Note: “Davidson” is not looking at this week or this month or this quarter. When he is talking market levels he is looking out 12-18mos from now.

“Davidson” submits:

One of the benefits of being a Value Investor, using the broad body of fundamental information available today, is being able to see that economic fundamentals are reliable in forecasting economic activity 12mos-18mos ahead. Fundamentals provide guidance to markets well before and often in contradiction to consensus market psychology. Fundamentals provide a long-term rate of return (Natural Rate) that can be used to compare returns from markets and individual securities. Having fundamentals which can do this for us make them a good tool to separate the investments which carry value from those which reflect more hope than substance. Many forecasters have called for a ‘Market Top’ every year since 2010 ($SPY). In counter-point, fundamentals have continuously forecasted higher equity prices since late 2008. Over the long-term, history shows that fundamentals have always driven market psychology which in turn drives market prices. A market top is not near. A top is not even close. Markets are a ‘Human System’. We should worry most when most are not worried.

In the past 6mos a number of high profile investors have warned that 7yrs of a recovery is as long as a recovery should go. The new highs being experienced today were predicted by only a handful of forecasters. History shows that current market psychology is always reflected in market prices. Pessimism has never been high at market tops. Pessimism is characteristic of markets being at lower prices than what has occurred 12mos-18mos in the future. For a market top to occur, investors must have turned optimistic and invested all their available capital and even borrowed capital (used margin) in anticipation of gains. When market tops occur, investor and consumer indebtedness expands reflecting their confidence in risk-taking. When investors turn optimistic we have always witnessed a period of excess consumption reflected in the buying of goods and services using credit cards and borrowed funds. Lenders tend to loosen credit standards. The demand for borrowed funds to fuel this consumption eventually causes short-term borrowing rates to rise such that the credit spread between short-term Treasuries and 10yr Treasuries falls to 0.0%. Once this occurs, lending rapidly becomes unprofitable and consumption decelerates. As consumption decelerates, the first signs of correction we see is in help wanted indicators. These first go flat and then begin to fall. Hiring slows which in turn slows new consumption. Recent hires, the new employees hired on the expectations that consumption was expanding, start to be the first to be being laid off. Laid-off employees who were the most recent credit borrowers begin to default on their debt. Lenders seeing this begin to tighten credit standards and an economic correction ensues. Market psychology takes a period to turn back towards pessimism(This is called ‘The Recency Effect’). As the economic correction progresses market psychology becomes increasingly pessimistic. The coupling of economic fundamentals to market psychology has been long noted. The pessimism reflected in the media today coupled with expanding economic fundamentals and declining use of credit tell us that a market top is not near nor even close.

Market psychology has long been discussed by forecasters as a leading economic indicator. It is not! Market psychology follows economic tends. During periods of economic expansion, investors can take several years to turn optimistic. Consensus optimism by itself is not a signal that a ‘Market Top’ has been reached. That optimism can itself last several years. Economic fundamentals tell the real story.

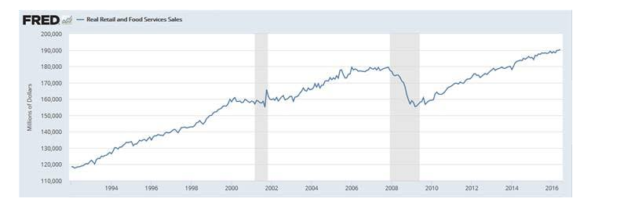

Real Retail and Food Service Sales indicator is a good example of economic activity forecasting recessions ahead of market tops. The chart from the St Louis Fed FRED site shows recession periods shaded in GRAY.

Economic fundamentals are leading indicators and reflect what market psychology does not. Market psychology changes direction often responding to every shift in prices and unanticipated events. Economic fundamentals reflect the activity of 320million individuals seeking to improve their standards of living. Economic fundamentals do not reflect a ‘go’ or ‘no-go’ pace of activity. Even though monthly reports have some volatility due to the data collection process, the actual activity is very smooth. Economic activity gradually enters recovery from recession. It gradually gathers a pace of real annual growth of ~3%, the historical US Private GDP rate of return. Today’s Real US Private GDP is ~3%. When market psychology turns optimistic, the Real US Private GDP shifts higher and may move as high as ~5%. Economic corrections only occur after periods of economic excess. Economic excess requires a multi-year period of optimism. In spite of beliefs present in investor superstitions, we have never seen a natural economic correction from an average level of economic activity. When correction has occurred in the past from an average level of economic activity it has come from a change in government policy. Pessimism in the face of economic uptrends today forecasts higher equity market prices are likely.

As long as consensus opinion remains pessimistic, equity prices have risen. The greatest enthusiasm produces the highest prices. We have seen this reflected in the F.A.N.G type stocks the past few years. As a Value Investor, I see no or little Shareholder Equity being created in these issues. I favor Danaher(NYSE- $DHR) type of companies which produce goods and services with resultant growth to Shareholder Equity(BV/Shr). There are a good many of these available which rarely receive the attention they deserve, but their long term performance has been good for portfolios.

With pessimism continuing to reign investor psychology, there remains significant capital not invested. The very, very low 10yr Treasury rates, 1.6%, compared to a Natural Rate of 4.8%, indicate that there is a bubble in the credit markets which will be corrected at some point. Historically the 10yr Treasury rate has tracked the Natural Rate. Rates must rise and cause considerable losses to bond holders in my opinion. Capital always seeks to avoid losses and achieve an adequate return. I can only see one direction for this. I expect we will continue to see higher equity prices and a recovery in Natural Resources. One reason for my expectations comes from history that rising rates has often caused investors to believe are the result of rising inflation. When this has occurred in the past investors have made a shift from debt to ‘inflation related assets’. I expect to see the US$ decline. Should this occur, commodity and infrastructure issues can be expected to rise.