“Davidson” submits:

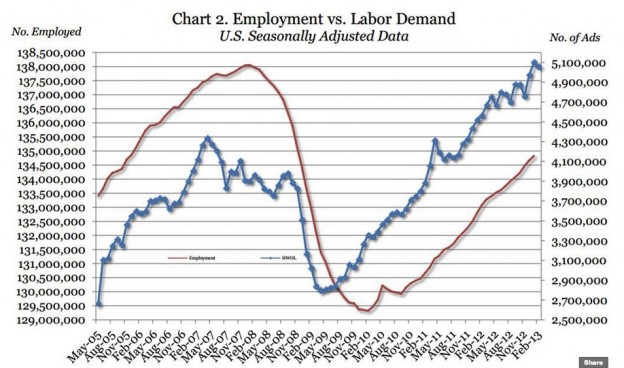

The Conference Board released the Feb 2013 Help Wanted Online report today. The level was 44,400 lower than Jan 2013, but as it should be quite clear in their chart below that the trend from the lows of May 2009 has continued without a serious break. The press release can be found at this link:

For investors this forecasts higher employment and economic activity for the next 6mos-12mos and historically this has always been correlated with higher equity prices even with instances of unpredicted negative news. Once investors turn the corner to become more positive on equities, they reflect a strong tendency to ignore “Bad News” and invest on “Good News” .This is called “The Recency Effect” with current perceptions influenced strongly by the past ~3yrs of experience.

The media continues to find reasons to be fearful. This focus has long been a tenet of the news media that nothing sells better than “Bad News”. A good dose of “Bad News” causes sharp rises in viewership for broadcast media and higher sales of newspaper and higher internet traffic.

Calls for a market top just because the market is near a past peak misses fundamental aspects of the primary market driver long term. It is the economy which drives earnings, equity prices and market psychology. If the economic trends forecast future economic expansion, then can expect stock prices to be higher with improved earnings and investor psychology.

Conditions continue to favor an optimistic stance towards equities.*