“Davidson” submits:

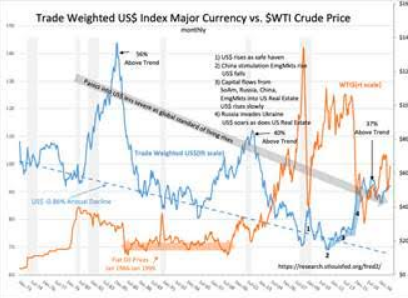

Capital has been leaving China for a while, makes for higher US$ as global safe haven. Normally periods of US$ strength have proven negative for US businesses coupled to exports and commodities priced in US$. The initial surge in the US$ in 2014 when Russia invaded Ukraine had this effect. Since then, after an industrial recession, US companies have adjusted and business has recovered to historical levels.

US tariff initiatives to lower tariffs globally if successful may be in the process of permanently changing the long term declining trend which has been -0.86%. As negotiations gain global support, the US$ has retained its strength. Investors are coming to recognize that US growth continues and offers potentially the better market. US investment markets have been the better investments the past 12mos.

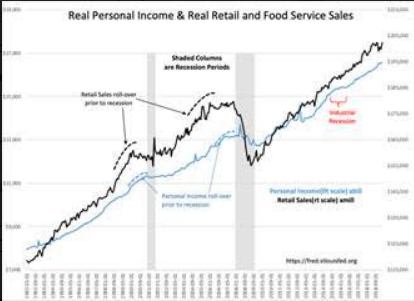

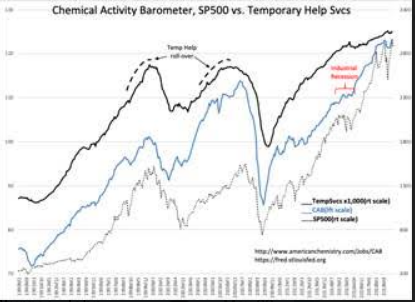

Meanwhile, US economic indicators continue to reach new highs in the face of strong recession fears and US equities continue to report positive surprises. Investors do not believe earnings can continue to rise and the SP500 has stalled near the $2,900 level, but many corporate managements continue to forecast their businesses are likely to do quite well the next 2yrs. The continued trends in Real Personal Income and Real Retail Sales underscore these forecasts.

While current investment fundamentals are continuing in a positive direction, investors fear that the end of the investment/economic cycle is at hand. Market prices are driven by investor perception. Investment history is permeated with periods of investor uncertainty during economic expansions. Investors have always rushed to buy or sell equities in a belated effort to catch-up to fundamentals. This time is no different. Faced with the fundamentals we have today and the potentially very positive impact of lower global tariffs and improved mortgage lending in the US (recent rise in MCAI), investors are recommended to hold portfolios 100% in US based companies.

To access premium content FREE for 5 days, follow this link