“Davidson” submits:

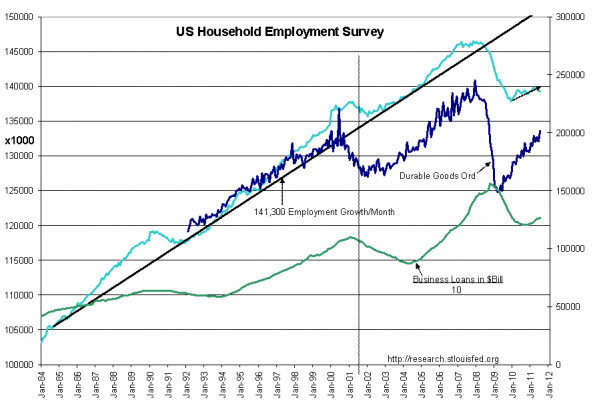

Durable Goods was reported up 0.4% to $201.5 billion in July 2011. Although quite choppy, this index can be seen to offer ~6mos-12mos forecast for employment and although not on this chart to the direction of the SP500.

Note: Business Loans are a lagging indicator and clearly Business Loans continue to rise after Durable Goods have declined in the broad economic cycle since 1984. Piling on debt as an economy slows is the reason we have difficult economic contractions.

Today’s Durable Goods report continues the stream of positive economic trends that have been in place for the past 2yrs and provides no indication that a “2nd Dip” is likely. Bloomberg’s auto sales story of yesterday should be a “wake-up” event to those who are shorting this market. I expect to see a reversal in market psychology in the coming weeks perhaps as early as Sept 30th which should provide upward bias to the SP500.

I view the recent few months of negative media interpretation as finding all economic data reflecting portending recession as unwarranted.

The market remains a quite positive equity buying opportunity in a long term economic uptrend barring unexpected geopolitical events.

Regarding an comment by Art Cashin on CNBC this morning:

“…regional Fed data weaker than Durable Goods” he believes that the Durable Goods report is out of sync and just a wrong interpretation.

The problem is that Fed Surveys are psychological readings and not “HARD DATA”, but the Durable Goods report is actually “HARD DATA”. One should never let measures of market psychology over-rule factual data.

Whenever dealing with a flood of data, one needs to ignore opinion and go with the actual “HARD DATA”. Science teaches one to separate numbers based on sentiment vs. from numbers based on measured fact into separate categories, surveys are fiction and helpful, but they are not factually based as the Durable Order report is.

Durable Goods is quite positive and should determine one’s investment stance.