc 8.47

PACR Pacer Intl Inc Tenn 13.11

PABK PAB Bankshares, Inc 14.66

PJC Piper Jaffray Cos 43.15

PIR Pier 1 Imports, Inc 4.30

PGTI Pgt Inc 7.40

PGR The Progressive Corpo … 17.88

NCC National City Corporation 21.44

MTB M & T Bk Corp 89.17

MAR Marriott Intl Inc New 37.37

LUV Southwest Airlines Co. 13.34

KMX CarMax, Inc 18.93

KLIC Kulicke & Soffa Indus … 6.75

JBLU Jetblue Awys Corp 8.10

JAH Jarden Corp 28.50

GMTN Gander Mountain Co 4.90

GMT GATX Corporation 38.54

FUN Cedar Fair, L.P. 22.53

FRE Freddie Mac 45.84

FNM Fannie Mae 50.01

FL Foot Locker Inc 13.31

EBHI Bauer Eddie Hldgs Inc 6.20

EBF Ennis Business Forms, Inc 17.78

DPZ Dominos Pizza Inc 13.93

CPKI California Pizza Kitc … 15.02

C Citigroup, Inc 33.99

BSC The Bear Stearns Comp … 97.11

Wednesday’s Links

Locked Phones, Festival, Krispy Kreme

– Apple (AAPL) cannot makenup its mind and had re-locked iPhones

– Here is the latest Festival of Stocks

– The Master’s have nailed it to this point, why doubt them now?

“Buy fear and sell greed” Warren Buffett

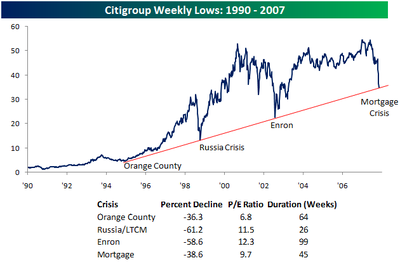

I found an very interesting chart over at Bespoke Investments. It contrasted today’s “crisis” with past ones (LTCM, Orange County & Enron). The chart (below) illustrates that this sell-off in Citigroup (C) shares is in keeping with past ones and also shows the rapid accent after the “crisis” passes.

Is Citi is trouble of failing? Not by a country mile. Let’s not forget these are just paper losses. Citi made $21 billion last year and sits on $2.3 TRILLION in assets as of 9/30 which is more than 2X it current debt. The dividend, now at 6.3% is safe as Citi has a plethora of options to use to pay it. Let’s not forget, aside from writing down the CDO’s, the rest of the banks operations are performing very well and the international operations are going gangbusters.

What if Citi has to sell off assets to meet obligations? Isn’t that what people want to unlock the value in it? They won’t but even if they do, let’s say they sell $50 billion in assets. That whopping amount comes to 2% of Citi’s total asset base…. am I the only one who really does not think that is a big deal? It is a bit like us selling our dishwasher.

Citi could issue $200 billion in debt to provide funds and even with that, it assets base would still be twice its debt level.

The thing of it is, a billion dollars used to be a lot of money. It just isn’t that much anymore when you are talking about institutions sitting on trillions. Some perspective is in order.

While Wachovia (WB) passed on the opportunity to acquire Merrill Lynch (MER), they are in effect acquiring some of its most valuable assets.

Wachovia has been hiring some of Merrill’s most accomplished brokers and traders. since those folks have a large amount of their pay packages in Merrill stock, let’s just say they have taken a significant pay cut with Merrill’s stock down 32% YTD.

Wachovia is offering upfront bonuses to the people they want and reports are that they are getting them in mass.

Wachovia passed on acquiring Merrill’s problems last month, they have jumped at getting the assets that matter, its people.

Sprint Saves Itself: For Now

Sprint (S) took the first step to tuning around its annually depressing subscriber numbers, it will sell Google’s (GOOG) Gphone.

It looks like sprint ands T-Mobile (T) will be the first two carriers to handle to new phone. The best part of the phone it that it will not be made by Google. Why is that good? We will be getting phones in all shapes and sizes and price ranges that will carry the software. That means that all types of people are now potential buyers of the product.

For Sprint this means that all it customers are now potential customers and of those that are not, all customers in all demographics could make the switch, not just those who will fork over $599 for the device like when Apple (AAPL) rolled out the iPhone (it now sells for $399).

So, is Sprint a buy? No, not yet. We still need more info. When is the rollout? What is Sprint going to do to fix its customer service issue which are the main reason subscribers have left. If they cannot fix these, any gains they get from the Gphone will be short lived as subscribers will leave for the other carriers that have the phone.

Wednesday’s Upgrades and Downgrades

UPGRADES

Cephalon CEPH AmTech Research Neutral » Buy

Mindray Medical MR Credit Suisse Neutral » Outperform

Millennium Pharm MLNM Cowen & Co Neutral » Outperform

Gevity GVHR Roth Capital Sell » Hold

Sun Microsystems JAVA Citigroup Sell » Buy

Comstock CRK KeyBanc Capital Mkts Hold » Buy

Research In Motion RIMM Credit Suisse Neutral » Outperform

OdysseyRe ORH Citigroup Sell » Hold

Allos Therapeutics ALTH JMP Securities Mkt Outperform » Strong Buy

CA Inc CA Lehman Brothers Underweight » Equal-weight

Autodesk ADSK Lehman Brothers Equal-weight » Overweight

Portugal Telecom PT UBS Neutral » Buy

American Eagle AEO Citigroup Sell » Hold

MasterCard MA Deutsche Securities Hold » Buy

DOWNGRADES

Universal American UHCO Keefe Bruyette Outperform » Mkt Perform

Sterling Bancorp STL Keefe Bruyette Outperform » Mkt Perform

ACADIA Pharmaceuticals ACAD Brean Murray Hold » Sell

Symantec SYMC Lehman Brothers Overweight » Equal-weight

CompuCredit CCRT JMP Securities Mkt Outperform » Mkt Perform

Cognos COGN CIBC Wrld Mkts Sector Outperform » Sector Perform

Entergy ETR Jefferies & Co Buy » Hold

PepsiAmericas PAS JP Morgan Neutral » Underweight

Quiksilver ZQK Caris & Company Buy » Average

Restoration Hrdwr RSTO Caris & Company Buy » Average

Citigroup C Banc of America Sec Buy » Neutral

"Fast Money " for Wednesday

Wednesday’s Picks

Jeff Macke is a buyer of Intel (INTC). Open $27.49

Guy Adami recommended Ford (F).Open $8.63

Karen Finerman would short Lehman Brothers (LEH).Open $59.37

Pete Najarian would short MBIA (MBI). Open $35.65

Tuesday’s Results

Jeff Macke recommended buying Cisco (CSCO) at the open and selling it by the closing bell. Open $33.08 Close $34.08 GAIN

Guy Adami liked Time Warner (TWX). Open $17.81 Close $18.33 GAIN

Karen Finerman said “Long Goldman (GS) Open $218.39 Close $222.50 GAIN and short Lehman (LEH).Open $58.54 Close $59.37 LOSS

Pete Najarian recommended buying MBIA (MBI) puts. Open $33.23 Close $35.65 LOSS

Since my tracking began on 6/21 (1-1 means one up pick and one down pick and no results from my vacation weeks). The percentage is the percentage of successful picks

Guy Adami= 42-24 = 65%

John Najarian= 13-4 = 76%

Jeff Macke= 47-32 = 56%

Pete Najarian= 30-29 = 51%

Tim Seymore= 4-3 = 57%

Karen Finerman= 25-14 = 61%

Stacey Briere-Gilbert= 3-0 = 100

Ned Riley= 1-0 = 100%

Carter Worth= 0-1 = 0%

Tuesday’s 52 Week Low’s

SYNL Synalloy Corporation 17.00

SYMM Symmetricom Inc 4.07

SUAI Specialty Underwriter … 6.64

SRSL SRS Labs Inc 6.00

SPSX Superior Essex Inc 27.30

SHJ Symmetry Hldgs Inc 6.94

SFST Southern First Bancsh … 17.00

SCVL Shoe Carnival Inc 14.19

SCSS Select Comfort Corp 10.73

SCHS School Specialty Inc 32.29

PNRA Panera Bread Co 37.18

PETM PETsMART Inc 27.52

PERY Ellis Perry Intl Inc 20.82

PER Perot Sys Corp 13.85

PBH Prestige Brands Hldgs Inc 8.80

MWA Mueller Wtr Prods Inc 9.99

MV Metavante Technologie … 23.82

MS Morgan Stanley 54.15

MRT Mortons Restaurant Gr … 12.71

MAR Marriott Intl Inc New 38.18

DITC Ditech Networks Inc 3.40

DEEP Superior Offshore Int … 8.63

DBD Diebold, Incorporated 38.75

CVC Cablevision Systems C … 26.82

CC Circuit City Stores, … 7.34

CAR Avis Budget Group 18.71

CALC California Coastal Cm … 7.89

CAB Cabelas Inc 18.08

C Citigroup, Inc 34.97

BBBY Bed Bath & Beyond Inc 31.44

ATBC Atlantic Bancgroup Inc 28.01

ASHW Ashworth Inc 4.67

AN AutoNation Inc 16.42

Tuesday’s Links

“Acting smart”, Bloggystyle, “Bad Kid”, Glenn Beck

– Explain to me why acting intelligent and educated is a bad thing?

– Here it is, the best weekly blog aggregation out there..

– The next time you parent piss and moan about you as a kid, show them this

– He gets more money that Brian Williams because he is just BETTER……..

Archer Daniels Midland (ADM) released record Q1 results an the news for shareholders was indeed good.

ADM has been hit this year like the rest of the ethanol sector as investors apparently forgot about its other segments. Profits came in at 71 cents a share vs 61 cents last year and 59 cents expectations.

Results:

*Net sales and other operating income increased 36% to $12.8 billion. Increased selling prices resulting from sharp rises in commodity prices accounted for approximately 75% of the increase while higher sales volumes, principally vegetable oil and wheat, accounted for the remaining 25% increase.

*Net earnings increased $38 million due.

*Oilseeds Processing operating profit increased $39 million to $209 million from $170 million last year due principally to strong global demand for protein meal and oil. Worldwide crush volumes increased 2.4% to 7.2 million metric tons.

*Crushing and origination results increased $27 million due principally to better crush margins in North America and improved origination results in South America partially offset by a reduction in crush margins in Europe.

*Value added refining, packaging and biodiesel results increased $13 million principally from improved refining volumes and margins

*Corn Processing operating profit decreased $36 million to $253 million from $289 million last year due principally to lower ethanol sales prices and volumes and higher net corn costs which were partially offset by favorable risk management results.

*Sweeteners and Starches operating profit increased $45 million to $164 million on higher average sweetener and starch selling prices partially offset by higher net corn costs

*Agricultural Services results increased $114 million to $229 million due principally to improved global merchandising and handling results as volatile commodity market conditions, large North American crops and global wheat shortages provided profit opportunities.

* Shares outstanding decreased 2%

In short, ADM is a global commodity play. Not just ethanol or biodiesel like Verasun (VSE) and Pacific Ethanol (PEIX), not just sweeteners, not just food processing, they are all of the above. If corn prices crimp ethanol profits, they can move that into sweeteners and make money there. As wheat prices rise, ADM make money there. As more people require more food, ADM is there the provide the processing for it and profit from it.

The best part? ADM will increase it ethanol production 50% and double it biodiesel production in the next 18 months. The ethanol expansion alone will add 25% to earnings at today’s depressed selling and record high corn prices. All this assumes no acquisitions of which ADM has been vocal about seeking out.

Trading at just 10 times this years and 12 times next years earnings ADM is THE company perfectly positioned to capitalize on the world predominate trends, commodities, biofiels and food.

ADM makes money from all three. sooner or later folks will figure this out.