Fortunes are made in bear markets….you just don’t know it at the time….

“Davidson” submits:

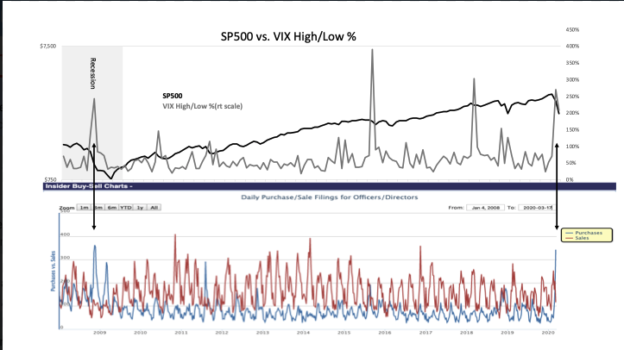

The current market panic has drawn the highest level of Insider Buying since the Sub-Prime Crisis. Corporate insiders have stepped up accumulation levels to the strongest signal since Nov 10, 2008. Insider trading reports tends to lag a couple of days with daily reports being mix of 3-5days of recent activity. The SP500 vs the VIX High/Low %(percentage monthly spread) is compared to the history of insider transactions reported by http://openinsider.com/charts.

Insiders known as the most informed Value Investors have always signaled when decent buying opportunities are present in equity markets. In using this data, it is important to recognize that market prices are determined by investor market psychology. Markets represent a broad composite of investor perceptions, but they fall into two broad categories, Momentum Investors and Value Investors. Momentum Investors are price-trend followers while Value Investors invest based on comparisons of prices to fundamentals. Even though they use the same terms and sound like they speak the same language, they do not. This makes parsing the daily commentary into something approaching common sense impossible. What is said is truly a Tower of Babel. One must listen carefully and track commentary over a period of time to separate who speaks from a Momentum vs. a Value perspective.

Except for those deemed corporate insiders, no investor is as well informed. Corporate insiders are deemed Value Investors whose activity is based on assessing whether prices represent fairly underlying business fundamentals. The value of including insider activity as part of any investment analysis occurs when insiders are buying shares while the investing consensus is selling. Periods such as today’s panic, when insider activity is very positive, occur infrequently and define major buying opportunities. The value of insider activity is multiplied when one identifies management teams with successful financial records especially when including previous stressful periods.

An Insider Buying signal of this magnitude is often taken as carte blanche that investors can buy anything. This is never the case! Markets are always a composite of investment perceptions. Momentum Investors who invest on price-trends routinely over-value issues relative to fundamentals in every cycle. These issues are titled ‘Momentum Stocks’ which sport excessively high valuations to underlying fundamentals. Many are growing revenue without producing Cash Flow or Net Income. In today’s market Tesla and Netflix are good examples. In the current cycle, it appears that there are a good many Momentum Investors present. This includes those relying on Financial Planning schemes which are in fact based on Modern Portfolio Theory that in turn is based on long-term price-trends. Financial Planning is a form of Momentum Investing.

Price-trend investing differs as much from Value Investing as oil does from water. When Momentum Investors are in panic and driving prices lower at some point Value Investors begin to buy heavily discounted fundamentals. Insider Buying represents prices which discount future fundamentals but does not identify pricing lows. Momentum Investors can sell shares 20%, 30% even 50% lower than levels which draw Insider Buying. Momentum Investing relies only on price-trends and computer trading algorithms without consideration of fundamentals. They will and do sell shares lower till shares finally draw in enough buying from other investors to stop a decline. This is called a “Bear Raid’. Bear Raids are a form of unfair market manipulation, which had been prevented by the ‘Uptick Rule’. This market rule was in effect from the 1930s till 2007 when Hedge Funds lobbied that this be rescinded. Eventually, economics and business fundamentals become fairly priced which means that Value Investing requires patience to work though times like this.

Value Investing and Insider Buying identifies discounted investing opportunities, but does not identify market or individual share price lows. Insider Buying simply tells us when things are cheap vs fundamentals. All investors should be aware that none of the so-called ‘Growth Stocks”, i.e. The FAANG issues, exhibits any Insider Buying.

The current market represents a significant buying opportunity for well-managed businesses. The arrows identify 2008 vs 2020 comparing Insider Buying and VIX peaks vs. SP500 price contractions. Patience required. One can buy excellent long-term value even if one cannot predict a bottom.