It sounds nice but what does it mean and as an investor why do I care about it? Durable competitive advantage is sometimes referred to as a “business moat”. In its simplest term, it means the scale of a business in its field vs it peers. That is its “competitive advantage”. But, what makes it durable? What make an advantage durable is the cost and time it would take a current or potential competitor to grow large enough it this area (high barrier of entry) to adversely impact our business. A high level of durability allows us with a greater degree of accuracy to predict future earnings and thereby arrive at a price we are willing to purchase a piece of the business (share of stock). Now, how do we recognize those businesses that have this (or don’t) and how we look for it. Strict adherence to the “durable” portion of the phrase enables us to do one thing before we even begin to look at possible stocks to invest in: eliminate whole sectors of possible investment. This makes our investing easier by shrinking the field of candidates and reduces the chances of us making the mistake of investing our money in a good company in a lousy business.

Some examples of sectors that lack the “durable” portion:

Airlines: Investing history is littered with airline bankruptcies. Once high fliers fall victim to either high or low jet fuel prices or a recession and go under. After 9/11 were it not for the US Gov’t bailout of the airlines, most of them would have failed despite only being out of business for less than a week. High union costs, fickle customers and volatile fuel prices make any accurate assumption of future profits by investors impossible. Why would you buy into a company in which you have no idea of its future profitability? Southwest Airlines is a great company and the best managed of all the airlines but investing in it is akin to having the best lounge chair on the Titanic, eventually you’ll be sorry.

Tech: We have to be careful here and not throw the baby out with the bathwater. Not all tech qualifies here but let’s look at it generally and you will have to decide on a case by case basis. Warren Buffett of Berkshire Hathaway (BRKA) said it best about tech investing. I will paraphrase “I cannot invest in something that two teenagers with a pc in a garage can destroy”. What? Simple, Micheal Dell started building pc’s in his Texas dorm room, Bill Gates started Microsoft in his garage, Ebay was launched in a weekend from a living room after a labor day conversation and Google was a research project by two Stanford University students. All these businesses toppled industry leaders at the time and Google is in the process of doing it to several now. How can you be confident about an investment that an 18 year old writing code in his family room before he takes out the trash could make obsolete? This industry must constantly reinvent itself almost yearly in order to survive. The pace of the necessity of this change is accelerating every year. Look at the ipod, its success has exploded the last 3 years and in 6 months the iphone comes out. Having an ipod and a phone and having to carry both around will be a thing of the past. Competitors will flood the market with similar products and the stand alone ipod will be history. It will be relegated to the “remember when” conversations. This is how fast things change in tech and all these companies make missteps along the way and when they do, investors pay the price, heavily. Remember, since 2000 when investors thought these companies reinvented the rules of investing, Microsoft (MSFT), Dell (DELL), Amazon (AMZN), Yahoo (YHOO) and other are all still down over 40%. When is the last time you did not buy a bag of M&M’s because they “were so yesterday”, searched for the “newest version of Arm & Hammer baking soda” or would not be caught dead eating a Hershey’s candy bar? Me either..

You have to wade through the tech field carefully (I personally avoid it) and if you do decide to jump in, please do not do what most tech investors do, overpay for your shares (see yesterday’s Google post).

Auto Industry: See airlines

Pharmaceuticals: Decades ago these were great investments. However, the advent of generic drugs has turned this into a simple commodity business. They used to enjoy the financial fruits of new drugs for decades, now the exclusive locks up are shorter and increased competition means competitors have similar products in the market almost simultaneously with the generics undercutting profits. This industry is under attack by govt’s and now in the courts by users of their products. The economics of their industry have permanently changed for the worse and it should be avoided as they are spending more and more money to develop drugs with smaller profits potential. Bad equation.

So, now we have a brief idea of what to avoid it would be nice if I gave you some ideas of companies that have a competitive advantage that IS durable.

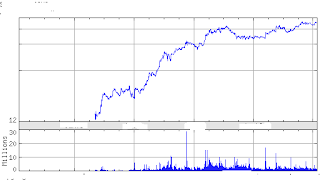

McDonald’s (MCD)- The turn of the century was hard on the golden arches. They had the perfect storm of bad events and the stock was punished over the next two years from almost $50 down as low as $14. Some of the mistakes were theirs and others were from events beyond their control. The turn of the century began with a heightened interest by consumers of what they put into their bodies. McDonald’s was slow to recognize this and their sales began to suffer. Then came mad cow. The whole fast food industry suffered as consumers began to look for options other than meat products to eat and McDonald’s was once again slow to react. Then the Jack In The Box chain in the pacific northwest began serving ecoli burgers and killed several people. These events lead people to fear the drive thru window. But, what was really wrong with McDonald’s that a menu fixin‘ wouldn’t cure? Nothing! Because of the durable competitive advantage it held over the rest of the industry and the value the McDonald’s brand held worldwide, after some menu tampering McDonald’s was once again off to the races. It has a worldwide distribution system second to none. It has since survived the premature death of 2 CEO’s and share are up 214% from their lows. Recent proof of McDonald’s advantage has been the introduction of coffee at its locations (good coffee I should say). It has been a huge success and chains like Dunkin‘ Donuts and Tim Horton’s have noticed sales declines were McDonald’s competes. At is low McDonald’s was a value investors dream…

John Deere (DE) / Caterpillar (CAT): If you are either farming or in construction your search for equipment most likely begins and ends at either of these companies. Both basically invented the industries in which they operate and by far are the world leaders in them to this day. Both stocks are up over 125% since 2000.

Walt Disney (DIS): When you think of your childhood or amusement parks does anything other than Disney come to mind? After stumbling at the turn of the century the House of Mouse has righted its ship and shares are back on the march. If you are my age and your folks had bought you Disney shares when you were born you would be sitting on a 5000% gain.

Hershey (HSY): The Hershey Company markets such well-known brands as Hershey’s, Reese’s, Hershey’s Kisses, Kit Kat, Almond Joy, Mounds, Jolly Rancher, Twizzlers, Ice Breakers, and Mauna Loa, as well as innovative new products such as Take 5 candy bar and Hershey’s Cookies and is the largest chocolate manufacturer in N. America.

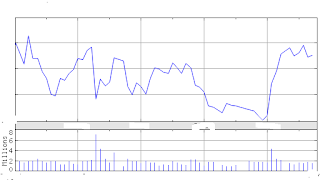

Coke (KO)/ Pepsi (PEP): The two dominant worldwide soft drink makers. If you really think about it, they are really the only two of any significance. Their products are known worldwide and both stocks have produced. Had your folks bought you share in either when you were born in the early 70’s you would be sitting on in excess of 3000% gains.

All of these companies have rewarded loyal shareholders with great gains. The important thing to recognize is all have had their problems and because of their durable competitive advantages, have not only weathered the storms but emerged stronger companies.