“Davidson” submits:

Understanding the market does not come from the “Top Down” view, but from the “Bottom Up”. As Doug Yearley, Toll Brothers CEO, says here consolidating all information as a reflection of one major theme often leads to misconstruing important trends. The true meaning is in the details.

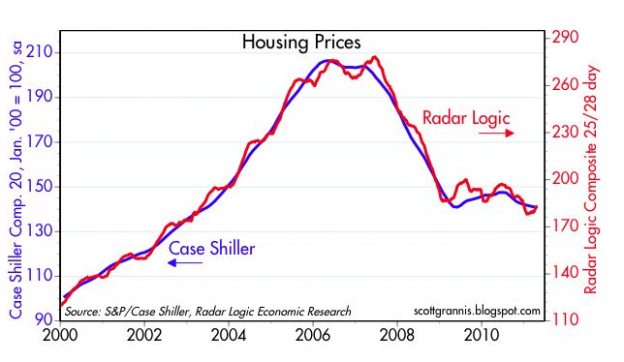

Scott Grannis provided the chart in his June 28, 2011 economic commentary. http://scottgrannis.blogspot.com/ There has been much recent concern with a “2nd Dip” which has come from a recent drop in foreclosed home prices. Radar Logic reported yesterday a rise in home prices signaling a possible counter trend. My interpretation is that the push by banks to unload foreclosed homes means that they are now strong enough to be able to accept the losses, but because the effect of distressed homes is currently larger, consolidated housing price indices have declined the past several months. Distressed homes are in some instances not even livable due to looting of appliances, plumbing, heating/cooling and electrical systems and should never be consolidated with “livable” dwellings. But, these indices are not constructed with this level of detail.

The most important informational trends are lost by consolidating all data series without regard to the specific meaning of each.

One can develop a better understanding of the actual economic trends by monitoring the commentary of highly qualified CEOs within the specific industry. One such CEO is Douglas C. Yearley, Toll Brothers CEO. Yearley says in the Toll Brothers May 25, 2011 2Q2011 report:

“Still, many potential buyers have deferred their purchase decisions due to concerns over the direction of the economy and

media headlines suggesting that all home prices continue to decline. We question the many studies quoted in the media that

combine distressed sales data, including foreclosures and short sales, with nondistressed home sales data. We believe that

averaging distressed and non-distressed sales data provides a misleading picture to the public regarding home price direction.

In contrast to these reports, according to a CoreLogic® study, prices for nondistressed existing sales are up 3% in 2011’s first

quarter — the most since they started to decline in 2006 — versus down 12% for distressed sales. We are experiencing

flat to slightly increasing pricing in most of our markets. As consumers better understand that prices are firming, we believe

they will gain confidence, which will help release some of the pent-up demand that must be building in the market.”I interpret the fact that new home prices are higher while bank selling has increased is a sign of economic strength, not weakness! One should always carefully examine the separate details which are consolidated in any “Top Down” view.

One reply on “Davidson on Housing”

[…] A more nuanced look at the housing market. (ValuePlays) […]