“Davidson” submits:

The 5yr mov avg of US Inventories vs. market pricing behavior is one of the relationships I track for my investors. Crude pricing correlates closely to capital spendng in your industry even if economic activity is steady elsewhere.

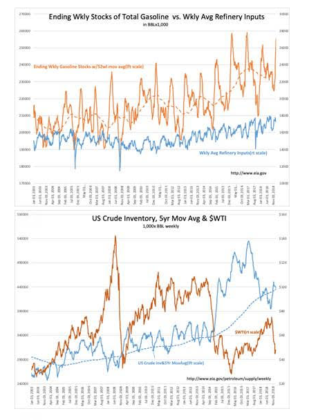

The street is focused on gasoline inventories rising as a negative, but history shows this is simply the seasonal build to meet summer demand and preparation for the Spring shutdown-maintenance/catalyst change over. Most investors seem to be very short-term focused and miss the obvious seasonality that comes from being a long-term investor. Short-term gasoline inventories do not provide the guidance many attribute.

Better is the 5yr moving average of US Crude Inventory vs. weekly reported levels. You can see in the chart that oil prices tend to shift whenever current inventory levels crosses above or below the 5yr mov avg. We are poised to see US weekly inventory reports fall below the 5yr mov avg, perhaps within the next month. Investors are likely to drive oil prices higher when this occurs. I see this as a pure market psychology effect and not one based on fundamentals even though it may have a financial impact on your business.

While we like to think market pricing is logically connected to fundamentals, in reality pricing is through market psychology which itself is loosely connected to fundamentals. Best we can do is guess the market response and be prepared to take advantage should it develop favorably.

Something to consider.