“Davidson” submits:

Part of nearly every economic and market prediction today are based on patterns of past cycles. If only the past repeated in some understandable fashion investing for the future would be far simpler and the advice proffered today with so much confidence would be effective. But, sadly it is not the case. The situation we face is that markets are driven by evolving perceptions of expanding standards of living which are based on an always new set of inventions and policy outcomes which cannot be predicted. Predicting markets is not a simple process of taking past trends and extending them forward using perceived mathematical extensions. Markets do not have a math solution.

The investment solution to markets starts with recognition that market prices today are based on our perceptions of the future. The problem with this is that cannot foresee future events. While economic activity tends to be cyclic, how the cycle shifts from recession to the next peak never takes the same path as we always introduce new self-governance policies and technological innovation. This essence of investing becomes reading an epic novel as it is being written with unpredictable plot twists and character introductions. You only really know what has occurred. Not what will occur. How this becomes translated into market prices is very complex due to human perception spanning a wide spectrum.

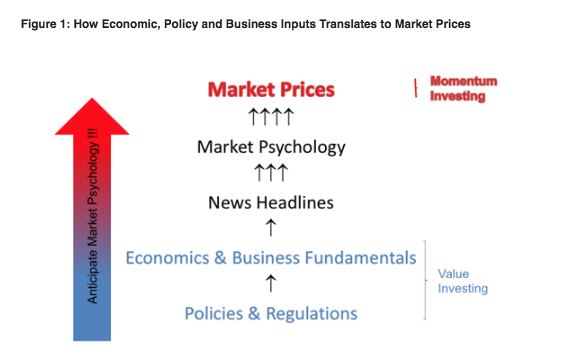

Figure 1 sketches the pathway how the drivers of human activity, as we strive to improve our Standard of Living, become translated to market prices. Markets let us share the benefits of successful advances across society and the investment markets, a modern invention of something which has evolved with mankind, let us grow excess capital by participating in the underlying businesses supporting standards of living. Part of the driving force are policies we install to improve the ‘Human System’ and improve what we perceive as ‘fairness’. How we price our own activity depends on the personalities of who is looking.

Figure 1: How Economic, Policy and Business Inputs Translates to Market Prices

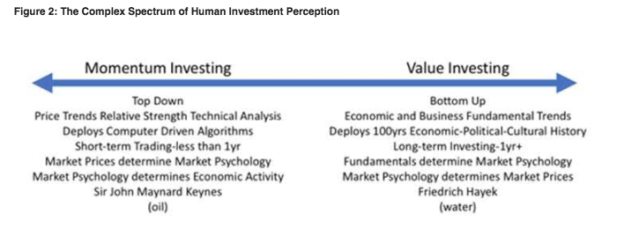

Figure 2 sketches in a simple diagram the complex context of human perception from which market prices evolve. It spans from Momentum Investors to Value Investors with such a difference in perception at the extremes that one group trying to explain their understanding to the other is much like trying to mix oil with water. The basis for one set of market perceptions is almost treated as nonsense by the other. Yet, both work effectively enough to have survived alongside each other ever since markets have been with us.

Figure 2: The Complex Spectrum of Human Investment Perception

My Investment Thesis and Basis:

My basis is from the Value Investor side of the spectrum, but I have come to appreciate the impact of Momentum Investor thinking. It is Momentum Investor thinking which produces the F.A.N.G type stocks every investment cycle which eventually are added to the indices by which we improperly measure investment performance. Even the so called ‘Value’ stocks gain some aspect of Momentum over a cycle. In other words, Exxon(XOM) a ‘Value stock’ today eventually becomes priced much higher by Momentum Investors after 12-quarters of positive earnings surprises. How this occurs is called ‘The Recency Effect’. With enough positive mention, any issue becomes priced with market consensus. This is why F.A.N.G issues become so highly priced till they are eventually found lacking in underlying business returns. It happens every cycle and even Value Investors must be cognizant of Momentum perception.

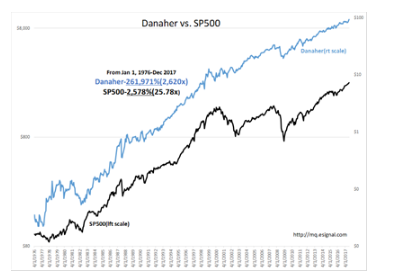

As a Value Investor, I cannot recommend the F.A.N.G. names at 10-15x Revenue and little justifying Cash Flow or Earnings. My focus is on the Danahers(DHR) of our markets which have produced lasting year-over-year returns, but even these develop a Momentum component. When prices have risen to levels which indicate over-valuation, I recommend exit for other opportunities deemed priced at relatively lower levels. Danaher’s price history vs. SP500 comes from consistent business returns from skilled management teams based on consistent corporate culture responding successfully to the needs of an ever evolving Standard of Living.

Of the Russell 3000 Index companies, there are roughly 200 or ~7% which screen as possible ‘Danaher-like’ companies. Very few have DHR’s history. What one looks for are management teams who are geared towards developing sound business returns through improvements to their business cultures. It is from this group of companies that I not only build portfolios, but these management teams provide excellent and honest insight to business conditions across our economy. No business operates in an isolated silo. Every business reflects a swath of business conditions. Having the input of quarterly earnings conference calls from a diverse set of management teams across all economic environments is an effective means of reading that epic novel as it is being written.

As the current cycle sits today, major policy changes continue to provide opportunity to expand the current cycle. How this evolves fully is unknown, but lower taxes, fewer regulations, potentially solving issues of No Korea, Iran and Russian threats to Democracy as well as potential lowering global tariffs to businesses will all be positives if they occur.

Keep tuned. This part of the epic novel is still being written.