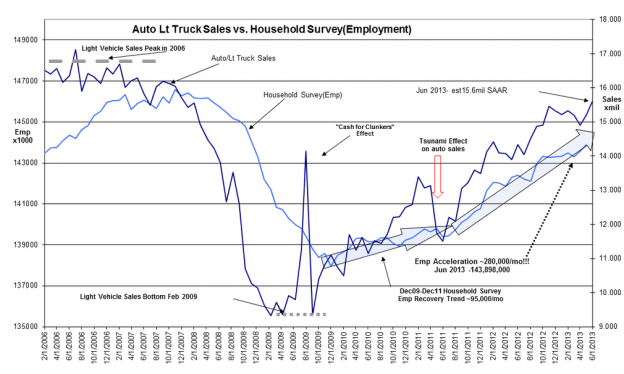

When you combine this auto news with increasing housing starts and existing home sales, it means continued employment and GDP growth

“Davidson” submits:

The basis of my investment advice is the perspective of our past business cycles, how the data develops data point by data point to form economic trends and finally how these trends become reflected in market prices. The fundamental concept is simple, but compiling the data and doing the analysis is where the work is. The perspective is an investment history of hundreds of years, but the up-cycle may be only a few years. The goal is to capture the investment up-cycles and avoid the down-cycles.

Yesterday, US Auto and Light Vehicle Sales were reported at an estimated ~15.6mill SAAR(Seasonally Adjusted Annual Rate)-see chart. Historically there has been a strong correlation between vehicle sales and employment with vehicle sales trend leading the trend in employment by 6mos-9mos. I expect to see continued expansion in US employment for at least 2yrs as housing and construction which are improving result in additional demand for labor.

Rising interest rate spreads at this stage in our economy permit banks to expand lending activity. Bank profits should expand in the coming months and will likely be a major surprise for many investors who do not understand the relationship.

Optimism towards equities continues to be warranted in my opinion. I continue to favor LgCap Domestic ($SPY) and International Equities. Fixed Income has already seen a sizable correction within the past 5 weeks. As rates continue to rise, Fixed Income should come under considerable pressure. Before this business cycle has peaked (5yrs-6yrs from now), it would not be out of the question to see 10yr Treasury yields higher than 6%