This is a perfect example of a misleading headline that is in fact debunked withing the very article itself….

From The Street (emphasis mine)

Bank of America Risks Capital Shortfall: Creditsights

By Dan FreedNEW YORK (TheStreet) — Bank of America($BAC) is “at risk” of failing to keep up with a Federal Reserve timetable for strengthening its balance sheet, according to research published Tuesday by Creditsights, a credit research firm.

The Fed has yet to issue formal objectives for bank capital, but a newly-instated annual review requiring the largest U.S. banks to get permission to increase payouts to shareholders through dividends and share repurchases offers clues as to eventual regulatory requirements, the report states.

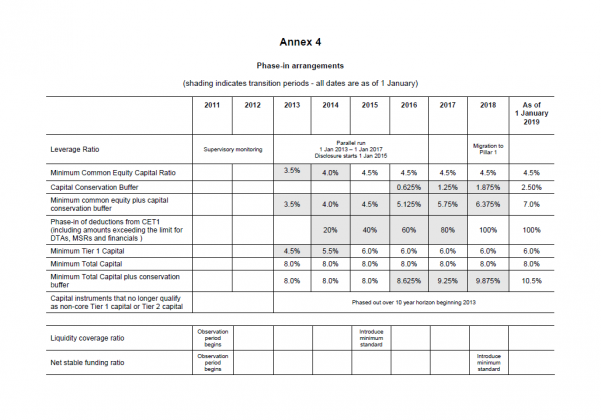

While Creditsights analysts expect U.S. regulators to follow the international capital regime known as Basel III, which has a seven-year phase-in period, they also believe the Fed may restrict dividend hikes and repurchases for institutions that are not on track to meet those requirements by the start of 2013.

“Bank of America remains at-risk of failing to meet the fully phased-in requirements” by the fourth quarter of 2012, the report states.

Nonetheless, Creditsights believes Bank of America will meet a “sliding Basel III phase-in schedule,” so that regulators are unlikely to force an equity raise. As a result, the Creditsights analysts “expect the company to continue to improve its capital levels through asset sales, stock-based compensation and debt conversions for the most part.”

Here is the actual schedule from Basel itself (click for pdf):

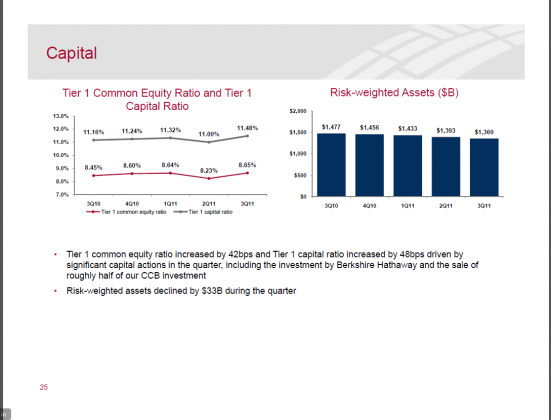

Any mention of 2012 and “fully phased in” ratio’s is wholly inaccurate. Let’s assume the Fed adopt Basel III (I think they will). Partial phase in of the requirements does not even start until 2013. Well, where does $BAC stand now?

$BAC already nearly meets or exceeds the Basel requirements for 2019. It also blows away the requirements for 2013, the first year of phase in. Yet, the headline of the article would leave you believe next year $BAC was in danger of not meeting them. Nothing could be farther from the truth.

Let’s look at it. Let’s flash forward a year and say this is 2012. In a week and a half we hit 1/1/13 and the Basel III requirements kick in. Let’s also assume $BAC 100% stopped improving its balance sheet and ratios over the past year so that where they are today is where they will be next year same time. Let’s also assume the Fed plays hard ball and requires the full 2.5% SIFI buffer in place by 1/1/13 rather than the 1/1/19 that Basel does.

Where would $BAC be at? Well Basel would want them to have a Common Equity Ratio of 3.5% (plus the Fed’s 2.5% SIFI) of 6%……..$BAC is at 8.65%. Basel (and the Fed) would want them to have a Tier 1 Capital Ratio of 4.5%….$BAC is currently at 11.48%. See? My example assumes stricter than proposed implementation of the SIFI and no further improvement by $BAC and even then it trounces the requirements.

In another note: $BAC settles another case. The “record” settlement of $335M covers 200k borrowers. That comes to $1,675 a borrower…peanuts. I expect a surge of these as 2012 unfolds…the amount of the settlements will undermine the current “massive litigation exposure” meme currently running around. As it happens, shares will reprice to the reality.