“Davidson” submits:

US Employment reports indicate that the economic uptrend continues. While the Household Survey(Emp) fell by ~30,000, other indicators, ADP and Establishment Survey, reported a sharp rise. Media commentary was bullish comments were with this ‘positive surprise’.

“Total nonfarm payroll employment increased by 227,000 in January, and the unemployment rate was little changed at 4.8 percent, the U.S. Bureau of Labor Statistics reported today.”

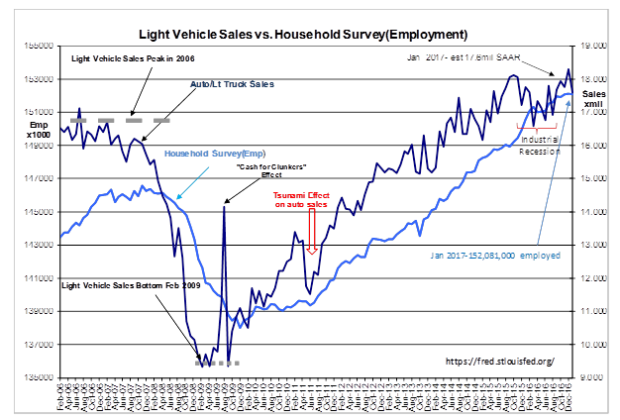

In fact, it is not about any single number, it is all about the 4mos-6mo trend about which we care most. The trends in Vehicle Sales vs. Household Survey(Emp) are shown in the chart. The economic expansion continue to be affirmed.

A comment on employment indicators:

I use multiple employment indicators to assess employment trends. Sometimes one indicator can diverge without support from other indicators. The HWOL, an Internet based indicator, showed weakness beginning mid-2015 which BLS Job Openings did not. The strength continued in multiple indicators such as the Household Survey, Vehicle Sales, Retail Sales, Personal Income and the Chemical Activity Barometer. Job losses had occurred in 2014-2016 specifically in oil/gas, infrastructure and US$ sensitive industries as the US$ strengthened. The HWOL was more sensitive to this. The Gallup Job Creation Index, a sentiment survey, did not capture this nor did other employment indicator. The Gallup Job Creation has shifted to an all time high since the election

One cannot assume any indicator is the end-all measure of what is actually occurring economically. Economic measurement is very ‘fuzzy’. I stopped presenting the HWOL, because it did not agree with trends in other indicators. It is still a relatively new indicator, tested only 10yrs. Why it differed so much from positive trends elsewhere was initially confusing. In hindsight it appears HWOL in particular captured US$ impact where other indicators did not.

One must continuously test indicators against each other to be intellectually honest.

Summary

Economic expansion continues. Equity markets should rise. Interest rates should rise as investors shift capital to capture equity returns.