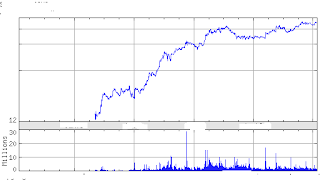

SHLD- Is there something Going On Here?

SHLD has been bouncing around rather undramatically between $170 and $180 for the better part of a couple months now. Investors have been waiting for Eddie Lampert to make his next long awaited acquisition and for the FY 2007 results on about March 1st. Barring any significant news, I had not expected the stock to do much of anything exciting either way. Something very interesting happened Monday while you were at lunch. At about 12:30 buyers (or one big one) came into the market big time and SHLD shares jumped from $178 to almost $183 in only 16 minutes. Clearly somebody thought they new something. Had this just been a mutual fund buying shares to accumulate a position they would have done so gradually and not caused the spike in the price. This was somebody big rushing in as fast as they could to be there before an event. It is clear that they though news was imminent that was going to drive the stock up and wanted to be there first. It is called “unusual volume”. No news was released and the stock settled just shy of $180 up 1.55 % for the day. Nobody can keep a secret on Wall St. no matter how hard the regulators try to keep them quiet. Keep an eye out…

OC:

Owens Corning (NYSE: OC) announced that it is currently scheduled to announce its fourth quarter and full-year financial results on Wednesday, Feb. 21, 2007, prior to the opening of the New York Stock Exchange.

Dave Brown, president and chief executive officer, and Mike Thaman, chairman and chief financial officer, will host an earnings conference call on Wednesday, Feb. 21 to discuss the company’s results for the fourth quarter and full year of 2006.

Owens Corning also established the following dates to announce financial results in 2007. These dates are a forecast of Owens Corning’s earnings announcement calendar and are subject to change.

-- May 2, 2007 - First quarter 2007 financial results

-- Aug. 1, 2007 - Second quarter 2007 financial results

-- Nov. 1, 2007 - Third quarter 2007 financial results

ADM:

Archer Daniel’s Midland announced CEO Patricia Woetrz has been named Chairman of The Board. ADM, the world’s largest producer of both ethanol and bio diesel, is the largest American company headed by a female CEO. ADM also raised it quarterly dividend by 15% to 11.5 cents a share. This is payable on March 9th and will be reflected in the portfolio in the April update.

DOW Chemical CEO Andrew Liveras

In re-reading the recent interview he did after last quarters earnings something struck me. Mr. Liveras in a value investor! Look at what he said when asked if DOW would use its growing cash hoard to make acquisitions. He said “asset prices in many areas are inflated due to private equity” he went on, “in this environment we would be more likely to be a seller of assets than a buyer”. In the same vein he said “any acquisition we were to consider would have to be immediately accredive to earnings”. Translation: If it is not cheap enough to add to earnings this year we will not do it. So, he is willing to sell overpriced assets and will only buy underpriced ones…. sound like a value guy to me.

The Wall Street Journal & Value Plays:

On Thursday Feb. 1 I posted here that Altria shareholders should dump their Kraft shares after the spin off. On Monday the Wall St. Journal penned a pieced titled “Altria holders may bet against Kraft shares”, in it they suggested another way to profit from the expected surge of Kraft shares hitting the market. From the article:

“The hedge is on shares of Kraft Foods Inc. that Altria shareholders are about to receive. Altria will spin off its stake in Kraft next month, giving investors 0.7 share of Kraft for every Altria share they hold.

Excitement about the move, which was announced last week, has helped lift Altria’s shares about 13% since the third quarter, as the company overcame barriers to the spinoff.

Shares of Kraft, on the other hand, have lost nearly 5% in the four months as the company has faced competition and cost pressures.

So it is understandable that Altria shareholders might not be that interested in keeping the shares of Kraft they are due to receive, and that has some expecting that a flood of stock for sale will cause a notable decline in Kraft’s share price. “More than $50 billion of Kraft equity needing to find a home all at once will likely cause an extended oversupply of the shares,” D.A. Davidson analyst Timothy Ramey said in a recent note.

Investors worried about this should “go out and buy puts even though they don’t own the stock yet,” said Joseph Palazzola, options strategist at A.G. Edwards & Sons.

By doing so, investors can lock in Kraft’s current $34.03 share price — less the cost of the puts, of course.”

Buying any option entails an investor being prepared to lose all of their money since when you buy an option you do not actually own anything. It’s value is based on the difference between the strike price of the option and the price of the stock it tracks. In theory you could go to lunch, have good news make the stock jump and be left holding an option worth nothing in this case. Add to this options trade on supply demand just like other securities so the price you will be paying for these suggested puts will be expensive. Short term options trading is very volatile and if you cannot watch these trades you could lose your whole bet (notice I said bet and not investment, short term option trading is just that, betting not investing). Unless you own at least a thousand shares of MO and would be receiving 700 Kraft shares, after you figure in transaction costs, the risk you are taking on vs the potential reward is just not worth it. I will not do any of this. I will take my spin off, be happy and not get greedy.

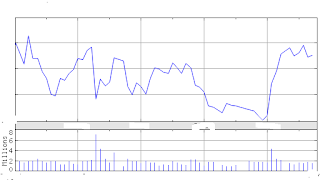

USO:

As of this morning our USO pick is up almost 10% in a few weeks. Remember, when I recommended it I said I thought at that price it was at equilibrium. Any news would cause it to jump either way. The current cold snap in the US has cause upward price pressure. Should this cold last expect this trend to continue. Complicating matters is Iran again. They recently said that on March 11 they will have a “significant announcement”. Who knows what that means. But as that date comes closer speculation will grow rampant. That will lead to fear. Remember, fear in the oil markets acts contrary to fear in the stock market. This fear will cause the price of oil to rise. If the news is rather benign, expect oil to fall (assuming no other major event leading up to it). Should the price of oil run up ahead of the announcement on a worse case scenario and the news is bad, oil may just sit where it is since this news has already been factored in. What am I trying to say? Do not get either to happy or frustrated with this. I said oil is very volatile and the last two weeks have proven that. The long term fundamentals of the investment still remain. Just sit back and hold on.