This article is a good gauge of sentiment. Read it first an we will look closer at it after. Note the negative title….

Number of troubled mortgages on rise again

By Les Christie August 22, 2011: 11:39 AM ET

NEW YORK (CNNMoney) — In another hit to the beleaguered housing market, a report out Monday found that the number of delinquent mortgage borrowers — those who have missed at least one payment — rose during the second quarter.

The delinquency rate grew only slightly, up 0.12 percentage points to 8.44%, but that reverses the steady improvement of the past two years.

The increase, as reported by the Mortgage Bankers Association (MBA), may not sound like much, but it could mean that the recovery in the housing market will take even longer than thought.

The MBA breaks down delinquencies by degree of severity, ranging from one payment past due to 60 days late, 90 days late and loans that are in the process of foreclosure proceedings, the final step before bank repossession.

One bright spot: The number of loans more than 90 days late declined. Those are the mortgages that are most likely to proceed all the way to repossession.

Still, the number of initial filings ticked higher.

Borrowers earlier in default are more likely to begin repayment again. Often the problems besetting them were temporary, such as an unexpected medical bill or a brief layoff from work.

“Delinquencies are mirroring what’s taking place in the employment market,” said Jay Brinkmann, the MBA’s chief economist.

There were other reasons for hope. There was a drop in the number of new foreclosures initiated, which means fewer borrowers are actually losing homes to bank repossessions. The nation is back to 2007 levels in that delinquency category.

Another is that the newest loans, those issued after 2007, are performing much better than earlier issues. Mortgages originated from 2005 through 2007 represent 30% of all mortgages, but account for 65% of defaults.

Once the problems with those mortgages work through, delinquency rates should start to drop off more significantly, as long as the economy starts to pick up and hiring gains strength.

Now, lets look at the data points given:

Negative:

1- Delinquent loans increased one tenth of one percent

Positive:

1- 90 day delinquencies decreased

2- 2007 are performing “much better” than earlier issues

3- New foreclosures dropped to 2007 levels

4- We have seen steady improvement for 2 years in delinquency data

Not included:

1- Delinquency rate is currently 141 basis points below year ago numbers

2- Foreclosure inventory rate for all loans dropped 9 basis points from Q1 ans 14 basis points from Q2 2010

That about sums it up. Six positive data points and one marginally negative yet we get a title that implies much more dire information to follow in the article. We easily could have said “Despite Small Rise in Delinquencies, Mortgage Market Continues to Improve” or even “Mortgage Market Continues Choppy Improvement”?

Now, I am not saying the author is doing anything sneaky at all, it is his interpretation of the data nor an I suggesting a housing boom is around the corner. I think I have been consistent for a long time in my feeling that we are going to bounce around here for a while on housing data and improvement will be regional, not necessarily national. My point is that it seems we are looking for bad news (you will always be able to find some) and wholly ignoring anything decent or improving (witness 6 positive data points vs 1 negative gets a negative title). We are in a “if it sin’t great, it sucks” mentality now.

It goes to my tweet earlier today. “Economists” were horribly off on numbers to date this year (more so if you go back to the end of 2010 and see the predictions). If you go to their 2009 predictions, 2010 was markedly better than any of them predicted. Yet, now that they have “reduced estimates”, investors are blindly following them down the path of negativity. James Montier in his books show how estimates virtually all the time extrapolate current conditions into the future, thus the reason they are so prone to error, they miss the ebbs and flows of an economy. We hear all the time “nothing goes in either direction in a straight line” yet economists predictions show just that not only for EPS but GDP. Whatever trend they see, estimates follow that trend in a line. Currently it is slowing so we are bringing EPS and GDP estimates down across the board which is odd because the vast majority of the S&P guided in line or above for the rest of the year which means someone is gonna be way wrong. Seeing as we are 1/2 way through Q3 when these company based estimates were given, I’m in the camp that is listening more closely to them. Note: Yes, I know their track is not much better, but for the past 2 years, it has been.

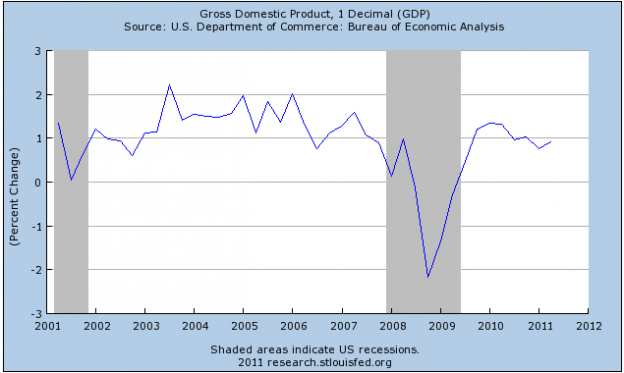

It is just as likely than not that current estimates now are too negative as economists take the “slowing” meme and simply follow the data downhill. Look at the quarterly GDP data here, nice and choppy?

Yet, predictions for it are nice and smooth. That is not how a real economy works (and thus the reason economists are so often wrong). I do not claim to know which way it is going, I just know that simply because xyz economist says it is “going this way”, well, I’ll do my own work on it thank you.