“Davidson” submits:

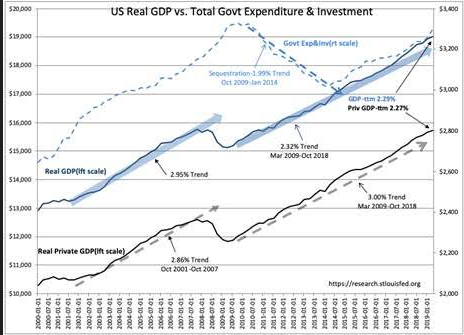

2Q GDP reported this morning shows a rise in Govt Exp&Inv due to rise in military spending while both Real GDP and Real Private GDP trailing twelve month paces have slipped. Likely we are seeing an impact from the administration’s lower-global-tariff initiatives which has reduced Chinese trade.

There is a value to having a strong military especially if it means that it provides a bargaining chip that one does not have to actually deploy which makes military costs cheaper long-term and less inflationary. This appears to be the intent of this rise in spending.

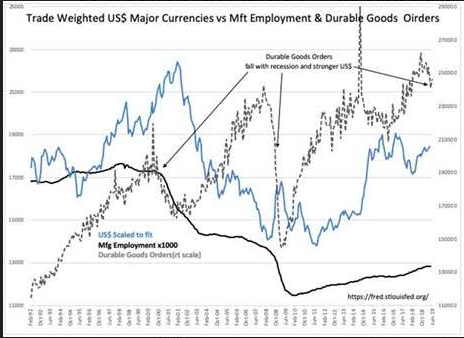

US$ has been rising as current US policies counter anti-Democratic threats globally drives capital to US$ based assets for safety. The tariff initiatives have a similar impact as lower tariffs should they occur will benefit US manufacturing vs. high tariff foreign locals. A portion of lower Real Private GDP comes from lower exports of Durable Goods due to US$ strength making these exports more expensive. The end game favors this administration’s approach but the timing is uncertain.

US global policy initiatives are a work-in-progress. If successful, the current economic expansion can last at least 5yr more. Only time will provide answers to these initiatives and will require close attention to a number of economic trends. Thus far, we remain in the right direction.