“Davidson” submits…

There exists a little used but highly correlated relationship between US Employment and Power Use(Electric/Gas Utility Production) each of which can be found at the St. Louis Fed Economic Data – FRED® link.

Electric/Gas Utility Production series: http://research.stlouisfed.org/fred2/series/IPUTIL?cid=3

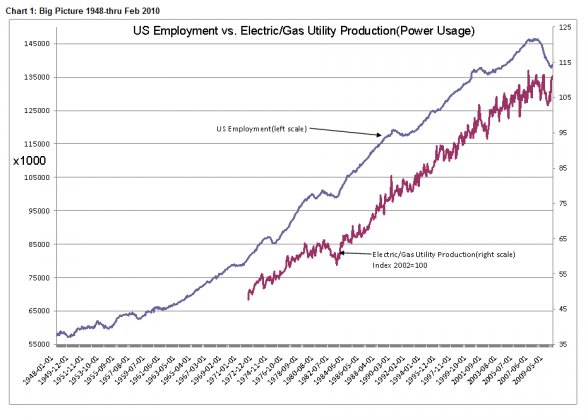

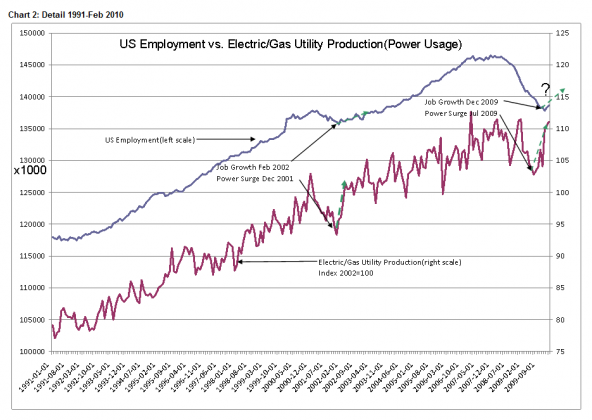

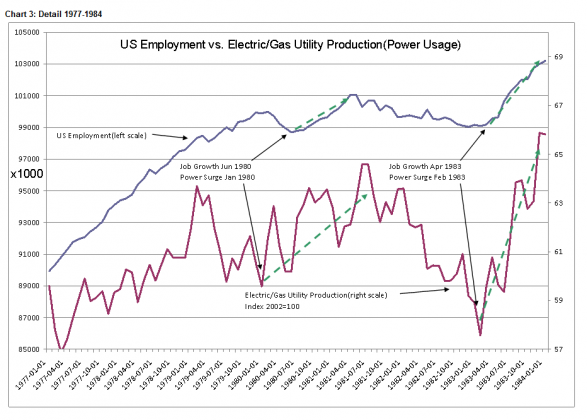

The Household Employment Survey: http://research.stlouisfed.org/fred2/categories/12The long term relationship between these two fundamental and highly revealing economic data series is presented in Chart 1: Big Picture 1948-thru Feb 2010 with two detailed views, i.e. the recent data in Chart 2: Detail 1991-Feb 2010 and a comparable difficult period in Chart 3: Detail 1977-1984.

Chart 1 provides the perspective that employment and power usage are highly correlated over the history of the Electric/Gas Utility Production series since inception in 1972. One needs to keep in mind that data collection on the US economy which began in WWII was based on the need to understand the US capacity to wage war. The collection of data has gradually expanded and evolved as various series proved useful in understanding and supposedly educating economists and government towards the implementation of correct(?) policies.

I think the importance of the particular predictive relationship between Power Usage and Employment has been lost in modern analyses efforts. The slicing and dicing of data in ever more detail over shorter and yet shorter periods has occurred as some in society have sought to gain investment returns in competition with others. What has blossomed has been an entirely new investment industry populated by Hedge Fund investors.

I recommend highly three recent texts which together provide an interesting overview of the past 20yrs of this new market influence, i.e. “The Quants” by Scott Patterson, “The Myth of the Rational Market” by Justin Fox and “Too Big to Fail” by Andrew Sorkin. One will gain an understanding of the influence of computers and mathematics as wielded by highly competitive individuals seeking investment success and how this has in many ways simply changed the general focal period for investment returns from one of 5yrs-10yrs to one of micro-seconds. It is almost impossible today to find in the daily media commentary that promotes a low turnover, fundamental approach. I believe that this is the reason why the correlation between Power Usage vs. Employment seems to have been ignored.

Charts 2&3 reveal the important details of recent and significant recessions. You will note that in each instance that Power Usage increased prior to each and every recovery in US Employment, The July 2009’s Power Surge offers a very intriguing forecast for future employment in our current economy. The explanation rests in understanding the economic Supply/Demand chain and how recovery is implemented by businesses.

Power Usage is most heavily influenced by the business cycle on the margins of society in heavy manufacturing. There is no better example than auto and small truck sales, called Light Vehicle Sales by Fed data collectors. Light Vehicle Sales have reportedly recovered from a Feb 2009 annual pace of 9.14million to a reported monthly pace equating to annual sales of 12.5million units. Importantly, the “Cash for Clunkers” program ended last August 2009 and is not part of the current trend. In order to sustain the current sales pace, multiple supply chains must be activated to supply the ~6,000 separate parts required in the average light vehicle. Parts are required to replace inventory as it is drawn down. Before the metal parts can be manufactured, parts makers must order refined metal products in various forms from their appropriate supply chains. And, before the metal is available for fabrication, mines and smelter operations must be restarted. It is the restart of mines and smelters that require significant power inputs that can be seen in the Power Usage series that provides the forecast for a surge in employment in the coming months. The July 2009 Power Usage surge provides strong support that a surge in US Employment is to be expected in the months ahead!

FedEx’s report that business is much better than anticipated this morning and that they must rehire furloughed employees is the type of evidence that recovery is strong.