Let’s go back a bit to the original deal:

Salesforce has entered an agreement to acquire social media marketing platform Buddy Media for approximately $689 million, the company has announced.

The price is lower than the recently reported $800 million figure, but still a formidable investment from the enterprise software giant, which is on a seemingly never-ending acquisition spree. Salesforce had acquired collaboration tool company Stypi in May 2012, as well as social media monitoring platform Radian6 in March 2011.

Under the terms of the agreement, Salesforce will buy Buddy Media for approximately $467 million in cash, $184 million in Salesforce common stock and $38 million in vested salesforce.com options and restricted stock units.

Both sides talked up the wonderfulness of the deal and how it was a boon to $CRM.

Now, here is a post I wrote back in August of this year regarding the folks at Buddy Media and their dumping virtually every share of $CRM stock they received in the acquisition. Even though they got >$400M in cash, they still elected refrain from holding any shares of $CRM as soon as their lockup ended.

Fast forward a few months and now we are getting some idea of what $CRM shareholder actually got for their huge investment. In a word……. losses

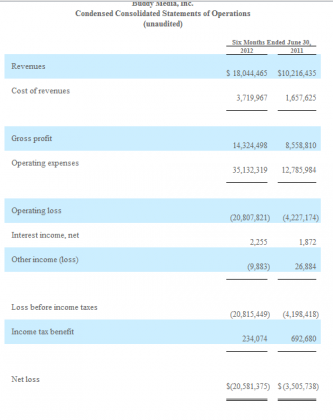

$CRM released an amended 8k today and in it are YOY comps for Buddy Media for the 1st six months of both ’11 and ’12. The results are a bit ugly:

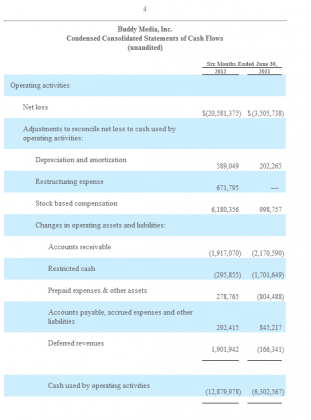

Losses are surging and the company is bleeding cash from operations:

Note regarding cash flows: focus on operating cash and not the aggregate cash flow numbers, Buddy Media sold $83M in preferred stock in ’10 and ’11 so that will make the numbers look FAR better that the reality. Just looking and the ending cash balances will give one the impressing cash is growing, it is, but not because the company is producing cash from operations, those results continue to get worse. They just sold preferred stock.

Now would be the time to point the ($20M) loss in the first six months of ’12 is largest than the ($14M) loss for all of 2011

BUT, and this is what $CRM will focus on if Buddy Media results are mentioned on the earnings call, revenues increased. This is the same story with $CRM. Increasing revenues and increasing losses. I’ll go back to the analogy I have used countless times before, I can sell $1 for $.75 and increase my revenues all day long. I’ll also increase my losses which is what we are seeing at $CRM. The theory for the bulls seems to be they will somehow sprinkle “profit pixie dust” on their financial results and magically begin to turn in profits.

I doubt this more every day as we are only now seeing both $ORCL and $IBM make serious pushes into the cloud CRM space. So, if $CRM has not been able to make any money when they essentially had the cloud CRM category to themselves, how the hell does anyone really think they will be able to do it when two 10,000lb gorillas come running after them? They can’t go any lower on prices, their financials pretty much tell us they are already there.

One could make the argument that both $IBM and $ORCL could make a serious push to undercut $CRM on price to steal share as they both have ancillary products to buffer any hit to results they make take in doing that. $CRM has no options

Does this means $CRM is going under? Not by a mile. It does mean that the value of their stock is but a fraction of the current price. Price and value always eventually meet and the value of $CRM stock is well under the triple digit share price it trades at now. They can only buy revenue increases for so long until reality hits and people start to expect these goofy little things like profits. When that day comes, it will be dramatic

Here are some previous posts on $CRM

One reply on “What Did CRM Buy in Buddy Media?? Increasing Losses and Cash Serious Flow Drain…”

[…] year he paid $781M for privately held Buddy Media, an acquisition that cannot be explained any other way than a disaster at this point. Results there have been below their initial targets and it is unlikely the unit […]