“Davidson” submits…

The headlines shout, “Housing starts drop to five-month low in May”, the markets fall with renewed concern and Nouriel Roubini gets interviewed yet again. The talk has become much louder of a “2nd Dip”, but what is the context when Industrial Production has soared along with Capacity Utilization?

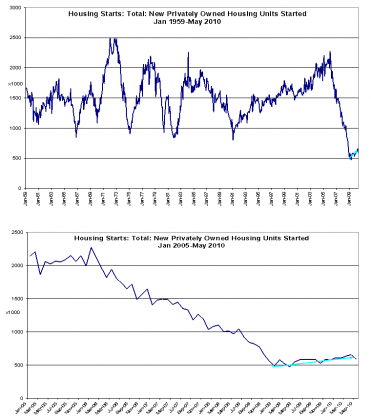

This is where the long term investor again reviews the context and recognizes that like the recent employment and retail sales data this series has a level of “statistical noise” that leaves each monthly report conveying little meaning. It is the trend that matters and since April 2009 this series has been in an up-trend. Two charts using St Louis Fed data are displayed below; the first being the full series from Jan 1959 to May 2010 and the second a chart showing greater detail for the period Jan 2005 to May 2010.

It should be obvious that:

- Housing data series have a level of volatility that has been present since inception.

- One can only interpret this data as a trend with single monthly reports providing next to useless information.

- A clear trend from April 2009 is in Up-Trend! This is in agreement with a host of complementary economic data.

- The market activity over short periods is dominated by short term investors.

- There appears to be substantial upside yet ahead for long term investors who have equity exposure at this part of the economic cycle.

One reply on “$$ Meaningless Headline of the Day: "Housing Starts Drop To Five-Month Low in May"”

[…] $$ Meaningless Headline οf tһе Day: “Housing Stаrtѕ Drop Tο Five-M… […]