Screaming a buy….

“Davidson” submits:

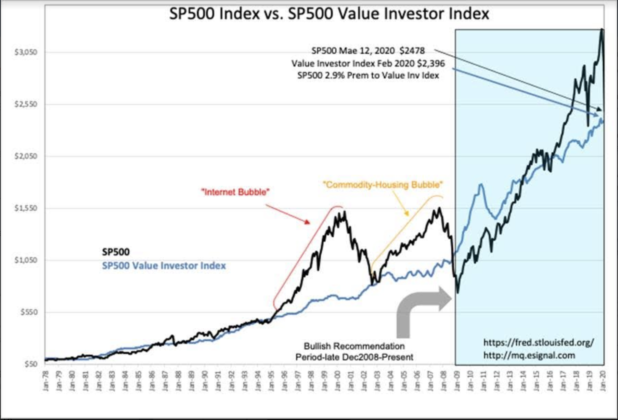

This is an update to the SP500 Value Investor Index and the correlations to Insider Buying Signals.

The SP500 Value Investor Index(VII) derives its name from the high correlation with increases in Insider Buying which are deemed the most informed of all Value Investors. There has always been a high correlation with market declines and increases in Insider Buying. Investors can routinely locate opportunities by following when and where corporate insiders are placing their own funds. It is during sharp market breaks when Insider Buying increases the most and provides a general market signal as with today’s volatile market. Daily Insider Normally, Insider Sales which are historically more frequent than Buys average roughly 2:1. When significant market declines occur, Buys exceed Sales or the ratio falls below 1:1. In practice when daily Buys rise above 100 (see chart), somewhere in the market a decline in corporate shares have stimulated Insider Buying. Investors should investigate which shares have declined and which may offer investment opportunities. The correlation with the VII occurs because the VII reflects SP500 fundamental valuations using a Private GDP benchmark. It is useful to think of the VII as a relative ‘fair price’ for the SP500. The SP500 varies from being discounted to the VII during recessions to a premium of 65%-100% for recent cycle peaks. When the SP500 declines close to the VII, this represents a fundamental buying opportunity for those companies with the best long-term financial histories and active insider buying activity.

In actuality, markets have multiple intermediate corrections during a cycle reflecting swings in Momentum Investor perspective. Momentum investors change their views as often as they discern change in price-trends. Two corrections in recent history, the correction of Dec 2018 and our current period, brought the SP500 down to less than a 3% premium to the VII. Neither Dec 2018 nor the current period showed no signs of economic weakness. It is worth noting that the most scary market periods occur not with observed economic downturns, but occur in fear of economic downtrends with most information unknown. Markets bottom as fear is displaced by information. The current correction hit a low of $2,478 on Mar 12, 2020 and daily Insider buys have spiked to 434 vs 90 Sells. This is the strongest general buy signal since 2011 when the world believed that the tiny island of Cyprus would collapse the global financial system. Cyprus obviously did not collapse the global financial system! Few noticed the lack of logic in this concept at the time as fear cascaded through markets. The same is true today. The media is promoting the belief that the US faces 2mill deaths from the coronavirus when China which, by comparison a primitive healthcare system, has had 3,100 deceased. Promoting the fear that the US will experience nearly 700 times higher casualty rate than China is well beyond sensationalism in my opinion. It has been just over a year when the Dec 2018 correction was labeled by many as ‘1929’ again. The lesson to be learned is that when market fear is palpable as it is today, look at what the insiders are buying and decide if these are opportunities.

When one does examine which insiders are buying shares vs those who continue to sell, it should come as no surprise that the most heavily promoted names in the media continue to have high levels of Insider Selling. These are the FAANG-type issues which even in correction have high valuations relative to business fundamentals. They are the Momentum issues the media promotes every cycle. FAANG-type issues begin cycles over-priced and remain so till there is an economic correction. The 2000 Internet Bubble saw corrections of 90% for those companies which survived. Many others simply faded quickly from memory. The companies with sound managements and sound fundamentals which had bouts of Insider Buying during intermediate market corrections are the companies which grow from cycle to cycle. These long-term growers are rarely recognized as ‘growth stocks’ when investors are in a frenzy with FAANG-type issues. Key to using Insider Buying as a guide is to analyze the financial record of the management teams who are the buyers. Federal Express is a good example.

We do not have a complete picture of insider activity with daily snapshots. Insiders are heavily restricted with ‘Blackout Periods’ and have regulated buy/sell periods. The buys we see today represent a unique set of conditions. Generally, managements buy when shares are discounted, but they may not do so till all material information released by the company in the course of business has been disseminated to the public. (Sales carry the same restrictions) When markets decline as rapidly as they have the past 2wks, many insiders remain restricted. It should be no surprise that if shares remain depressed that higher levels of insider buying activity than we see today are reported.

The SP500 Value Investor Index is a pricing of US economic activity based on capitalization by long-term Private GDP and inflation. The SP500 is market psychology pricing relative to investor sentiment to the underlying fundamentals. TheSP500 can be higher or lower than the Value Investor Index dependent on how investors perceive the future. The more SP500 prices correct relative to the Value Investor Index pricing, the greater the number of opportunities present. Insider Buying points out which issues appear attractive to this select group based on their intimate knowledge of their own companies.

We have a huge buy signal for equities at the moment.