“Davidson” submits:

The Business Cycle Value Investor (this is my investment approach) analytical process is both “Top Down” and “Bottom Up”. The investment activity is mostly driven by the broad economic trends (called “Top Down” analysis) as in what is happening to auto sales and employment trends. As part of the effort, one needs to confirm the “Top Down” by frequent and detailed analysis of individual company business trends which is called “Bottom Up” analysis.

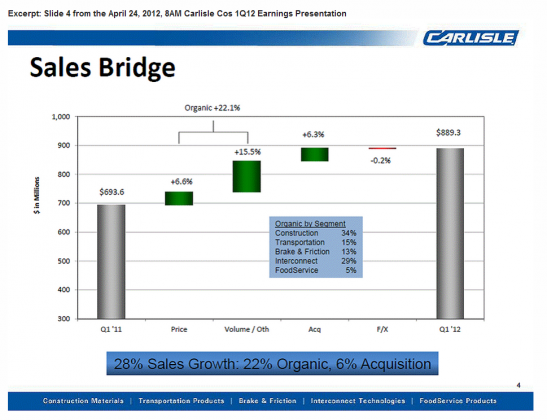

Carlisle Cos reported this morning with a $0.94/shr 1Q12 earnings report when the average analyst had expected only $0.61/shr even besting the highest estimate of $0.68/shr. This was a 77% increase over the 1Q11 reported earnings. Carlisle’s Dave Roberts on the 8AM conference call this morning reported that he “did not see a European slowdown”. Roberts reported a 22.1% increase in Organic Sales (sales only attributed to existing businesses). Not only did he not agree with the reports of Europe in recession, but he expected 2012 to be a strong organic global sales year for Carlisle.

Carlisle Cos $CSL serves building supply markets with rubber roofing, the company supplies off road tires to the agricultural and power sports market, brake and friction products to the agricultural, construction and mining vehicle suppliers (Caterpillar) and wire harnesses to the aerospace industry. Carlisle also has a smaller plastic food service business. Carlisle’s businesses if anything are dead in the middle of global businesses serving the basic needs of society. Carlisle is a “Lean Mfg” company and has brought back manufacturing formally performed outside the US by “re-shoring”. Dave Roberts is responsible for the “Lean Mfg” revolution at Carlisle.

When I see strong employment, industrial production and auto sales gains in the general economy it is always confirmed by what companies like Carlisle are reporting in their individual businesses. I have excerpted slide #4 from the presentation of this morning below. The complete presentation is available at this link: http://phx.corporate-ir.net/phoenix.zhtml?p=irol-eventDetails&c=99690&eventID=4753901

I spend as much time performing “Top Down” as I do “Bottom Up” analysis. I do this to confirm that what seems to be reported on a gross basis is actually being experienced in detail by the many companies which comprise the investment markets.

Dave Roberts’ comments this morning were quite positive and in line with current “Top Down” analysis. Carlisle is only one of many companies reporting better than expected results from global business activities. The US is the largest single consumption market in the world and if we are experiencing expansion and if the detailed reports support “Top Down” and “Bottom Up” global expansion, then we should not be listening to the “Doom and Gloomers”.

Optimism is warranted in my opinion!

(I own Carlisle personally)

One reply on “Carlisle Results Counter “EU Recession” Talk”

[…] level of demand destruction I think many people are assuming is happening there (this is back by yesterday’s post on Carlisle). It is also important to remember when looking at the chart that the demand growth pictured in […]