“Davidson” submits:

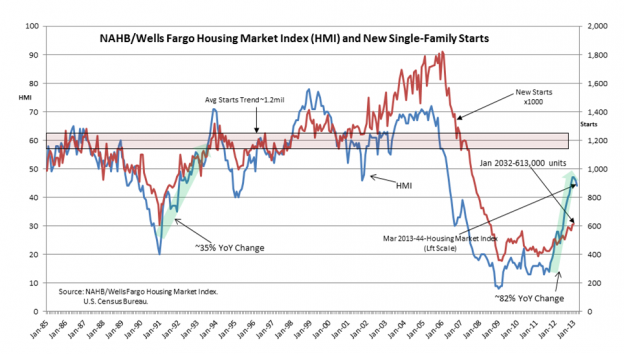

The National Assoc. of Home Builder’s HMI(Housing Market Index) was reported at 44 today, down slightly from the Jan 2013 high of 47-see chart. Notice that the history of this index is not a straight line with many zigs and zags. What is important as an economic indicator and important as helping to provide support to the current stock market trend is that the HMI remains within the sharp YoY 82% uptrend beginning in June 2011. There has been a decent rise in Single-Family Starts beginning one month later-see chart-which is beginning to show up as increased hiring in the Residential Construction Employment numbers. All good news!

These positive trends are both representative and conducive to an expanding economy and higher equity prices. The housing market has begun its recovery later than in previous economic recovery cycles. My opinion is that the low rates engineered by the Federal Reserve has made lending to less than Prime Borrowers more risky without sufficient interest rate spreads to absorb the normal level of delinquencies and defaults expected with the average borrower. Even so, anecdotal news suggests that banks are loosening credit standards as the economic evidence suggests a stronger recovery.

In past market cycles we experienced rising rates with rising lending as spreads permitted banks the profitability to offset future default risk. Rising rates also accompany rising earnings and rising stock markets as investors shift capital from fixed income towards opportunities to achieve higher returns in the equity markets and in business ventures. Rates typically peak only at market tops when equity and business opportunities are no longer deemed as attractive ($SPY).

Housing appears on a healthy growth trend ($XHB). The historical range often reported for the long term average Single-Family Start level is 1.2mil starts-see chart. We remain a society with continued household formation at traditional levels, i.e. people still fall in love and want to live together(not in their parent’s household) married or not. I think it is correct to consider “Love” as a primary economic driver which is not going to change its pace regardless of any economic circumstance.