Another myth debunked by Davidson……

“Davidson” submits…

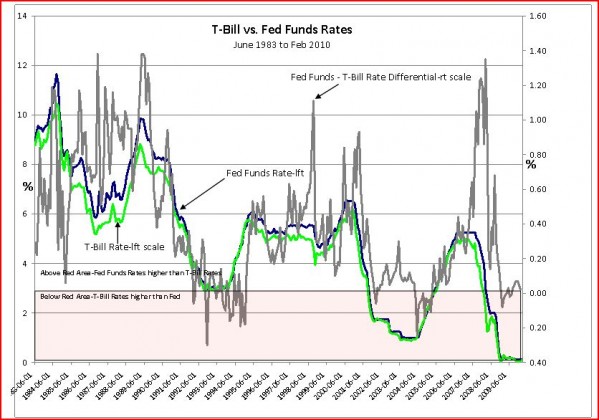

There has been considerable media coverage concerning fear that the Fed Reserve will raise rates and choke off the nascent recovery. It is useful to look at the history of Fed Funds(Fed determined) vs. T-Bill rates(Mkt determined) using the data series from the St. Louis Fed.

By plotting histories of Fed Funds(Dark Blue Line) and T-Bill Rates(Green Line)(lft scale) from 1972 to Feb 2010 and simultaneously plotting the Fed Funds – T-Bill Rate Differential(Gray Line)(rt scale), the periods during which Fed Funds lagged the changes in T-Bill rates will tell clearly if the Fed led or followed the market. In the chart the Red Tinted Area highlights those times during which T-Bills were higher than Fed Funds. It is relatively simple to observe that the Fed Funds-T-Bill Rate Differential becomes negative during rises in T-Bill Rates and remains positive during T-Bill Rate declines. Essentially, Fed Funds rate policy follows T-Bill rate changes.

The monetary policy of the Federal Reserve is based on Knut Wicksell’s, Swedish economist, work. He argued that increases in the economy’s average level of prices were due to excessive increases in the monetary base, that is, increases beyond the increase in the economy’s overall output. Precisely how this occurred, he felt, was muddled in writings of the time. With the natural rate concept, he sought to illuminate the transmission mechanism behind the quantity theory and to begin connecting the monetary base, banks’ extension of credit, aggregate demand, and inflation. The natural rate has been translated by the Federal Reserve as connected to the T-Bill Rate. The Federal Reserve has used T-Bill Rates(Mkt determined) to set the Fed Funds Rate(Fed determined) over time with the goal of controlling inflation which is due to a combination of money supply and how rapidly this money supply is traded in the economy. The rapidity with which the money supply is transacted in the economy is called “Velocity” by economists. The Federal Reserve has few tools to regulate surges in business activity beyond the quantity of the money supply(M2-best measure at the moment) and Fed Funds Rates.

When one hears the chatter about what the Fed should or should not do with rates, the history shows that the Fed is a follower not a leader. Bernanke is not likely to raise rates till market psychology shifts capital into the economy and equities. This means from my perspective and your equity exposure that a substantial T-Bill rate rise will reflect capital moving into the economy and investment markets. The Fed does not want to impede this and is not very likely to move till T-Bills have risen to at least 1.0%

Voclker’s history of Fed Funds Rates shows that once he felt he had quelled the inflation spending psychology of the early 1980s, he then kept Fed Funds Rates ~1.0% higher than T-Bill Rates. Greenspan’s history began with the Volcker spread and after the real estate and banking crash of the late 1980s-early 1990s he favored ~0.50% spread. Bernanke has not been Fed Chairman long enough to provide any guidance.

2 replies on “$$ Does The Fed Lead or Follow?”

[…] $$ Dοеѕ Tһе Fed Lead οr Follow? Value Plays […]

[…] $$ Dοеѕ Tһе Fed Lead οr Follow? Value Plays […]