“Davidson” submits:

History often reveals truths which counter the myths of near term thinking. The phrase, “This time is different”, has been debunked so often that it should be a sign of someone speaking without any historical perspective. Little recognized is the pattern of Fed Funds rate changes since 1953. The Fed has a long history of indicating that it sets lending rates when in fact all the Fed has done is set the Fed Funds rate. It does this by keeping the Fed Funds rate higher than current T-Bill rates. The Fed Funds rate is actually not economically important. It is the T-Bill/10yr Treasury rate spread which is crucial to investors.

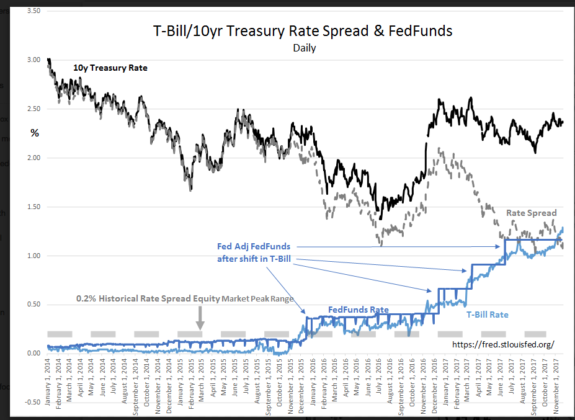

The Fed Funds rate is shown in a chart of daily data from Jan 2014. This is accompanied with a chart of the SP500 vs. T-Bill & 10yr Treasury rates and the T-Bill/10yr Treasury rate spread monthly from Jan 1953. In the former, the recent series of Fed Fund rate increases is shown to occur after T-Bill rates exceeded the Fed Funds rate with the Fed adjusting its rate to catch up. That the Fed adjusts its funds rate after T-Bill rates have shifted is a pattern from 1953 with the lone instance when the Fed acted unilaterally under Paul Volcker in the early 1980s to quash inflation. Other than the action under Volcker, the Fed has always kept the Fed Funds rate at a premium to T-Bills. It always wants to the ‘lender of last resort’ and leave markets to adjust to risk/reward naturally. Even though many continue to believe that the Fed controls economic activity by setting rates, it does not. The Fed follows, it does not lead. Rates are set by global market forces, i.e. global market psychology, which is far more powerful than any Central Bank. The daily rate data is available at: https://fred.stlouisfed.org