Last weekend I listed what I thought were the notable comments from Warren’s letter to the Berkshire Hathaway shareholders. Since I have entrusted the largest portion of my personal portfolio to Eddie Lampert at Sears Holdings, I ought to post the important “notables” from his.

Retail Operations

“Lands’ End had a record year in profitability in its traditional business (i.e., catalog, online, and inlet stores). In addition, we saw a significant improvement in the profit performance of Lands’ End merchandise in our Sears stores. With a new leadership team and a more integrated approach to working across Sears Holdings, the business is moving in the right direction. Our customers are embracing the opportunity to buy Lands’ End quality merchandise in our stores, on the phone, and on the Internet, and we are working hard to make Lands’ End available across more of the chain.”

If anyone has seen the Land’s End “store in a store” concept in Sears, it is a real winner. I am fast becoming convinced that the future direction of Sears apparel will predominately be Land’s End merchandise.

“Home Services is another business that achieved a record year of profitability in 2006. Home Services is not only a highly profitable business for us, but also an important strategic asset as it provides a point of differentiation from many of our competitors.”

“The apparel businesses at both Kmart and Sears also showed continued improvement. Kmart is further along in partnering with our sourcing and design groups, and we believe that we have improved our offering for our customers with higher quality, better fit, and appropriate fashion at great value. Sears apparel has turned around the decline that occurred in 2005 when it moved away from the styles our customers wanted to buy. The team has made significant progress this year, and is focused on creating the kind of breakthrough improvement that would return Sears to its previous levels of profitability in this area.”

On Cash flow

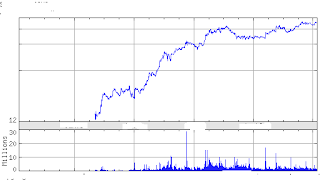

While we like to think of ourselves as a start-up, we are different from most start-ups in our cash flow generation. Since the merger closed in 2005, we have demonstrated a consistent ability to generate cash flow. This strong source of cash provides us the flexibility to deploy capital in the manner that we believe is best calculated to create long-term shareholder value. (Emphasis mine).

Ratings Agencies

We ended the year with more cash on hand than debt. On a combined basis (including Sears Canada) we have $4.0 billion of cash and only $2.8 billion of debt (excluding capital lease obligations of $0.8 billion). Domestically, our $3.3 billion of cash exceeds our debt balance of $2.3 billion (excluding $0.7 billion of capital lease obligations). Furthermore, approximately $350 million of the outstanding domestic debt represents borrowings by our Orchard Supply Hardware subsidiary, which is non-recourse to Sears Holdings. Despite the conservative nature of our capital structure and our improved profitability, the rating agencies have not upgraded us and continue to hold a non-investment grade rating on our debt. We believe Sears Holdings is an investment-grade company; the lack of response by the agencies is puzzling and is certainly something we continue to hope will change. Then again, we have taken these measures not out of a desire to please the rating agencies, but rather because we believe they are the right moves for our Company at this time.

Derivative Instruments

Our disclosure in 2006 that we had entered into total return swap transactions generated a fair bit of media attention and speculation. Perhaps this was prompted by the disclosures that we provided relating to the risk of the investments. As we disclosed in our filings, these total return swaps are derivatives, a term used broadly to describe a vast spectrum of financial instruments, which often have very different characteristics and purposes. Derivatives are so labeled because their value is tied to, or “derived” from, the value of one or more defined underlying indices, prices, or other variables. But it is important to remember that derivatives come in a myriad of forms and carry various levels of risk.

In our case, we entered into total return swaps, whose value is directly derived from changes in the value of the underlying securities. We could have purchased the underlying securities directly, but we elected to make our investments in the form of total return swaps because it can be a more efficient and cost-effective means of managing capital. As of February 3, 2007, the notional value of these derivatives was less than $400 million.

While we chose to include risk disclosures to make clear that, as with all investments, there is risk associated with the total return swaps, it is also the case that every company takes risks every day. Indeed, business is about managing risk. When these risks come in other forms, they are not always accompanied by the same level of detailed disclosure in public filings. Doing business in California will always carry “earthquake risk” and doing apparel business in winter clothing will carry “weather risk.” Investors and executives focus on some of these risks and tend to overlook others. If a company’s risk-management process is a robust one, the level of focus will be proportionate to the amount of risk and the probability of the risk occurring, as well as whether or not the risk can be effectively managed. At Sears Holdings, we try to manage risk in an effective way – whether it is in our investment decisions, our real estate decisions, or our product line decisions – and we are prepared to take risks where we believe the probability of success justifies the investment. We will not always be successful, but if we do a good job of evaluating opportunities and executing on them, we believe that our shareholders will be well rewarded.

A Strategy of Disciplined Growth

As we look ahead, I want there to be no doubt about one thing: It is certainly our intention to grow Sears Holdings. Some commentators have asserted that we want to shrink the Company, but that is simply not so. No great company would aspire to become smaller, and we certainly do not. But before embarking on a growth plan, it is critical to provide a sound base from which to grow. To this end, we have set out to improve the profitability of our business model. Our objective is disciplined growth. We do not want to grow simply for the sake of becoming bigger. Rather, our aim is to become more profitable, and as such we need to ensure that any revenue growth occurs at an appropriate level of profitability.

As we have said before, we do not want to spend $1 too much or $50,000 too little on our stores. Unless we believe we will receive an adequate return on investment, we will not spend money on capital expenditures to build new stores or upgrade our existing base simply because our competitors do. If share repurchases or acquisitions appear to be more productive, then we will allocate capital to those options appropriately. We will seek superior returns, wherever they may be found.

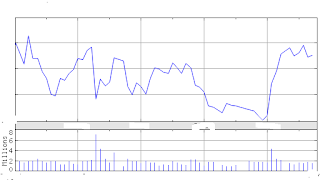

Many of our largest competitors, on the other hand, are primarily focused on growing their top line. To that end, and consistent with the conventional wisdom, they are quickly building new stores. This is a highly capital-intensive way to try to drive returns for shareholders, but provided the return on their investment in new stores is more attractive than their alternatives, it may be the best use of capital for them. Over the past three years, by contrast, we have shown that there are other ways to create value for shareholders. Sears Holdings’ stock has been one of the top retail performers for each of the past two years, as was its predecessor Kmart in 2004, in spite of this non-traditional approach.

We believe we have managed to create a lot of value for shareholders without excessive spending partly because of our disciplined stewardship of our shareholders’ capital. For Sears Holdings, in the near term we believe the greatest value will come not from increasing our store base, but primarily from better utilizing our existing assets to deliver more value to our customers and ultimately our shareholders.

Compensation

I believe one of the causes of the many well-known accounting abuses was this myopic focus on moving share price by driving short-term earnings. As we have explained, we do not attempt to manage earnings or expectations, we generally do not meet with Wall Street analysts, and, except in a few select cases, we have not provided options to our associates. Stock options can play an important role in compensation arrangements if handled correctly, and many companies have used them to motivate and compensate their executives and employees appropriately. The requirement that companies account for stock options as an expense is helpful in highlighting to investors and directors the cost of these programs.

At Sears Holdings, we have linked a very significant part of our executives’ variable compensation to the EBITDA of Sears Holdings or one of its businesses, adjusted for certain items that are not within the control of our associates. We consider EBITDA a superior measure of operational performance, as it provides a clearer picture of operating results and cash flows by eliminating expenses that are not reflective of underlying business performance. We have both a one-year EBITDA goal used for annual bonuses and a longer-term goal that is generally based on EBITDA performance that we have used for our Long Term Incentive Plans (LTIPs). Unlike some companies, which set targets at levels that are difficult to miss, we set targets that are achievable but require us to perform – it is important to set goals that challenge and stretch us.

Members Of The Military

One aspect of Sears Holdings’ commitment to the military – our Military Service pay differential and benefits continuation program – has received a fair bit of grassroots attention in the past couple of years. I have seen a number of emails and blog entries about this program, most of which ask whether it’s true or an urban legend. The initial skepticism is understandable, given the unfounded rumors and exaggerations that can circulate on the Internet, but in this case the program is real. For associates of Sears Holdings (other than certain part-time and seasonal associates) who are called to duty in the National Guard or Reserve, we make up any difference between the associate’s pay at Sears Holdings and his or her military pay – for up to five years. We will also hold a comparable position for an eligible deployed employee for up to five years, and allow those employees to continue most benefits while deployed. Since 2001, we have had over 3,500 associates participate in our military leave program; at present, there are about 400 Sears Holdings associates in the program. We are proud to support these individuals as they serve our Nation.