“Davidson” submits:

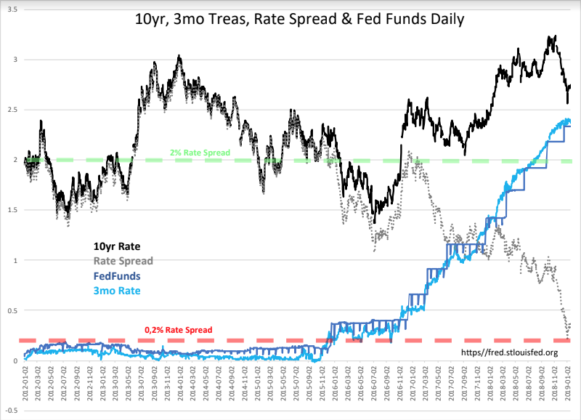

As you can see, one always needs to interpret what any data actually is telling us. Being locked in to any single indicator or pattern requires confirmation in other indicators. More than this, one also needs to be aware of the many themes playing out which result in capital flows globally. Most analysts know no more than what they have been taught which is based on a century of misperception and mathematical models.Everyday, I have learned to sit back and reassess everything to make sure I am not missing a developing trend, a capital flow, which is new and influential that was not apparent yesterday. Taking the position that markets cannot repeat because conditions never repeat as society shifts ever forward with innovation and technological discovery is the only way to view markets. It became obvious a decade ago that capital flows from China, Russia, So America and etc were influencing accepted returns on real estate and 10yr Treasuries which everyone took as higher levels of perceived risk. Some of this may be ending now with Trump’s tariff initiatives. I ignored the sell signal the T-Bill/10yr Treas rate spread gave me because I saw the factors were not the same as had been historically.This chart is updated as of yesterday’s close.