“Davidson” submits:

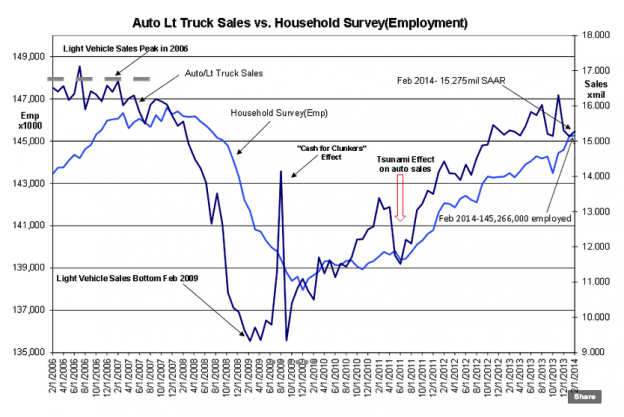

Employment and Vehicle Sales which reflect the heart of our economy (as do a number of other economic measures) continue on trend and forecast a broadening economic expansion and higher equity prices-lower bond prices(higher rates) if you believe as I that our historical behavior repeats fairly reliably even if not exactly. The trends shown in the chart below reflect an impact of a very difficult winter for the US vehicle market even so employers have kept hiring.

I use the Household Survey because even though it is more statistically based than other indicators it does capture the self-employed and provides a fuller employment picture than is supplied by either the ADP report or the Establishment Survey. None of these provide anything approaching something useful from one month to another. All economic indicators only reveal their useful information when viewed over a period of 4mos-6mos which reveals where the data is trending.

I have been quite positive since late 2008-early 2009 on the equity markets and the recent economic trends continue to support my expectations that we still have 5yrs-6yrs of economic expansion ahead of us. Inflation was reported by the Dallas Fed this week at 1.3% for the 12mo Trimmed Mean PCE. My Prevailing Rate sits at 4.3% and the SP500 Intrinsic Value Index sits at $1,933. If our 20yr history repeats, then it is quite possible that the market can exceed the SP500 Intrinsic Value Index by 50%-100%. This translates into a 2019 price range for the SP500 of $3,500 to $5,500. Remember…market pricing is 99%+ market psychology. Even though we have history to help us price how this may impact the future, we cannot ever make precise predictions.

That market psychology is tuning more positive can be seen in the response to Putin’s invasion of Ukraine and the US’s low key response. This is a huge issue, but the market responded with far less concern than that which accompanied the fear of collapsing Cyprus banks 3 1.2yrs ago. The net impact was a one-day market decline with a full recovery the next day to new market highs. The IPO market is heating up and the media continues to produce a heady stream of negative interviews. The only positive I saw was a 3hr session with Warren Buffett who saw many positives. I recommend reading the CNBC transcript of this program: http://www.cnbc.com/id/101461797