This is amazing. Shareholders are being bled to death by the constant option exercising by management. Now, as we have noted relentlessly via twitter most of the option exercises by management are being done 1-3 years before the options expire (they are cashing out early). Table II in this example will tell you when the option expired vs date exercised. If you are one to believe managements actions tell you what they think of the stock price, you might want to think about that. Perhaps even they know share prices are unrealistic?

We talked last week about their “Goodwill” and how we are mystified that there have been no writedowns to the exploding metric despite the acquisition binge they have been on resulting in only increased GAAP losses.

Let’s look at “stock based comp” today. This is compensation given to executives in the form of stock rather than cash. The stock price goes up, the value of their stock options/grant goes up.

When used responsibly, it give execs incentives to make decisions that in theory are best for shareholders since a chunk of their comp is tied to the share price. We have also seen countless examples where their practice has lead to accounting shenanigans that have in the end left shareholders holding an empty bag once execs have cashed out.

From the most recent 10Q pg 35:

Stock-Based Expenses. Our cost of revenues and operating expenses include stock-based expenses related to equity plans for employees and non-employee directors. We recognize our stock-based compensation as an expense in the statement of operations based on their fair values and vesting periods. These charges have been significant in the past and we expect that they will increase as our stock price increases, as we hire more employees and seek to retain existing employees.

During the three months ended April 30, 2012, we recognized stock-based expense of $81.3 million. As of April 30, 2012, the aggregate stock compensation remaining to be amortized to costs and expenses was $888.1 million. We expect this stock compensation balance to be amortized as follows: $255.2 million during the remaining nine months of fiscal 2013; $292.4 million during fiscal 2014; $232.8 million during fiscal 2015, $105.1 million during fiscal 2016 and $2.6 million during fiscal 2017. The expected amortization reflects only outstanding stock awards as of April 30, 2012 and assumes no forfeiture activity. We expect to continue to issue stock-based awards to our employees in future periods.

$881M still to be amortized. That means at current share prices (April 30th) shareholders can expect $881M dollars of additional stock to be dumped by insiders. When you market cap is $17B, that comes to ~5% of your current market cap. Here is the kicker, that number is only the tip of the iceberg.

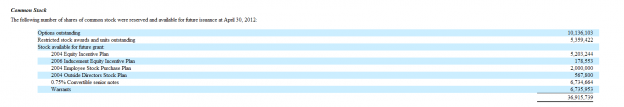

Yup, 36M more share are waiting in the wings to be doled out. THAT is the equivalent of 24% additional shares being dumped by insiders or another $4.5B shares. Now, why do I say “dumped”. What if insiders get these options and exercise them and hold shares? Many companies do this and when the option is exercised the employee sell just enough to cover the tax nut and keeps the rest. Well, is that what is happening at $CRM?

Sadly, no. Not only are they exercising the options early (some as many as three years early as noted above), but in virtually every single instance, every share is being sold. I say “virtually” because I may have missed one instance they didn’t sell them all but I have not found one…. Here is the Form 4 (insider activity) list for $CRM, if you do not believe me, go through yourself. In fact not only has an insider NOT bought a share in over three years, as a group they have sold $476M in stock.

So, when management sits there and tells you how bright their future is, how exciting the opportunities are and what amazing potential $CRM has, you have to ask yourself, “if all that is true, why are they mass selling like this?”. Wouldn’t a management group that truly believed in the above do what most folks in a similar situation do? Sell enough for taxes and hold the rest to watch it appreciate. I get insiders sell, they buy houses, have tuition bills etc…..but $476M in sales to ZERO buys? The implication there is not even debatable….

HT Reader Scott for reminding me of this…

One reply on “Salesforce’s Multi-Billion Dollar Dilution…”

[…] Salesforce’s Multi-Billion Dollar Dilution… […]