Davidson submits….

I view the key to rational investing as based on trends over multiple months not from month to month. The analysis should be performed within the context of economic/finance history. I think much confusion arises from the desire to get one’s 15sec of fame which drives many to seek something actionable in monthly data reports so that CNBC gives them additional air time. This ego stroking is very much akin to an addiction, a need to receive attention by many, to be seen to be an expert. So much is misleading by this behavior, but it sells ad time and it is part of society’s mores. One truly has to struggle to go against the part of our genetic engineering that fosters the “Herd Instinct”. Steven Pinker’s “The Blank Slate” and his other books provide very useful insight to our genetic imprints and I highly recommend them.

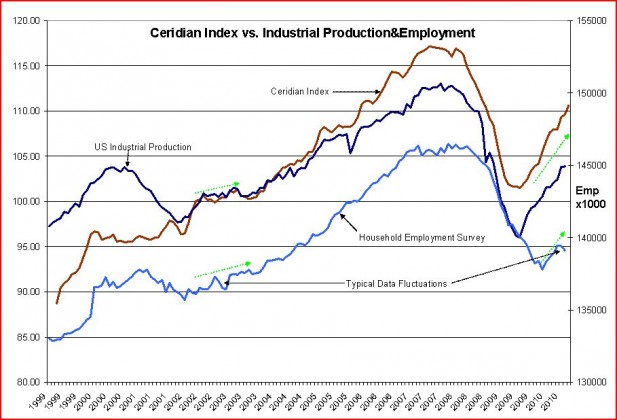

The chart below is part of my analytical process. I placed green arrows where “data blips” occur in the heavily watched Household Emp. Survey had no long term investment implications. One can observe easily that “blips” in one series are routinely not reflected in others. Since all data series carry statistical “blips” of this type, the only means of doing a proper investment analysis requires that every data series be placed in the context of multiple series. Economic activity is never isolated solely in single measures of an economy. There is always uniformity across various economic indicators, i.e. Industrial Production, Employment, Rail Traffic, Auto Sales and many others are intimately linked at the hip. Where the “blips” in one series are not reflected in other comparable data series, one simply ignores them and relies more heavily on the trends established by the bulk of the data. The process is really quite simple.

I find myself amazed that so many heavily promoted financial professionals can react so viscerally to a couple of months of “data blips” of a single economic indicator when so much information is freely available.

The Ceridian Index is the diesel fuel use by truckers in the US and Canada. It is an excellent real time read of the current pace of economic activity because the data is collected at the moment a charge occurs for diesel fuel.

I remain quite positive on the equity markets even with the overwhelmingly negative media. I think that this will change fairly shortly as fall seasonal sales of goods result in positive month-over-month reports.

One reply on “$$ Davidson on Data Series”

[…] The economy is stronger than the bears think. (ValuePlays) […]