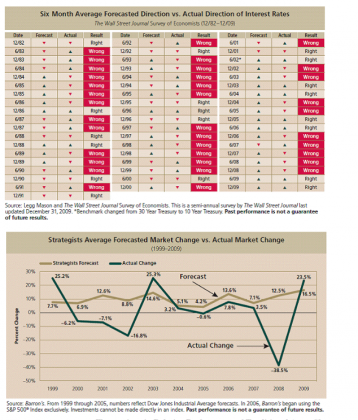

Davis Advisors discusses in their Semi-annual Review 2010 a history of major interest rate (Dec 1982-Dec 2009) and market performance (1999-2009) forecasts vs. subsequent events-see the 2 excerpts immediately below. The lack of any apparent correlation of forecast to events should not be a surprise to anyone. The full discussion is attached for your review (click to enlarge).

Typically, Investment Strategists and Economists make attempts to predict markets 3mos to 18mos in the future. The thinking is that this provides enough time for institutions to convene an investment committee meeting and come to a decision regarding a response to the forecast with time to effect the adjustments deemed to provide the best result. Individuals are far more flexible decision makers, but records displayed below force an important question:

“If the forecasts are so often incorrect, isn’t this just an extreme amount of wasted effort?”

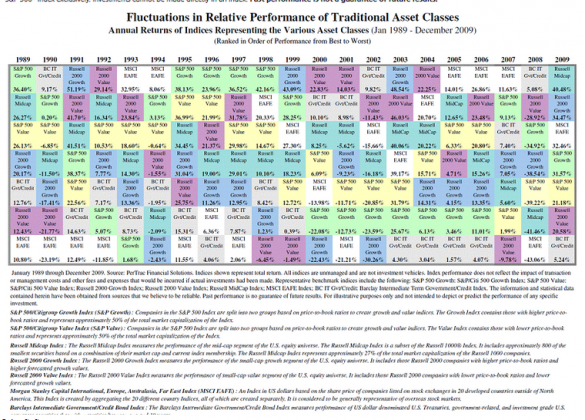

The point that Davis Advisors makes and one with which one can agree is that markets are impossible to predict, but not that impossible to value. Below (click to enlarge) you will find the Jan 1989-Dec 2009 relative annual performance of 7 selected asset classes ranked “best to worst” from “top to bottom”. It should be quite simple to observe that there is no pattern to any of the performances. One year does not predict the next year’s result nor does one year’s performance of a single asset class provide reliable guidance to performance in the next year. There is no predictable pattern with any asset class over the 20yr span. Whereas Davis Advisors applies this view to their US Large Cap Stock discipline, it is even more applicable to a balanced and asset class allocated portfolio using selected portfolio managers.

Herein the 20yr asset class performance chart lays one of the great investment insights first outlined by Gary Brinson in 1986. (Reprinted-*Brinson Gary- Financial Analysts Journal, January February 1995, Vol. 51, No. 1-133-138-1-1995). By allocating across asset classes using the best mix for highest return/lowest volatility combination in conjunction with a rebalancing discipline, one can achieve acceptable returns with less year-over-year volatility. In my experience if one adds to this approach a Return/Risk evaluation using historical valuation and performance guidelines one can lower volatility even more so.

Predicting market performance and timing is not possible in my experience, but observing what drives markets and how markets are valued during business cycles can be and should be part of the Return/Risk analysis. Markets represent multiple composites of security responses to business cycles, government regulation and social-engineering efforts, myriad geopolitical events and multiple investor types. Predicting near term or even full business cycle responses to these multiple inputs should be seen as simply impossible.

The best approach in my experience is to observe each asset class in the context of historical valuation and performance parameters and to then make whatever adjustments seem prudent. It is a constant process of evaluation and re-evaluation; a sifting of a multitude of inputs which includes the gross valuations of asset classes using a historical benchmark, i.e. Market Capitalization Rate, down to the details of individual securities, the valuations, performances and the economic commentaries of well known portfolio managers and CEOs. Although pertinent information is collected and analyzed daily, the Return/Risk parameters of any asset class only change gradually; usually over several years. Investors may have pulses of enthusiasm or pessimism which over several months can temporarily cause significant portfolio imbalances. When the deviation from our preferred allocation exceeds 20% (a 5% allocation becomes either 6% or 4% through market activity), the portfolio should be brought back into balance. When the Return/Risk parameters become unfavorable, exposure to the asset class is reduced and at extremes even eliminated.