“Davidson” submits:

The Conference Board Help Wanted OnLine Index(HWOL) was reported today up by 222,700 to 4,150,000 indicating that:

“…labor demand in April rose in practically every State and a wide variety of occupations from management positions to office workers and sales help.”

This report is very positive for the economy and for investment markets. The relationship between markets, employment and HWOL is worth exploring to understand how the markets can be rising while employment is lagging.

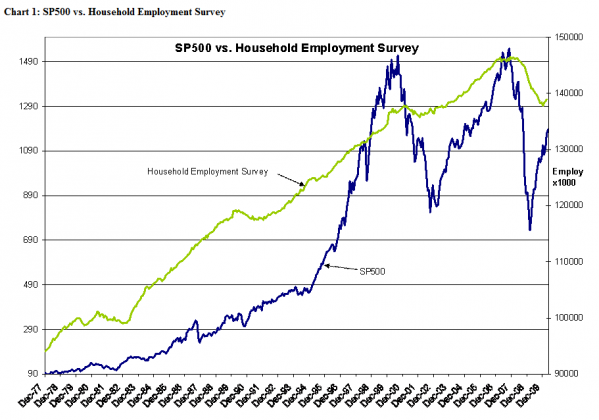

Chart 1 is the Dec 1977 to March 31, 2010 history of the SP500 and the Household Employment Survey(HES)(update released later this week). If one looks carefully and ignores the 1997-2000 “Internet Bubble”, one can see that in market “Tops” employment as reflected in the HES can be used as an SP500 market indicator as it tends to stall prior to peaks in the SP500. Slowing employment reflects a slowing demand for goods and a slowing economy. Eventually, without unusual stimulus from other sources, the SP500 stalls and then, falls as investors observing the same in the underlying economy change investment psychology and capital commitments. But, HES is not helpful as an indicator for SP500 “Bottoms”. HES lows were reached in December 2009 while the SP500 low was March 2009.

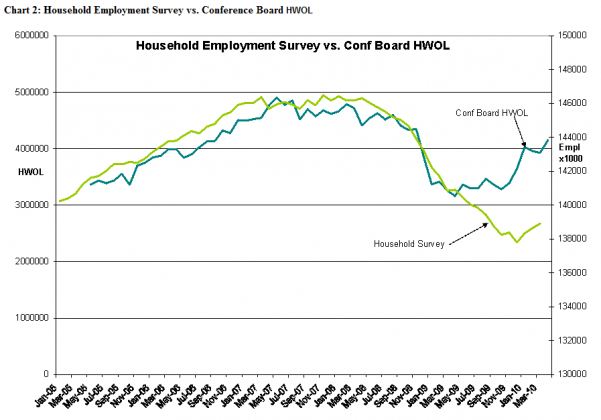

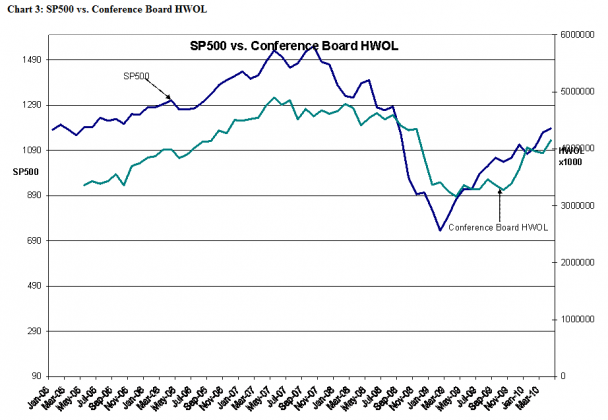

Chart 2 is the May 1995 to May 2010 (today’s report included) HES and HWOL history. Even though the Internet based HWOL is a new index, one can see that it leads the HES by a considerable period. In fact, the HWOL is almost coincident with the rise and fall of the SP500 as can be seen in Chart 3.

The HWOL report today is quite positive and indicates that strong increases in HES should be expected. GDP and SP500 should follow HWOL with positive responses barring unusual incidents.