This was originally posted Sept. 8th for subscribers. We bought shares based on this at $1.14 (currently stand at $2.02, 77% gain). Subsequent posts have bolstered the case for it.

Almost dismissed this one out of hand…..glad I didn’t:

Here is a quick review of the company’s most recent quarter:

Highlights for the 12 weeks ended July 14, 2009, compared to the 12 weeks ended July 15, 2008:

- Consolidated EBITDA increased $0.3 million to $10.3 million from $10.0 million for 2Q08.*

- Store-level EBITDA decreased 6.9% to $18.5 million from $19.9 million for 2Q08.*

- Total revenue for 2Q09 decreased 15.1% to $83.2 million from $98.0 million for 2Q08.

- Net loss for 2Q09 of $(5.1) million showed significant improvement when compared to a net loss for 2Q08 of $(89.2) million. Included in the net loss for 2Q09 are a non-cash store impairment charge of $7.5 million and a write off of $2.9 million for loan fees and discounts relating to the payoff of our senior term note, offset by a gain from derivative liabilities of $1.4 million associated with the senior note holder’s exercise of its’ put option and the June expiration of the Company’s warrants. Included in the net loss for 2Q08 are a non-cash charge of $49.7 million for trademark impairment, net of tax, and $3.3 million for store impairment charges, offset by $2.5 million in gain from derivative liabilities.

- Diluted loss per share for 2Q09 of $(0.10) compared to a diluted loss per share for 2Q08 of $(1.69).

- Company-owned comparable store sales for 2Q09 decreased 13.7%(1) ,which contributed to the decrease in store-level EBITDA.

- Six new franchise stores and no new Company-owned stores were opened during the fiscal second quarter of 2009, compared to 14 new Company-owned stores in fiscal second quarter of 2008. The total number of stores, net of any closures occurring during the period, increased to 735, comprised of 490 Company-owned stores and 245 franchise stores.

Commenting on the quarter:

“We continued to make strong progress against our strategic initiatives in the second quarter despite a challenging operating environment. We successfully completed the sale of $35 million in convertible,

preferred stock. The sale proceeds, which were used to repay our senior term note and eliminate all of our long-term debt, have strengthened our balance sheet. We expanded food across all day parts into almost 300 locations and made good progress in our brand licensing initiative. We grew our franchise base and are making continuous progress in our refranchising program. We also continue to advance our cost management initiatives,” said James D. White, president and chief executive officer, Jamba, Inc. “In the face of an intensely difficult macro-economic climate we implemented our BLEND plan which is mitigating some of the headwinds we face.”

“We are exceptionally pleased with the initial response to the grab-and-go food offerings launched in June. Based on our preliminary analysis, our stores in California, which were the first to offer grab-and-go food items, are showing an increase in customer visits and average check. The introduction of great tasting, high quality, value-priced, better-for-you food is a game-changing proposition for Jamba and we are fully committed to its success. These foods are a great fit with the Jamba brand and a perfect compliment to our beverages. We recently expanded our food offering to the East Coast with the launch of our California Flatbreads™ into the New York City marketplace in July and, as we announced today, the launch of a full menu of offerings into the Chicago marketplace.”

“We have made good progress on refranchising. We opened six new franchise locations and are on pace with our plans to open 40 to 45 new outlets, primarily franchised locations, by year end. In July, we announced the sale of nine Company stores in Oregon to an existing franchisee, which followed the earlier sale in the first quarter of 2009, of 10 Company locations to an existing franchisee in Arizona. We expect to close a number of additional deals this year.”

“Our brand licensing activities are also on target. We are actively working with Nestlé on our Ready-To-Drink beverage re-launch and our branded products with Think Wow Toys and Oregon Ice Cream should be in retail before year end. We also announced last week a license agreement for Jamba-branded smoothie kits with The Inventure Group and are exploring a number of other opportunities,” concluded Mr. White.

So why like it? A Few Reasons…

- It captures the healthy eating trend. All of their products contain no artificial flavors, no trans fat, no artificial preservatives and no high fructose corn syrup. This trend is not reversing anytime soon. It may wane as the economy does, but it will never disappear. That simply means that the suffering being experienced here is temporary. So, what is the company doing to ensure success once it is over?

- The franchise model. In one move they will de-leaver the corporate structure, provide more than ample liquidity for operations and expand its footprint at a much faster rate. For this type of food operation, the franchise model cannot be beat

- Airports and College campuses are the perfect location for Jamba. They plan to nearly double their footprint here this year

- Share price $1.15

- Debt = $ .00

- Cash on book equates to $.57 a share or 50% of the current market cap

- Property value = $1.48 a share getting a picture here?

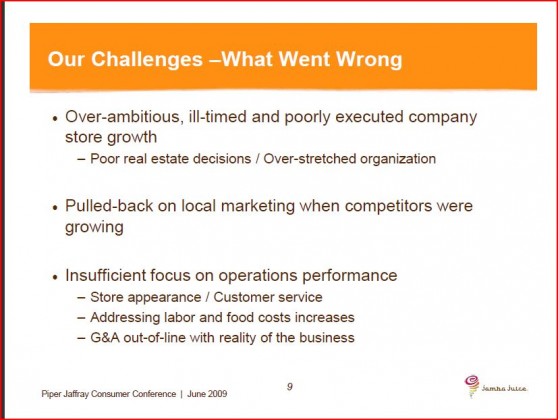

Well, if all that is so great you must be asking yourself, why have shares fallen so much since their high’s in 2007? Here you go:

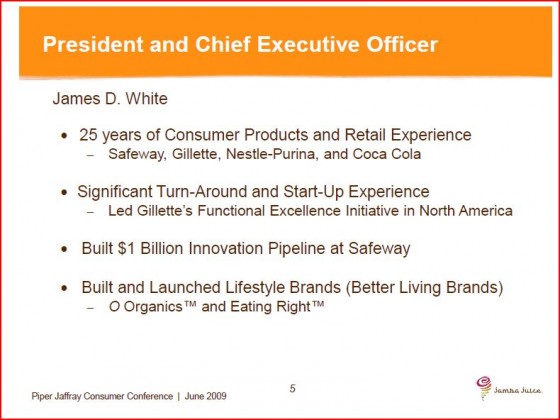

In short, they lost their way. Enter current CEO James White. “Who is James White” you ask?

So what has he done?:

He has placed the company on the track for success. Now unfortunately for them, these initiatives ran smack into the recession we currently see ourselves in. Despite that, impressive progress is being made and the company is heading in the right direction in a major way. Because they are such a small company, they are simply not on the radar of most investors and that bodes very well for us as the stock has languished.

We can pick up shares now at what IMO will prove to be a substantial bargain down the road. The licensing agreements, only just announced this summer will be integral in expanding the Jamba brand and providing important earnings diversification for the company.

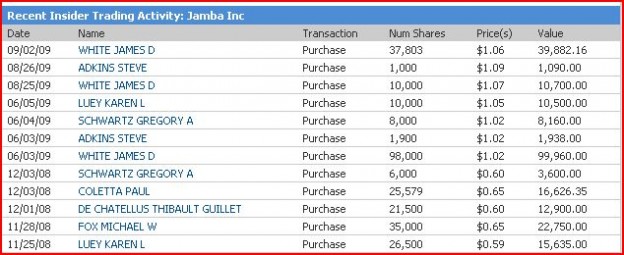

Here is a look at the recent insider activity:

Most recent 10-Q:

Sec