“Davidson” submits:

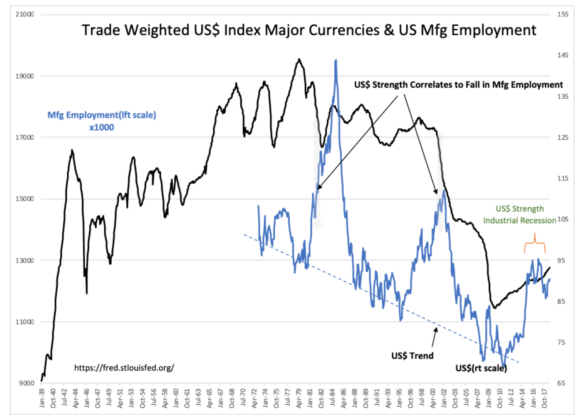

Trump touts rise in US Mfg Employment…yes, but what is this due to?

One of the hidden themes of the US economy is ‘lean mfg’, long in process at a few companies like Danaher, which has been spreading across all sectors in response to competition. First we saw this where foreign labor costs undercut US mfg in lower technology industries. DE, UTX long had a form of ‘lean’ internally, but in 2005 CAT made considerable improvements in that direction. Every time the US$ had periods of strength, ‘lean’ efforts had to doubled down. Businesses which could not adjust were shifted to foreign mfg sites.

What was fascinating was the 2014-2016 period in that Mfg Employment more or less held up as sufficient progress had been made that even in the face of another industrial recession, net/net Mfg Employment did not decline as in previous periods. (Commodity related inds certainly took a hit).

Some of the issues were self-imposed as in the previous administration’s regulatory climate. The current administration reversed/eliminated onerous regs which has been a help even without the US$ returning to its trend line. The tax cuts also have made US cos more competitive. US Mfg Emp has risen nearly 500,000 from 2015 lows, but the real turn higher began July 2017 for which the current administration can certainly take credit .

What happens with the current tariff initiatives requires monitoring. Lower global tariffs would preferentially favor US Mfg. Should tariffs fall sufficiently, the long-term decline in the US$ index would likely now shift towards something looking like side-ways stability. The reason for this is based on the long history exporting mfg to foreign markets due to high native costs raises the currency values of trading partners on which this index is based. Slowing the export of mfg of certain goods and slowing the reimportation of these goods will change the trajectory of this index.

Politicians, economists and etc fail to recognize the long-term underlying fundamental trends beneath the data. Instead they are reactionary and focus on short-term reaction and commentary responding to demands of constituents to ‘Do something!” By being short-term, misunderstood concepts become badly designed policies which can produce decades of unintended economic consequences.