Davidson submits:

One should always keep in mind the fact that market analysis is based on the measured psychological elements of the sum of all individual participant trust in the system. With regard to making capital commitments today, historical perspective provides only a level of “poetical” rather than “icy cool mathematical” prediction capability. The oft repeated variations on the theme that “Markets rhyme, but do not repeat!” reflects the long accepted observation of value investors that there is no such reality as mathematical precision in markets which are ever evolving with human society.

The non sequitur of pundit predictions of precise market levels by specific dates (short term predictions based on, “Our computer analysis….”) is lost to the vast majority of those who forecast as well as those of us who listen. The use of quantitative mathematical investment models (by “Quant” investors) rises from the supposition based on our previous scientific successes that if one applies tools powerful enough, i.e. computers and statistical analytics, that a form of “Holy Grail” can be extracted from the mass of confusing data presented to us daily. The belief is that computers can devolve short term trading trends accurately and reliably and lead to substantial profit. Having a scientific, mathematical and finance background (PhD Physical Organic Chemistry, MBA Finance), makes me doubt the use of scientific tools as helpful in financial markets.

My experience and analysis leads me in the opposite direction. Understanding the markets in my opinion comes from broad views of data and trends. But, the data and trends arise from individuals acting in free markets. Free markets are figments of society and their foundations are based on each individual’s trust of others to act in accordance with the basic norms of fairness. Trust in turn is based on many recognized cultural inputs and in free market societies creates relationships observed in data which form the patterns we use to develop our expectations of the future. Computers do not have a basis of inputting cultural norms or trust which are based on individual psychological perceptions as elements of calculation. Computers do not foresee the dramatic changes in patterns that can arise from changes in individual trust that may turn on the proverbial “dime”.

Trust is developed over time and is often reflected in financial patterns. But, trust can be destroyed in an instant with the input of a single “eureka event” which upends the context of all previous facts, i.e. Russian bond default, lack of govt. backing for Dubai debt and assumptions which led to Long Term Capital’s collapse. And, let’s not forget the Bernie Madoff deception. Computers and statistical analytics do not have the capability to assess “Trust”. Stand alone computer analysis of markets has limited value. Same for technical analysis and all other price pattern based analyses, if there is no coordinated effort made to tie price to some fundamental return valuation.

However, allowing for the observation that “Markets rhyme, but do not repeat!”, longer term data histories of 20yr or so in which we can view multiple economic cycles and society’s responses are very helpful although not perfect or precise guides to future expectation. But as longer term investors, we do not need precision. What we have is more than sufficient.

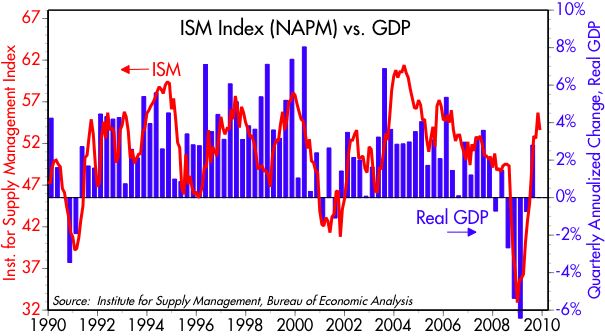

The current trends of Real GDP and the ISM Index look good to me (at the moment)!!