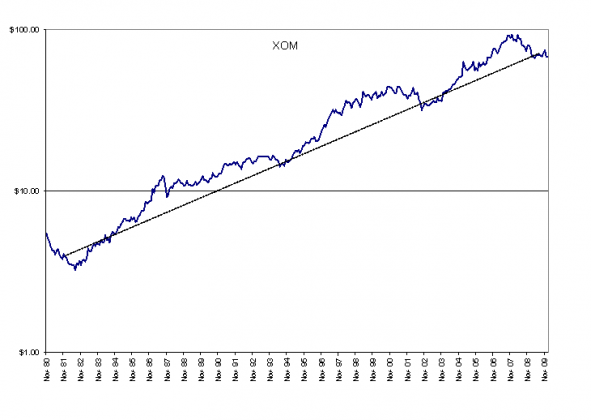

Davidson make a brief case for Exxon (XOM)

I thought you would find this price history of interest. Long term charts such as these reflect both economic fundamentals and market psychology in my experience. XOM’s ROE over business cycles runs from a low range 18% to 30%+ (in 2008 ~39%) and the P/BV from ~3x to a high ~4x.

Currently the ROE is 18% on trailing Net Income and the P/BV is 3x. XOM is helpful as a proxy for a robust economy as it is well diversified in its businesses. By this measure the economy is not robust with which most would agree and XOM I think is a stock to be held at the moment.

XOM is a position that by many measures appears attractive for a business cycle investment period.

Not all companies carry this type of consistency or the ability to adjust to inflation changes as well as XOM.