We have documented in the past what we feel are some questionable/aggressive accounting tactics $CRM is using to goose results. We have primarily focused on the balance sheet. Now let turn our focus to cash flows since CEO Benioff yesterday said:

Operating cash flow exceeded $130 million, an increase of more than 60% year-over-year. Operating cash flow is one of the very best measurements of success at salesforce.com, and I’m delighted to see this great result.

Given the company’s history, when I heard that my “lets dig deeper” antenna went up……way up. Since, we can assume none of the analysts on the call will given the lack of inquisition on it last night, someone has to.

To start lets get an understanding about cash flow:

Operating activities are normal daily operating activities of running a business. The indirect method of preparing the Statement of Cash Flows adjusts the net income figure to remove noncash revenues and expenses. Also removed are items like gains and losses that are not attributable to the operating activities of the business. In considering changes in current assets and liabilities, it should be remembered that changes in notes receivable and notes payable are not shown as operating section adjustments. Changes in notes receivable is shown in the investing section, while changes in notes payable is shown in the financing section.

The general reconciliation format for the operating section is as follows:

Net Income

+ Depreciation expense

+ Losses

– Gains

– Increases in current assets

+ Decreases in current assets

+ Increases in current liabilities

– Decreases in current liabilities

———————————–

= Cash flows from operating activties

===================================Notes:

Rather than memorizing the above format, a few simple examples can help

in understanding the logic:1. Depreciation is a non-cash expense that reduces net income.

Therefore, it is added back to put net income on a cash basis.2. The total cash proceeds from the sale of assets is reported in the

investing section of the statement. The effect of gains and losses

is removed from net income. Gains are subtractions because they

increased net income. Losses are additions because they decreased

net income.3. Consider accounts receivable in regard to current assets. An increase

in accounts receivable increases net income because of the associated

revenue. However, since no cash is provided, the increase in this

current asset is shown as a reduction to put net income on a cash

basis. The reverse is true for a decrease in accounts receivable. A

collection of accounts receivable provides cash but does not affect

net income. Therefore, the decrease in this current asset is an

addition to put net income on a cash basis.4. Consider accounts payable in regard to current liabilities. An

increase in accounts payable decreases net income because of the

associated expense. However, since no cash is yet paid, the increase

in this current liability is shown as an addition to put net income

on a cash basis. The reverse is true for a decrease in accounts

payable. A payment of accounts payable uses cash but does not affect

net income. Therefore, the decrease in this current liability is a

subtraction to put net income on a cash basis.

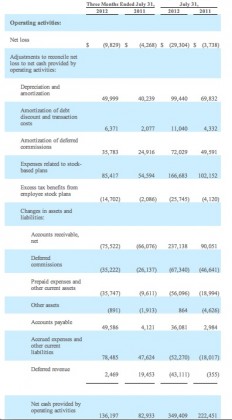

OK? Now lets look at $CRM’s cash flow statement from operations for the last Q. We will focus on operations because it is the most easily manipulated. For instance cash flow from investments pretty much is what it is and a decrease there can be good as investments/financing might be debt/stock repurchases or technological investments that will provide excess cash & shareholder returns in the future. With that said, here it is (click to enlarge):

I will focus on the two areas that $CRM has the most control over….when they pay their bills. Yes, they have some control over collectibles but if a customers can’t/won’t pay, they are stuck. BUT, they have 100% control over when they write a check. So, by looking at changes to A/P and accrued expenses, we get a picture as to whether the cash flow increase is due to a flood of cash coming in or simply $CRM delaying when it pays its bills.

Since, as Benioff said “it is the very best measure……” we are obligated to look at it…

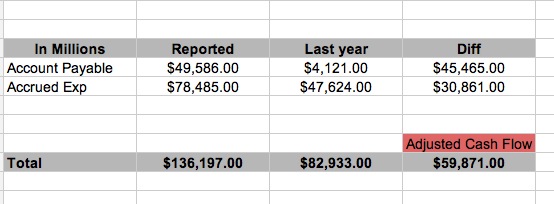

Now, as stated above, an increase in A/P or accrued expenses is a positive to cash flow as the expense is incurred (hits income statement), but payment is delayed so it is a benefit to cash flow. Here is the adjustment for the most recent Q

Now, some variation is expected in each quarter, but AP going from $4M to $49 is more than “a little”. In fact, is essentially eliminates a YOY comparison of cash flow without an explanation. After all, an 12X increase in a category ought to be a least noted, if not explained fully. Maybe the result was due to a single item? OK, tell us and then give us a cash flow number based on “normalized” conditions. I am more than a little sure if it was an item that reduced cash flow by that amount we would get an explanation.

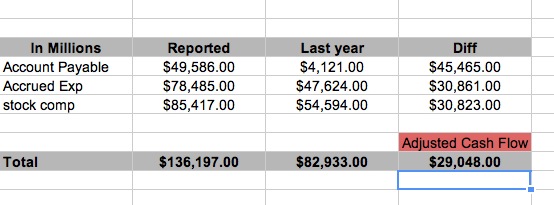

Here is another bone of contention. Benioff and Co. are having their cake and eating it too. When they report earnings, they love to use “non-GAAP” earnings which “exclude stock related expense”. OK, fair enough because of they include it, you know, results blow. BUT, magically, when they report cash flow, they INCLUDE the stock based comp category because it ADDS to reported cash flow. In fact, $85M of the $136M (62%) in reported cash flow is the stock based comp category. That number is $31M MORE than last year so even here on constant terms, reported cash flow YOY, if we eliminate this (why not, they eliminate it from earnings) craters even more:

Include it or don’t, I don’t care but to exclude it when it hurts you and then include it when helps is simply sneaky……real sneaky

Not good…….not good at all…….

2 replies on “Now CRM Plays Cash Flow Games”

[…] Sullivan at ValuePlays highlights how Salesforce.com’s Accounts Payable on the Statement of Cash Flows went from $4 […]

[…] Cash Flow […]