“Davidson”submits:

The basis of my investment advice is the perspective of past business cycles, how the data develops “data point by data point” to form economic trends and finally how these trends become reflected in market prices. The fundamental concept is simple, but compiling the data and doing the analysis is the bulk of the work. The perspective is an investment history of hundreds of years, but the up-cycle can vary from a few years to longer than 10yrs. The goal is to capture a significant part of the investment up-cycles as long term capital gains and avoid the down-cycles.

Importantly: Economic data develops over years. It creeps along! One cannot trade it, but I believe it to be very investible if one has patience and a time frame of 10yrs+.

One cannot avoid hearing the continued drumbeat from the media and the experts which fill airways and finance pages indicating that the world remains “mired” in economic quicksand with personal income stagnant and weak economic activity in all areas. They are very bearish! I am bullish and I think they are missing something spectacularly important. We both cannot be right!

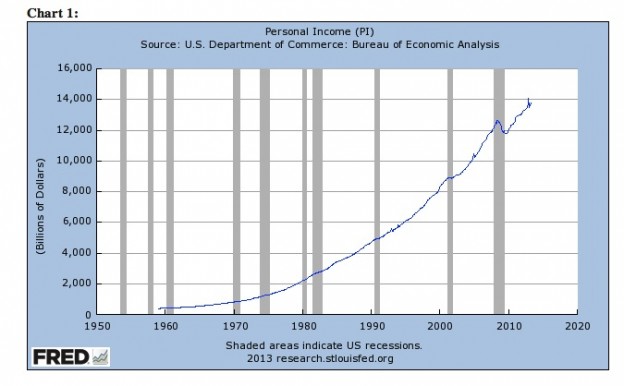

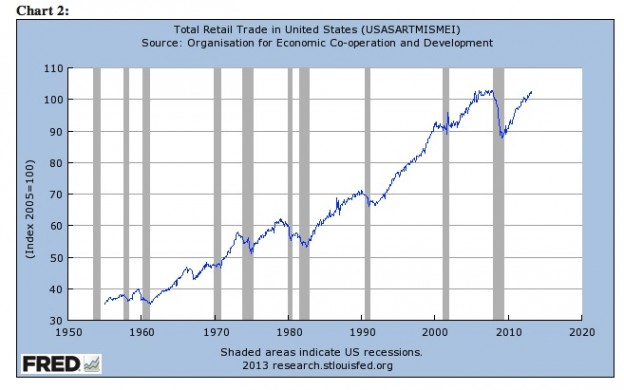

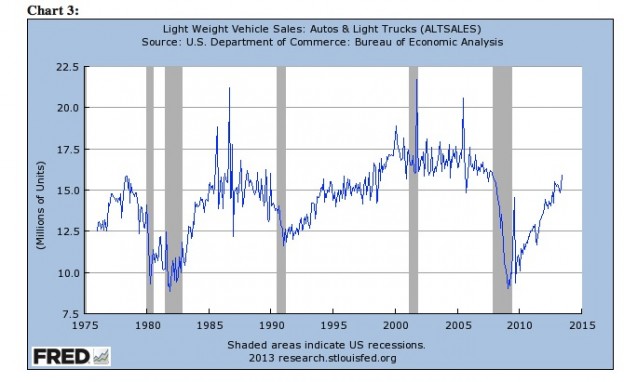

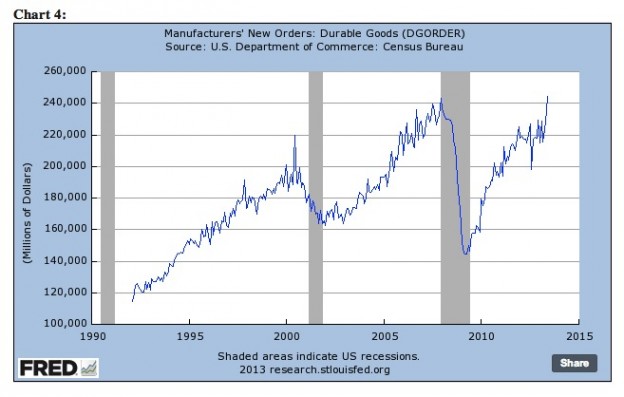

The negative argument is that all of the market’s gains are due solely to the Fed’s keeping interest rates low and that as soon as the Fed lets rates rise the economy will plunge rapidly back into the financial chaos of 2008-2009. It is argued that the Fed has reduced borrowing rates to such an extent that it is the savings due to lowered interest rates which are responsible for current economic activity. Let’s take a look at what the hard data says by looking at what has occurred economically since March 2009. These charts come from: http://research.stlouisfed.org/fred2/

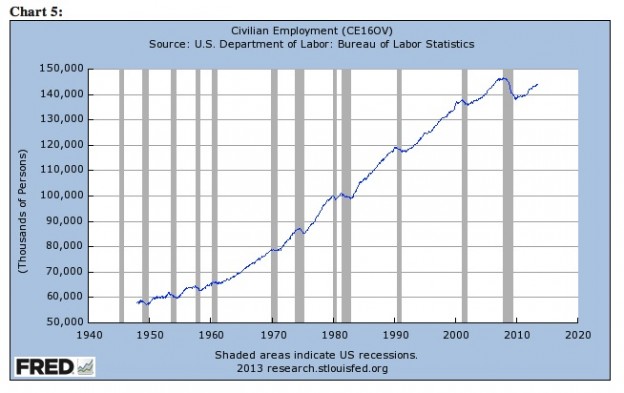

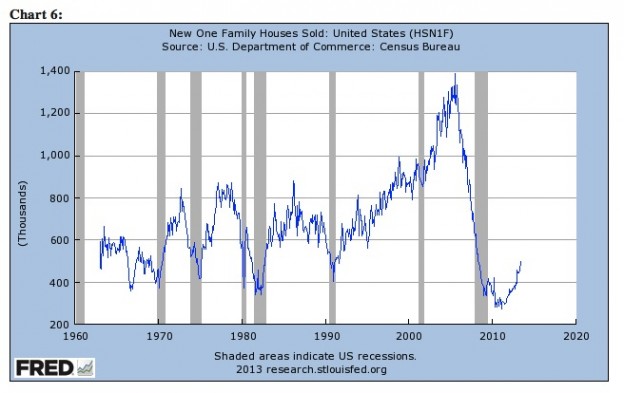

Charts 1 thru 6 show a dramatic recovery story.

1) There has been a real growth of Personal Income(nearly $2Trillion)(PI)

2) Total Retail Trade has fully recovered to the highs of 2007.

3) Light Weight Vehicle Sales(autos, pickups, vans and etc) at 15.95mil SAAR(Seasonally Adj Ann Rate) are close to a full recovery.

4) Mfg Durable Goods Orders have spiked to all-time highs indicating continued economic expansion.

5) Employment trends are in a solid uptrend-improvements in PI lets individuals buy vehicles, homes and leads to more hiring.

6) New Home sales long subdued now rising to fulfill pent up demand. Each new hire in home building = 7-8 new jobs elsewhere in the economy.

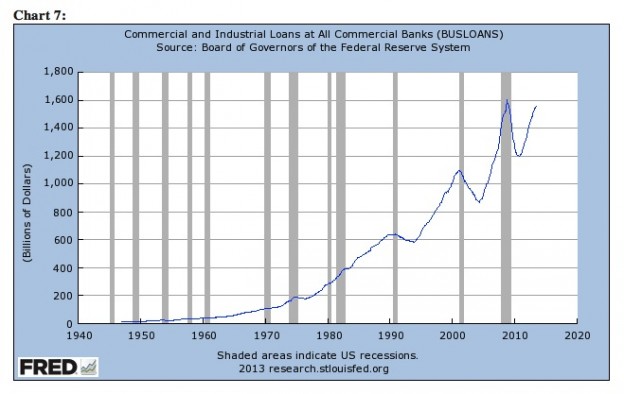

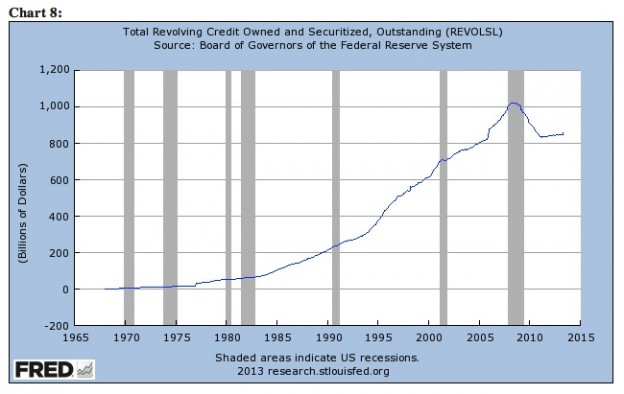

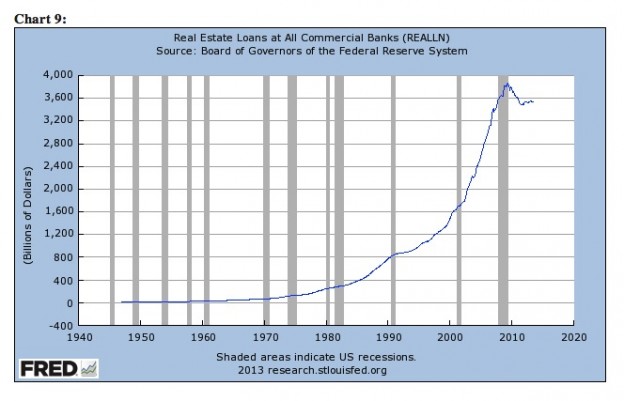

Charts 7-9 show that our borrowing or lower rates is not the reason for this recovery.

7) Corporate borrowing has risen no higher than $1.37Tril from the 2009 low of $1.2Tril or ~$170Bill. Even with 3% savings on rates, corporations have only trimmed $5-6Bil in borrowing costs.

8) Borrowing on credit cards has fallen ~$180Bil

9) Borrowing for real estate has fallen ~$400Bil

It is clear to me that our economy is not based on lower cost of credit and credit expansion. PI has risen due to value creation and the need within our economy for goods and services. JUST LIKE PAST RECOVERIES! This time thus far the SP500 has grown from ~$667 in March 2009 to ~$1,690 or some ~150%.

There is little which is greatly different in this recovery vs. previous recoveries except in the slow pace of our housing industry and the decline in government employment. Both of these are drags on our reported GDP. But, housing is recovering in spite of the Fed keeping rates so low that banks have not been able to lend profitably. Does the Fed really understand how banking works? The Fed is the banking regulator. The Fed did not prevent our lending institutions from lowering underwriting standards in response to government demands that they lend to those with poor credit histories.

Our economy and markets are human systems. One cannot plug the data which comes from them into a computer and expect to find a simple mechanical answer to solving the issues which arise from time to time. We make errors in judgment! We attempt to right the wrongs we see in society by dictating economic policy using government as our tool. Each time we have done this we have failed to see that government policy violated the rules which govern human behavior. When policy is not aligned with human behavior, major problems develop!

Today, the desire for each of us to advance our standard of living working closely with others in society, it is certainly a joint effort, has provided us with a decent economic recovery in spite of government’s prying and prodding. The current recovery does not rest on borrowed money or lowered costs from lower rates.

Yet, there remains a significant contingent which does not see our progress and wring their hands in despair of imminent collapse.

This recovery is quite real!! The data is solid! Being bullish from early 2009 has been and continues to be the right course for equity investors ($SPY). Optimism remains warranted!