“Davidson” submits:

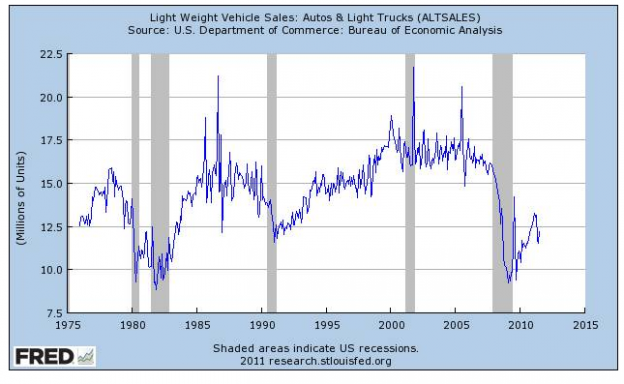

The St Louis Fed release late yesterday reveals that Light Vehicle Sales for August came in a much better than the 11.9mill rate forecasted at an annual rate of 12.2mill-see the chart below. The weight of the data this summer has supported the pattern of economic expansion at a slower pace than has been seen historically, but expansion just the same. The hue and cry as if a “2nd Dip” had already arrived and the hedge fund short selling of financials (and everything else), the European ban on short selling of selected stocks which drove that activity into our markets and so developed an enormous one-sided view of a pending domino effect bank failure that included France, Germany, Italy, Greece, Portugal, Spain and the European Union.

This is a lesson all should take to heart, i.e.

The economy is bigger than markets and once set towards recovery it continues in spite of the fears that come into play geopolitically. Stock and bond markets do not determine the direction of the economy neither does consumer confidence. Supply/Demand is the economic factor that counts and once we have been through a period of economic contraction the net Demand is greater than Supply as no one and I mean no single person wants to reverse his/her standard of living. It is the basic items like food, clothing, shelter, transportation, health care and etc that provide for support at economic “bottoms” and this demand represents a huge economic driver. It is the buying of a 2nd car or vacation home that supports economic activity at greater than the long term trend. And, it is the buying of these large purchases with borrowed money which drive the economy to unsustainable levels from which an economic contraction occurs. This is not a period of 2nd cars and vacation homes!!! Economic contraction has never occurred in an economy which was operating below its capacity unless government suddenly raises taxes or interest rates excessively. Our long term Real GDP rate is 3.04% and at today’s pace of 1%-2% we have nowhere to go but up unless government does something untoward. $SPY