“Davidson” submits:

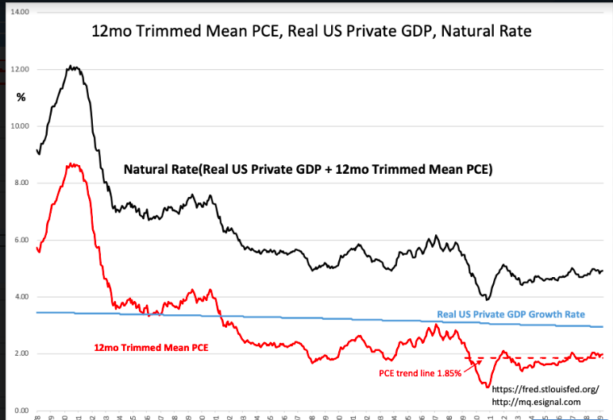

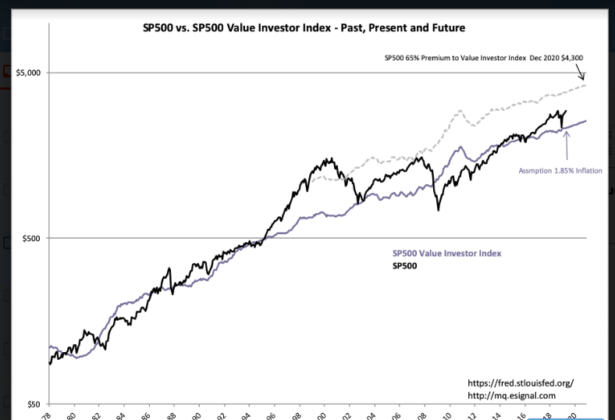

In this update, the trend of the 12mo Trimmed Mean PCE was raised from 1.7% to 1.85% and the SP500 was projected forward to Dec 2020 at a 65% Premium to the Value Investor Index. At some point investor psychology becomes speculative which leads to a market ending top. History guides to a 65%-100% premium to the Value Investor Index. In this update, inflation is set at 1.85% and the projection extended to Dec 2020.

At 65% premium to the Value Investor index with 1.85% inflation, the SP500 would be $4,300. Market psychology could be higher or lower than this, but if current administration’s policy initiatives lead to greater mortgage availability and lower global tariffs, the SP500 could rise higher than the $4,300 potential indicated.

Caveats: Higher inflation would price the SP500 lower but the impact of ‘The Recency Effect’ after a longer period of economic expansion than many expect today could very easily spike the SP500 to the $5,000-$6,000 range if the expansion lasts another 5yrs.

To access paid content, please follow this link