“Davidson” submits:

Did I tell you employment is accelerating?

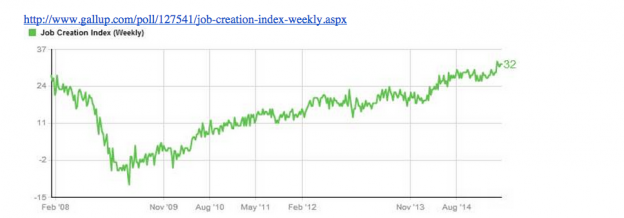

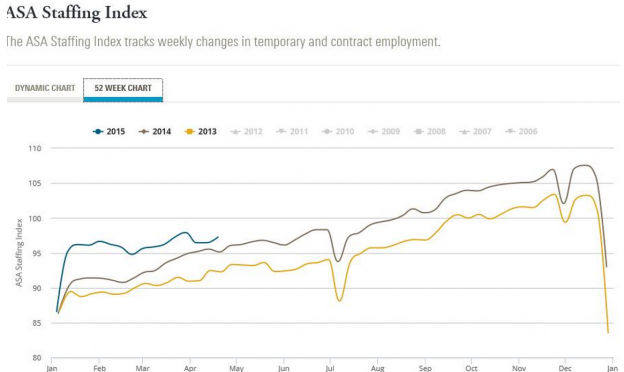

Only about a dozen times! The data has been showing an acceleration in employment since last summer. It does not have show up in every economic measure at once, but the trend shows itself in one or two indicators first and then spreads across all indicators over time if it is real and no just a temporary statistical aberration. Trends shows up in the ‘High Frequency’ (weekly) indicators before we see them in the monthly reports. The weekly Gallup Job Creation and ASA Staffing Index continue to hit new all time highs as shown below.

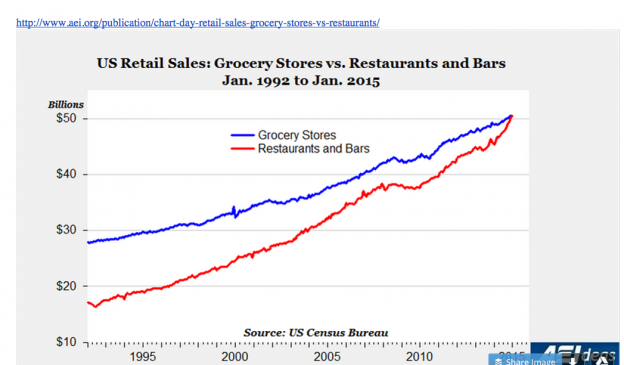

Before one can feel confident enough to invest, one needs to actually see it show up in actual consumer spending of one sort or another. Yes, indeed, we see good spending in Retail and Food Service Sales, home buying and vehicle sales. What is especially interesting is a recent chart Mark Perry published(shown below) which reveals that for the first time ever, US Retail Sales for Restaurants & Bars exceed that for Grocery Stores.

The implications for consumers’ sense of well-being and their preference for basics vs. entertainment are enormous. Consumers are certainly not feeling that they do not have enough income if they can spend an equal amount going out to eat vs. staying home. On what does the analyst community base its consensus view that wages are flat, consumers are struggling and etc., etc., etc. We continue to hear an almost constant drumbeat in the media about how bad things are economically. Only a few months ago, we had positive sentiment peeking through the curtain of gloom. Not to worry, the economy will eventually drag every one over to being positive.

The charts shown below do not reflect any information to make one negative.

Economic data is quite clear and this is why I use it. The economy today is decent and accelerating regardless of what one hears in the media. I continue to recommend LgCap Domestic & Intl along with exposure to Natural Resource issues.

You should note that recent trends support the view that we could be in a reversal of the recent collapse in oil prices, the excessive strength in 10yr Treas prices ($UST) and the recent strength in the US$. There may be some market volatility ($SPY) as Hedge Funds shift to capture these trends. Long term I continue to expect global economic recovery with oil prices ($USO), currency levels and 10yr Treas to normalizing to historic trends.

Be bullish! I remain so!