“Davidson” submts:

It has been an extraordinary 5mos in which multiple times the global financial system was reported on the verge of collapse only to days later be proven not so. This occurred so often that I lost count. Was it 8-9 times or was it as many as 20? It depends on who you are listening to and how important you think the individual’s insight carries with the investment/political classes. Well, we are still here doing the everyday things that are required to support families and simply get whatever jobs done that need doing like cleaning streets, growing food, taking kids to the doctor and repairing homes after storms. This basic type of activity shows up in various measures of the economy like Retail Sales.

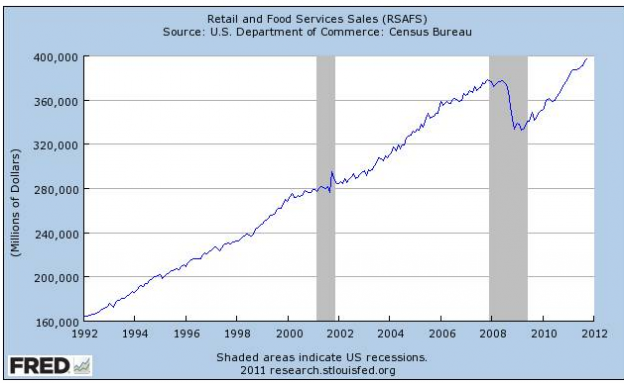

The St Louis Fed just released Retail Sales update-this does much to dispel angst and provide a wider investment perspective. Retail Sales are in a solid uptrend and have been thus all summer and even since December 2008. This is one of those economic measures which reflect the pace of economic health.

We are OK and have been OK even though there have been hundreds of experts telling us that we were not OK.

This remains an excellent time to invest capital into the growing economy. Any economy which can take the onslaught of negative news that we have been exposed to the past several years is in a word, “OK”.

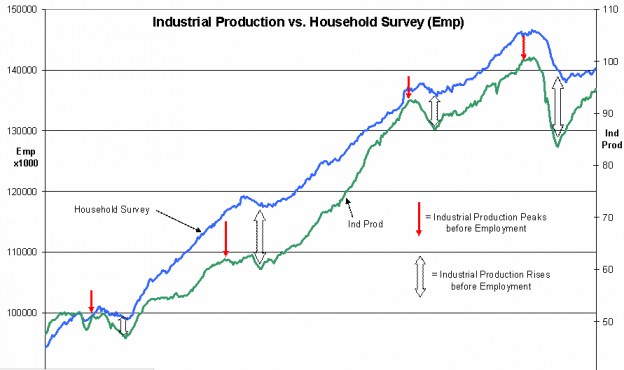

Today’s report on Industrial Production for October rising 0.7% strongly supports higher employment in future months. Industrial Production has a long history of being 6mos-24mos ahead of employment trends and thereby a good predictor of future SP500 prices albeit geopolitical events. Yes, the geopolitical news has been anything but positive, but over the long term economic activity trumps market psychology and this report confirms a long term uptrend that I would expect to see reflected in equity prices at some point just as has been reflected in past recoveries.

The chart below shows that the turning points in Industrial Production lead those of the Household Survey by some months. Although, there are not a precise set of months prediction prior to turns in the employment trends, the correlation is still significant enough to be good for investors who are patient and not bent on trading over the short term. The RED DOWN ARROWS identify periods of developing economic weakness in Industrial Production prior to the same being reflected in the Household Survey. The INDIGO DOUBLE ARROWS identify periods of developing economic strength in Industrial Production prior to the same being reflected in the Household Survey.

In spite of the negative geopolitical news and the many dire economic forecasts, the economy continues in a nice uptrend and the SP500 has been temporarily derailed by market psychology and remains attractive historically.

“BUY STOCKS!” is my advice! Poor market sentiment has no historical precedent of causing an economy to stall. Poor sentiment can cause a market to stall over the short term but there is no historical precedent for it keeping a market undervalued for long while the economy continued in an uptrend.