“Davidson” submits:

The biggest risk in the investing world is the risk of going against the crowd and being wrong! Everyone fears that all will remember if you have been horribly wrong especially if you have fiduciary responsibility for someone else’s pension or endowment. One’s personal reputation can rapidly deteriorate. If you are too far from consensus perception, one can find one’s self socially isolated. This is why there is safety in consensus opinion much like being in a herd of cattle when a bear comes hunting. The odds of being singled out in a herd are very low compared to being the only one in the pasture.

This social phenomenon is why there are so few Value Investors. To be a good Value Investor one needs to assume all the risk of being that lone cow in the pasture. A Value Investor has to have conviction. I like to think that Value Investors carry a sense of economic trends in their heads which causes them to act rationally when consensus are reacting emotionally and irrationally. Historically Value Investors have not quantified their investment decisions. I think this is because they have for decades gathered and synthesized information mentally from so many sources that they would not know how to begin doing so. Only since 2005 has the St. Louis Federal Reserve FRED provided a publically available single-source for current and historical economic data from global sources. I have been able to take advantage of FRED. FRED now offers 384,000 spreadsheets covering a broad swath of global economic/market data and is adding new sources weekly.

The research supporting my perceptions began in 2005 with FRED data. All the investment research I have developed had the benefit of ready access to these data sources. Data frequently stopped me from traveling down dead ends. When perception was not supported by available facts, then either I had not delved factually deep enough or had to change my perception. Throughout the process of separating consensus view (which is always wrong) from factual aspects of economic activity, one realizes that one becomes increasingly isolated as it becomes clear how few are the people who actually see how the economy operates. Value Investors are decidedly few in number and certainly non-consensus.

Value Investors are optimists. Because Value Investors study economic and human history, they understand that cycles have been with us forever. They see markets as having had cycles driven by market psychology as far back as history permits a view. Markets rise and fall, adjust and then rise again. Markets are an intimate part of improving our standard of living. Dividing life’s tasks and trading goods and services makes supplying improvements to our standard of living using markets as the most time and resource efficient approach. The term ‘Division of Labor’ is part of this process. Markets will always be with us. Markets will always have cycles. Knowing this, Value Investors have no difficulty being optimistic, buying at market lows, while the rest of the world is panicking in gross misperception.

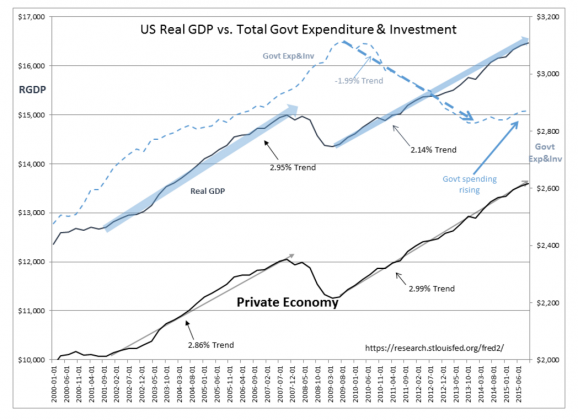

With this context, I present the chart US Real GDP vs. Total Govt Expenditure & Investment. The continued doom and gloom presented by consensus opinion the past 7yrs and emphasized the past few days with additional concerns with US GDP is not justified by the facts. US GDP has a number of components few forecasters separate to isolate how the economy is actually operating. The first one needs to do is to look at Real GDP as opposed to GDP to take out the impact of inflation from previous periods compared to the current period. It is impossible to make comparisons unless you do this. Yet, we see comparisons being made every day between higher inflation pereiods with today’s low inflation environment with many concluding that our current economy is “awful!”

Using Real GDP(inflation adjusted data) and separating out key components, Total Govt Expenditure & Investment and the Private Economy, one can see that our current Private Economy is actually growing slightly faster than the last recovery, 2.95% vs. 2.86%. The difference this time which has had many confused has been the fall off in Total Govt Expenditure & Investment which made the US Real GDP appear to grow more slowly. The perception of slower growth is even more magnified if one used GDP(not inflation adjusted) comparisons. Inflation is part of pricing and we measure production output by multiplying the numbers of things produced by their prices. Higher inflation inflates GDP! This is why one must correct for inflation or one will mistake inflation for growth.

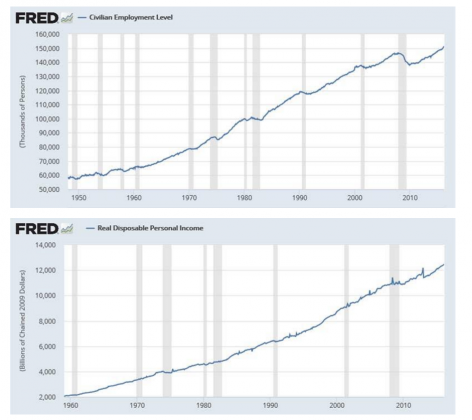

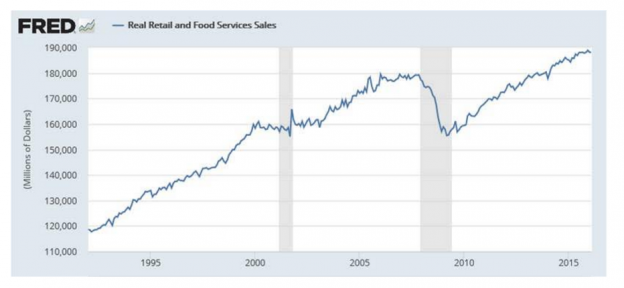

Current US economy is alive and even with an underperforming housing market due to Fed lending restrictions performing decently. This is why we have record Household Employment, record Real Personal Income and record Real Retail Sales as can be seen in the FRED charts. (Note that income and retail sales are adjusted for inflation)

I recommend investors remain positive with equities and cautious with fixed income. I am a non-consensus Value Investor because the data indicates one should be optimistic while most are not.