I have said it before the balance sheet is the heart of any company. If it is strong, it can withstand almost anything. If it weak or weakening, then even minor events can send it into a tailspin. When you combine a weakening balance sheet with a irrational stock price, the results can be a breathtaking fall.

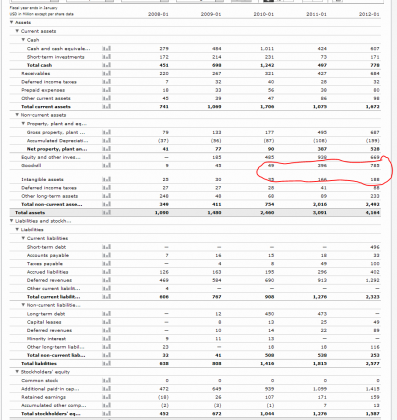

I want to look at $CRM ‘s balance sheet today. Here it is:

Notice the huge jump in the last three years in “goodwill” and “intangible assets” from $84M to $973M. That has been due to a rash of acquisitions:

- GroupSwim (December 2009) – now part of Salesforce Chatter

- Informavores (December 2009) – now re-branded to Visual Workflow

- Jigsaw Data Corp. (April 2010),- now known as Data.com

- Sitemasher (June 2010) – now known as site.com

- Navajo Security (August 2011)

- Activa Live Chat (September 2010) – Now known as Salesforce Live Agent

- Heroku (December 2010)

- Etacts (December 2010)

- Dimdim (January 2011)

- Manymoon (February 2011) – Now known as Do.com

- Radian6 (March 2011)

- Assistly (September 21, 2011) – now known as Desk.com

- Model Metrics (November 2011)

- Rypple (December 2011)

- Stypi (May 2012)

- Buddy Media (May 2012)

- Thinkfuse (June 2012)

- GoInstant (July 2012)

Def:

In the accounting sense, Goodwill can be thought of as a “premium” for buying a business. When one company buys another, the amount it pays is called the purchase price. Accountants take the purchase price and subtract it by a company’s book value. The difference is called Goodwill.

You used to have to depreciate 1/40 of the amount of goodwill from earnings each year but the FASB changed the rules saying that only deductions are necessary when the “asset” becomes impaired and it is clear the goodwill is not worth what the company paid for it. So rather than taking a hit each year to net income because of the goodwill depreciation, now it only happens when management deems it to be necessary.

This gives management HUGE discretion as to when the asset is “impaired”.

Now for “intangible assets”

Def:

Consists of patents, trademarks, brand names, franchises, and economic goodwill. Economic goodwill consists of the intangible advantages a company has over its competitors such as an excellent reputation, strategic location, business connections, etc. They should carry them at costs on the balance sheet, they are normally given completely meaningless values.

Here is a story that brings the point home from one of my favorite books, Ben Graham’s Interpretation of Financial Statements:

Michael Price’s introduction to the book:

In the spring of 1975, shortly after I began my career at Mutual Shares Fund, Max Heine asked me to look at a small brewery – the F&M Schaefer Brewing Company. I’ll never forget looking at the balance sheet and seeing a +/- $40 million net worth and $40 million in ‘intangibles’. I said to Max, ‘It looks cheap. It’s trading for well below its net worth…. A classic value stock!’ Max said, ‘Look closer.’

I looked in the notes and at the financial statements, but they didn’t reveal where the intangibles figure came from. I called Schaefer’s treasurer and said, ‘I’m looking at your balance sheet. Tell me, what does the $40 million of intangibles related to?’ He replied, ‘Don’t you know our jingle, ‘Schaefer is the one beer to have when you’re having more than one.’?’

That was my first analysis of an intangible asset which, of course, was way overstated, increased book value, and showed higher earnings than were warranted in 1975. All this to keep Schaefer’s stock price higher than it otherwise would have been. We didn’t buy it.”

So, $CRM has nearly 25% of its total “assets” in these two categories in which management has total discretion as to their value.

Let’s take a step back. What is the point of making any acquisition? Eventually the deal is expected to increase earnings per share, right? What is the point of making it if it doesn’t? When you have spent ~$1B dollars the last three years buying up companies, shouldn’t shareholders expect those deals to increase profits? If not you should have just given them back the money….no?

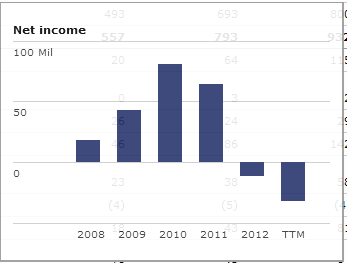

So, what have all these deals done for $CRM ‘s earnings? I am going to use net income so any share count changes do not skew the numbers.

Since they began the acquisition binged net income has cratered from a high of $81M in 2010 (why would any of you pay $17B for a company that in its BEST year made $81M????) to a loss of ($32M) in FY 2012. Note: FY 2013 will see increasing losses over ’12.

So, if we have spent $788M over the worth of our acquisitions and those acquisitions have lead to an increasing deterioration in net income, can we really justify not writing down that goodwill?

What would cause a goodwill writedown?

SFAS 157 eliminated some of the diversity in practice that had previously existed in goodwill assessments. Most importantly, SFAS No. 157 defines fair value as an exit price, or how much could be obtained upon sale of the asset. Considerations of entity-specific rationales that are not reflective of what the marketplace would pay are no longer acceptable.

So, if all of these deals have failed to delivery any profit to $CRM, then can we really say that they could be sold for what was paid for them? If we can’t say that then they should write them down. $CRM has taken no impairments for acquisitions since 2008. This means that they claim every deal they have made is worth as much or more than it was the day they bought it. In other words, $CRM management has a perfect investing record……watch out Warren….

Management will continually trumpet their “revenue growth” in doing their victory laps after each quarter. Here is the thing, if I stand on a street corner and sell $5 bills for $3 each I’ll have revenue (losses also). After a few days word will get out and I will see a line of people waiting for me and I will sell more $5 bills for $3 day after day. My “revenue” will increase daily (as would my losses)…….if you were a shareholder in my business would that make you happy? I’m not sure why $CRM execs expect their shareholder to be happy (although shareholders seem to ignore this reality)

Remember $AOL Time Warner? They eventually admitted to investors that goodwill was overpaid for when AOL and Time Warner merged. The company had to take a $100B charge against its goodwill account and immediately shares fell 75%.

Although it does explain why over the past three years $CRM management has sold $476M in stock and bought…….let me see……..oh, there it is ….ZERO

Increasing revenue coupled with dramatically decreasing net income and some questionable asset valuations IMO are setting up current shareholders for a painful lesson…..

4 replies on “When Will Salesforce Write Down Goodwill?”

[…] About balance sheets and write-downs: Value Plays. […]

[…] talked last week about their “Goodwill” and how we are mystified that there have been no writedowns to the […]

[…] We talked last week about their “Goodwill” and how we are mystified that there have been no writedowns to the exploding metric despite the acquisition binge they have been on resulting in only increased GAAP losses. […]

[…] Goodwill […]