Makes sense…..

“Davidson” submits:

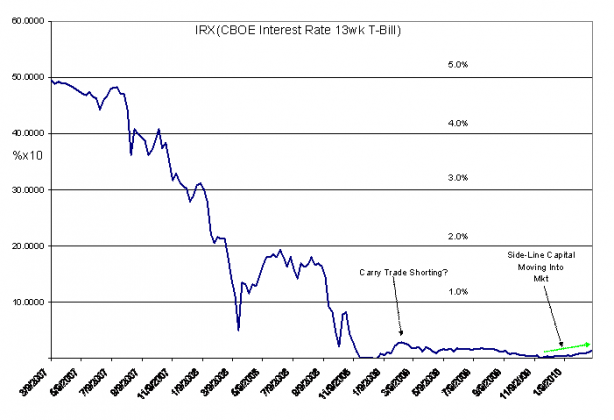

The common understanding of equity markets is that higher interest rates cause markets to fall. In my experience this is too simple a formulation of market quid pro quo. The scenario more likely to play out is that higher T-Bill rates result in higher equity markets until these rates reach a competitive return. Below is the chart of IRX(CBOE Interest Rate Index for the Generic 13wk T-Bill). If one wants to track this index on Yahoo Finance enter the symbol “^IRX”. The “^” is found above most keyboard “6” keys.

Market concerns developed in 2007 causing T-Bill rates to fall as investors sought safety. Concerns rolled into outright fear in 2008-2009 with T-Bill rates falling below 1.0% the week of 3/21/08, again the week of 9/19/08 and actually going negative in Dec08 as investors became panicky. As investors re-enter markets the reverse is true.

In 09 T-Bill rates rose sharply from 0.01% in early Jan09 to 0.29% the week of 2/13/09 as it appeared that those most comfortable with risk, the hedge funds, began to use T-Bills as a source of funding for Carry Trade positions. Although US GDP began to post positive numbers in June/July 2009, employment continued to rise, economic forecasters heavily focused on a host of negatives and importantly the US$ fell vs. other currencies, oil, gold and other commodities. The US$ remained weak till Nov/Dec 2009 when it began to reverse.

In my experience the turn in Nov/Dec09 was in response to the Institute for Supply Management’s PMI report of Oct that 1st indicated positive employment results. This was followed in Nov09 with the turn higher of the Conference Board’s Help Wanted Online Index. Both, of these indicators provided signals that in my experience triggered investment capital flows to the US that resulted in turning the US$ higher in Nov/Dec09 and in turn reversed significant portions of the Carry Trade.

The economic news has continued to improve providing impetus for some of the estimated $3Tril-$4Tril sitting in the safety of T-Bills and other very short term Sovereign debt to now enter the market. T-Bill rates can rise significantly as capital flows into investment markets. Historically, Ibbotson 50yr data indicates that T-Bill rates have averaged 1.3% above inflation. A comparable rate today is 2.5%. My work recent market history indicates that T-Bill rates need to rise higher than returns available in the SP500 Mean Estimated Earnings Yield before becoming a competitive threat. Today’s SP500 Mean Estimated Earnings Yield is ~5.8% with the SP500 priced at 1122.

The SP500 can sustain a large rate rise from T-Bills at 0.145% before competitive threat develops.

At the moment Higher (T-Bill) Rates = Higher Markets.