For those wondering “Davidson” has been saying this for a while….and here and here

“Davidson” submits:

Real GDP 3Q 2014 was revised higher than expected. More good news!

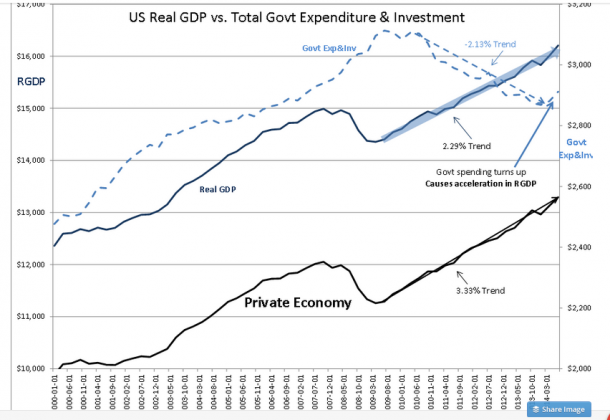

I prefer to breakdown the components into that attributed to Government Expenditure & Investment vs. that from the Private Economy. I think it provides a clearer picture of what is occurring overall in the economy which is composed of both private business transactions and those directed by government, i.e. political decisions. The Private Economy is the result of subtracting Real Government Spending & Investment from Real GDP.

The recent upside surprises in reported US Real Gross Domestic Product(Real GDP) can be attributed more to recent increases in the Government portion of spending than an acceleration in the private sector. This does not take away from our current economic expansion which for the private sector has been trending ~3.3% since the first half of 2009-see the chart below. It is important to see the data clearly and not over interpret the consolidated figures and race to conclusions.

Misinterpretation that our private economy is accelerating is what leads to excessive pricing and at this point in the cycle is beneficial to investors who recognize this. Most investors in my opinion price stocks based on trends in economic news which is always ‘old news’ by the time it becomes a story in the media. They are forever chasing the missed opportunities of past economic growth. This results in emotions dominating investment decisions. By learning to gauge the impact measurable economic trends have on future prices, those investors who rely more on logical analysis place capital into securities well ahead of news reports. Logical investors who are also Value Investors see the true economic values in securities as opposed to the majority who simply follow price trends. This is why a Warren Buffett or Ken Langone does not own a Tesla ($TSLA) or Amazon ($AMZN) but do see other issues as attractive even though fairly valued at the moment. The SP500 ($SPY) Intrinsic Value Index at $1,912 with the SP500 at ~$2,090 reflects this.

If you listen carefully to the many commentaries in the media, you will hear fairly convincingly that housing and construction are still held back from recovery to historical levels by restrictions placed on the banking system in response to the sub-prime collapse. Banking and Wall Street firms have been blamed by one and all, but the independent and discerning reader can quickly come to the conclusion that sub-prime lending was primarily driven by political . We have in our history periods in which one political philosophy takes control to such a degree that government policies have pushed our financial sectors into uneconomic and risky investing. In our recent past we have two previous periods similar, i.e. The Great Society agenda of the mid-1960s which led to the Great Inflation in the 1970s and the movement to benefit rural communities under President Wilson beginning in 1913 which led to the Great Crash in 1929. Even though our society has a tendency to go to excess in the battle of governing philosophies (deemed liberal vs. conservative in the current formats) what one should conclude from historical study is that we always, ALWAYS, right the ship! We are ‘righting the ship’ today!

All is on trend economically at the moment as we enter a period typical for market psychology shifting further into positive territory. As this occurs, markets become increasingly over-priced and Value Investors become louder in their concern. But, we have history to tell us that markets do not stop major trends till economic fundamentals turn. Today, history indicates that we should enjoy another 5yrs of rising economic trends with the improvement in housing and construction spending becoming one of the main drivers. It takes about 5yrs-7yrs from this point for these to reach their peaks. But whenever the economy peaks, it will be reflected in fundamental trends well before it is in the news.

The current economic trends lets one remain quite positive in expectation of significantly higher equity prices. Buy stocks!