I think we are at the point that when we see negative headlines we now instantly think “what’s the real story”

“Davidson” submits:

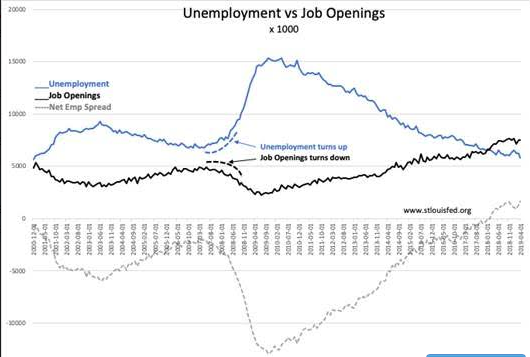

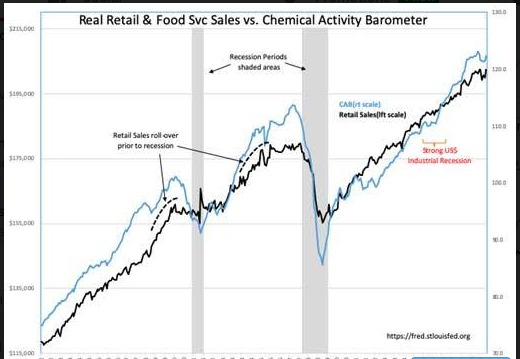

Yet another major recession scare, but no supporting evidence in the economic data. Retail Sales were interpreted as negative by the media today, but it is clear that the trend from 2009 remains intact. Unemployment vs Job Openings and their spread show that a remarkable level of employee demand has developed since Dec 2000. Even in the short history available of Job Opening data, we can see that this series turns down when Unemployment turns up prior to a recession. Job Opening data is trending higher and Unemployment is clearly trending lower which portend continued economic expansion the next ~2yrs.

Economic data tells the fundamental story which remains quite positive. Last week the Mortgage Credit Availability Index(MCAI) had reversed the fall-off due to the end of the HARP ending program as Dodd Frank regulations are eased for smaller banks. Higher Single-Family home starts should follow. The China tariff issue is much in the news, but behold the changing dynamic in this highly charged political environment with key individuals finding agreement on the current administration initiatives. Hard to believe!

The fundamental data and now the politics support economic expansion which in turn supports a more positive market psychology and higher equity prices in the months ahead.

To access premium content FREE for 5 days, follow this link